In this edition of the Glossy+ Research Briefing, we share insights from a recent conversation with the editors-in-chief of Glossy and Modern Retail, Jill Manoff and Cale Weissman, about the role TikTok Shop is playing in marketers’ holiday plans. And we highlight brand executives’ comments from this week’s Glossy Beauty & Wellness Summit on the pain points they’ve encountered with TikTok Shop.

Brands are unsure how to invest in TikTok Shop

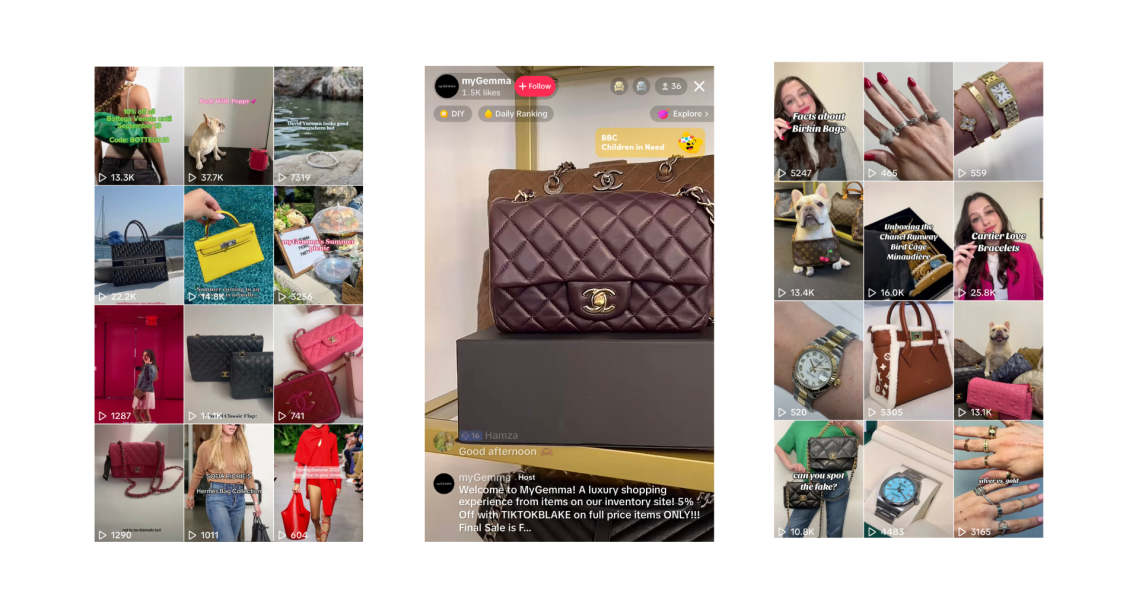

TikTop Shop has stirred a lot of conversation — both good and bad — among marketers, but especially as a pain point plaguing businesses in Q4. The logistical challenges brands face, including signing up for the program, have forced many brands to wait months until they are up and running on the site.

“It has taken about eight months and three companies to help us, and we are finally verified and ready to go,” shared a participant in this week’s town hall at the Glossy Beauty & Wellness Summit in Napa, California. “[We had no luck with the] AI-powered backend — as soon as we got connected, it would shut us down. My advice is you have to have physical people to help you do it. Our rep and companies [made it possible for us]. It’s not that easy,”

Additionally, brands are unsure how to invest in TikTok Shop without alienating their retailer partners. “We’re trying to be sensitive to our retailers, and they don’t want us on TikTok Shop, so I just don’t know that it’s a lever I can pull right now,” explained another participant at the town hall.

In Glossy’s holiday research presentation last week, the editors-in-chief of Glossy and Modern Retail discussed how startup brands are interested in TikTok Shop, but established brands are more hesitant to invest as the platform continues to change its selling format and discounting options.

“You’re seeing a lot of startup brands really interested in TikTok Shop, but incumbent brands, bigger brands, are still a little trepidatious,” said Cale Weissman, editor-in-chief of Modern Retail. “TikTok is trying to focus on live selling. … That is one of its competitive advantages it thinks it has compared to other platforms — that brands can go on and sell live, but big brands don’t want to be live for many hours. There are a lot of brand safety issues that you could run into when you have one person trying to sell your product for a very long time.”

“TikTok Shop is changing,” agreed Jill Manoff, editor-in-chief of Glossy. “There were all these incentives for brands. [TikTok offered] incentivizing discounts, so it was a double discount for customers. It was a win-win across the board. And slowly but surely, as Cale mentioned, they started pulling back on all of that. So, seller fees increased, and all of these incentives went away.”

During Glossy’s town hall this week, one participant noted that there is now additional pressure on brands to provide discounts for customers themselves. “I think [brands that] used it [TikTok Shop] in the past found it paid off, but it is a lot [to manage and navigate] because it’s kind of a race to lower the price,” the participant said. “I understand that TikTok Shop is trying to get new customers, but every time there’s a [sale on Amazon], they’re like, ‘Oh, you have to go lower.’ We have had some success, but it’s almost like, at what cost?”