To receive the Glossy Pop newsletter in your inbox every Friday, click here.

All products featured on Glossy Pop are independently selected by our editorial team. However, when you buy something through our retail links, we may earn an affiliate commission.

In case you haven’t heard: fragrance is booming.

And as the category grows, so too do its tertiary products, including hair perfumes, and hair and body mists, as popularized (for younger generations) by Sol de Janeiro. According to Circana, sales of hair and body mists reached $474 million in the prestige market in 2024, representing an increase of 94% year-over-year and making the category the fastest-growing piece of the prestige fragrance pie. Circana defines these products as sitting at an average price point of $25. For reference, Sol de Janeiro’s hero Cheirosa 62 Bum Bum Hair & Body Perfume Mist is $38 for its standard size (8.1 ounces) and $25 for a smaller version (3.04 ounces).

According to Larissa Jensen, svp and global beauty industry advisor at Circana, the initial spike in popularity for any given hot product typically lasts around a year. Then, “other brands start to become aware” and build on that success, she said. “They’re like, ‘Hey, this is something that’s growing in the market. I’m missing out on it; it’s a white space for me; I don’t have a product that meets that need. So I’m going to go out and launch it now,’” Jensen said, noting that the development process can take six months to around a year.

She added, “As more brands come into the market, there’s a lot more competition. It becomes much more fragmented. People are going to try other things. You’re going to have those who stick with the scent they like from [a given brand], but then there are others who are like, ‘I want to try this,’ or, ‘One of my favorite brands just came out with one. Let me try it.'”

That last part is where the market is now.

Recent entries across the hair perfume space, body mist space and the hybrid space in between the two are exploding. Since October 2023, Phlur has launched nine products fitting the bill. Since December 2023, Rare Beauty has introduced two. In mid-January, Touchland, known for its hand sanitizers, introduced a collection of eight body mists. Gisou will introduce three additional hair perfumes on April 1. And Snif launched its first three earlier this month. The list goes on.

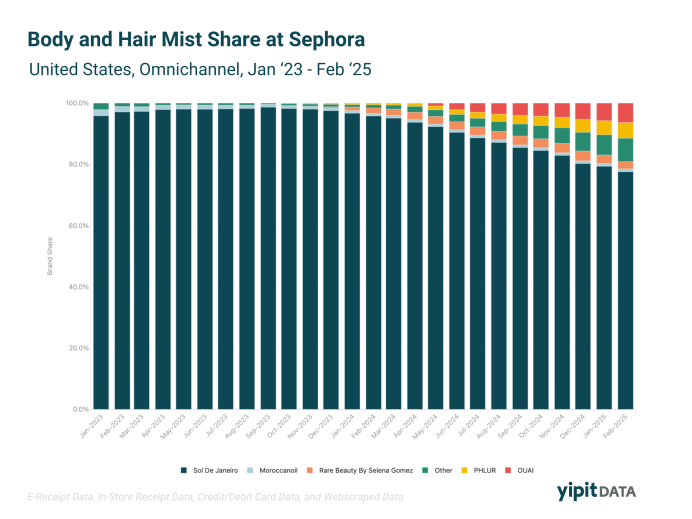

While Sol de Janeiro remains very popular — as confirmed by a 12-year-old Glossy spoke to — it is losing market share as options expand. According to the YipitData Insights Team’s data, “We’ve seen Ouai and Phlur pick up share in the hair and body mist category, with Sol de Janeiro seeing share fall from 95% of the category to [about] 77%.” FWIW: Ouai is another favorite of the 12-year-old.

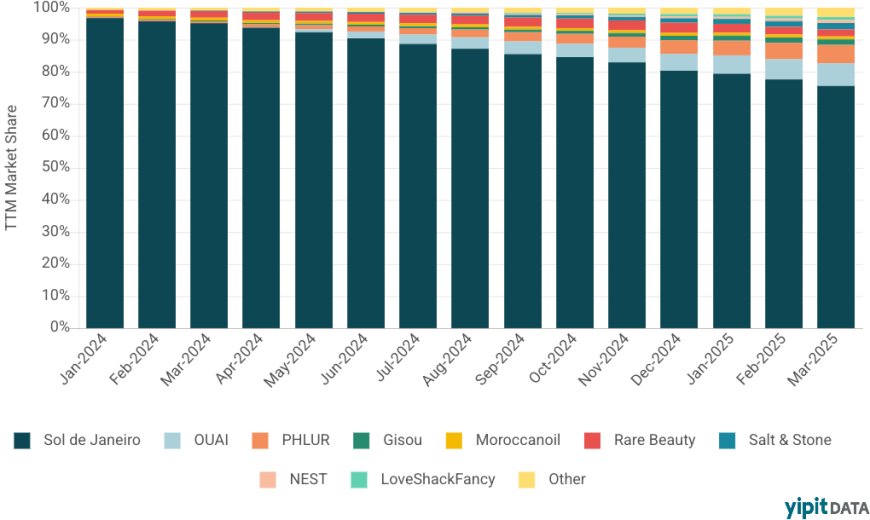

At Sephora, as depicted in the graph below, other best-selling brands include Gisou, Moroccan Oil, Rare Beauty, Salt & Stone, Nest and LoveShackFancy.

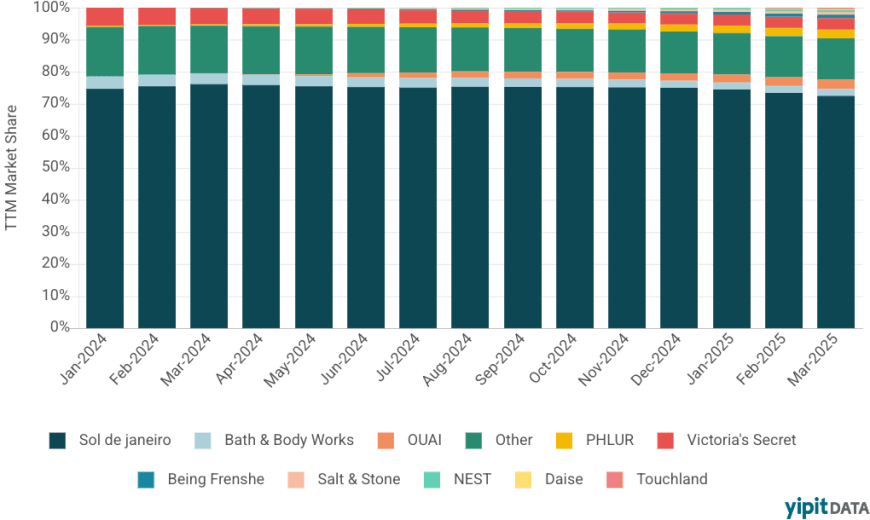

Across all retailers, that also list includes Bath & Body Works, Victoria’s Secret, Being Frenshe, Daise and Touchland.

Kimberly Ho, CEO and co-founder at baby, kids and teen brand Evereden, said that last year, fragrance “was one of our most requested products from parents of our existing customers as well as kids and teens themselves.” In response, the brand worked with customers to host pizza parties where kids helped workshop the Hair and Body Fragrance Mists the brand created, which are $23 each and available on the brand’s website. They include Darling, which Ho described as “that quintessential girly girl, feminine [fragrance] she wears to her ballet classes;” Main Character, which is the brand’s most fruity, gourmand scent, for “that preppy girl who’s popular, joyful and into sports;” and Supernova, which is “fresh, vibrant and multi-dimensional, for your quintessential cool girl.”

Evereden used the pizza parties to gather insight into the types of scents kids and teens want, which tend to be sweeter than more mature fragrances, Ho said. “We involved over 200 Gen Alpha and Gen Z kids, [ranging in age from] 10-18. And we had over 70 scents, which we narrowed down to the three [we launched],” Ho said. For example, “Winnie, 13 years old, said one of our earlier scents smelled like socks. Needless to say, we did not launch the one that smelled like socks.”

Hally Hair just launched a hair perfume, too — its first entry into the fragrance market. The scent, dubbed Lady H, made its debut solely on TikTok shop, where it has racked up 10 million impressions since March 6, when it hosted a TikTok live to promote the launch. In April, the product will enter Ulta Beauty. The brand also aimed to co-create with the 18- to 25-year-olds it will ultimately sell the product to, working with its more than 3,000 “Hally Insiders” (ambassadors) to gather feedback around the scent. “It’s really nice when you’re able to marry your core demographic and the customer, and then also a retail partner that is giving you advice and data and helping with the positioning,” said Hally Hair founder and CEO, Kathryn Winokur.

During the development process, Ulta weighed in with insight regarding popular notes. The resulting product is a gourmand, featuring cherry, jasmine vanilla and moss. To differentiate the product in an increasingly crowded market, the brand made it alcohol-free — a rarity, as alcohol is typically the first ingredient listed in a hair perfume. The formula also doubles as a hair shine mist.

Emi Jay, known for its hair clips, launched at Sephora in February and launched its $24 Aura Hair Mist the same month. “Our clips and our hairbrushes are expensive. … Our liquids are all amazing ingredients, amazing quality … [but] we wanted a more entry-level price point liquid option,” said Julianne Goldmark, Emi Jay’s founder. Like many of the other brands Glossy spoke to, Emi Jay intentionally added ingredients that benefit hair health, like aloe and glycerin, to its formula. It is a category Goldmark already envisions expanding, she said, adding, “Fragrance is currently the fastest growing category for Sephora.”

“For a lot of young Gen Zers, [the Aura Hair Mist] is a great way to get into the brand and [to] fall in love with the brand in a way that’s a bit more affordable, without compromising any of the experience or [the] hair-forward benefits. … It’s a nice complement. We knew that would be important to this [younger] customer,” said Claudia Allwood, Emi Jay’s CMO.

Like Emi Jay, Kitsch started in the hair accessory space, but in early March, it debuted a collection of four hair perfumes, which include patented odor-eliminating technology, to do more than simply mask hair odor. The scents launched at Ulta Beauty, where all four quickly sold out, though they have already restocked, said founder and CEO Cassandra Thurswell.

In creating the collection, which will be the first of many, Thurswell said she was inspired by Gen Z. “I love how they see fragrance as an extension of their personal identity. I’m a millennial, [and for my] generation, fragrance was like this finishing touch,” she said, adding that Gen Z has distinct confidence in layering scents.

Hair fragrance offers a new way to engage with the category, Jensen echoed. “Older consumers [like Boomers] tend to have a signature scent,” but that’s less common for younger customers. “[For them] it becomes a bigger thing to have more [options] to be able to layer, experiment and play with different fragrances. Consumers are way more educated about fragrances than they ever were. There are social influencers [dedicated to] fragrance [so now people know]: You can layer this with that, but you can’t layer that,” she said.

Back to the 12-year-old, whose roster currently includes Sol de Janeiro, Ouai and Bath & Body Works. When asked how she chooses what scent to wear — and she wears one most days — she said, “I kind of pick what goes with my outfit and what would match the vibe.”

Inside our coverage

Exclusive: Inside Rare Beauty’s plan to own the blush category

The Inkey List brings buzzy exosomes to the masses with new $22 serum

Act+Acre founders on the rise of scalp-care: ‘Education is the forefront of the brand’

Reading list

The conservative women’s magazine with big ambitions, and sex tips for wives

Why are so many young women convinced they’re balding?

The unexpected way this D.C. clothing store is helping women who lost their government jobs