This week in the Luxury Briefing, a deep dive into Chanel’s strategies as it walks back price increases. Also, a chat with eBay’s new stylist, Brie Welch; a Ralph Lauren earnings recap; executive moves and news to know. For tips or comments, you can reach me at zofia@glossy.co

After raising prices by 59% between 2020 and 2023, Chanel is entering a new era. In 2024, the brand implemented a modest 3% price increase, signaling a sharp contrast with its pandemic-era strategy. That shift wasn’t voluntary. The luxury market cooled, consumer pushback intensified, and Chanel’s volumes dropped by 7% year-over-year, according to estimates from investment management firm Bernstein. The company’s 2024 earnings, reported May 20, show a 4.3% decline in revenue to $18.7 billion, while operating profit fell by 30% to $4.5 billion. Chanel’s pricing power, once unrivaled in soft luxury, hit a wall.

“Chanel’s pricing strategy in recent years has clearly tested the limits of what consumers are willing to accept – even in luxury,” said Melissa Roth Mendez, founder of MRM Advisory. “Many long-time clients, especially in markets like China and the U.S., didn’t feel the price increases were matched by a meaningful shift in product or experience. And when that disconnect sets in, people start to question the value.”

The brand, which declined to comment for the article, had benefited from a post-pandemic surge in demand and used the moment to reposition itself at the top of the luxury hierarchy, outpacing competitors like Prada and Dior in price increases. But as Bernstein noted in the company’s latest readout, “value for money concerns” began to define Chanel’s 2024 narrative. Consumers weren’t just pausing, they were rethinking.

That pause is why Chanel reversed course, according to luxury experts. Instead of further increases, it focused on long-term investments: $1.8 billion in 2024 capital spending included stakes in a French silk supplier and an Italian jeweler, plus there was a $2.45 billion investment in brand support, including marketing to maintain visibility, according to the company’s 2024 earnings. Its boutique network expanded in growth markets like India, Mexico, and Tier 2 Chinese cities. It also added new flagships for jewelry and watches in New York and Taipei. Behind the scenes, the supply chain was fortified and repair services expanded.

“What stands out to me is that Chanel isn’t shying away from foundational investment — supply chain, boutiques, client experience — even as profits decline,” said Roth Mendez. “A lot of companies would pull back. But Chanel’s private ownership gives them the flexibility to stay focused on the long term.”

Dr. Achim Berg, luxury expert and former McKinsey consultancy partner, agreed. “Because they’re privately held, Chanel can afford to take a long-term view. They’re not beholden to shareholder pressure, so they can focus on what actually strengthens brand equity,” he said.

Notably, Chanel strengthened brand equity while increasing headcount to over 38,400 employees from 32,000 in the last two years. “They’re recognizing that in this macro environment, where demand is softening and the luxury market is tougher than it’s been in years, it’s important to focus on what makes the brand truly meaningful,” said Roth Mendez. “Not buzz. Not campaigns. But the fundamentals: craftsmanship, consistency and control of how the brand shows up.”

Scott Kerr, founder of Silvertone Consulting and luxury analyst, called Chanel’s strategy a textbook example of long-term brand management. “They’re not being reactive. They’re building a foundation for the next decade [based] on experience, craftsmanship, cultural relevance and global reach,” he said.

Other brands are facing similar realities. Burberry, which attempted to elevate its positioning under new creative leadership with Daniel Lee in 2023-2024, met heavy resistance from media and customers to its elevation and higher pricing. Products priced too high for their perceived value resulted in major discounts across channels. Last November, and again in January, pieces were marked down by as much as 97%: A reversible coat dropped from £2,590 (around $3,300) to £75 (around $95), while a fleece jacket once priced at £1,790 (about $2,280) also sold for £75. The Small Knight Bag, only months old, was halved to £1,290 (roughly $1,645), according to e-commerce tracking by Glossy.

“Scarcity can reinforce value in luxury,” said Roth Mendez, “but only if the foundation is there. If people don’t believe the product or experience justifies the price, they’ll wait for the discount.”

At Dior — which likely saw worse growth than LVMH’s reported 1% decline in Fashion and Leather Goods across the group, according to Bernstein — brand heat was also tested. The house was cleared by the Italian Competition Authority on May 21 following a probe into subcontractor labor conditions that started in July 2024. Dior committed €2 million ($2.2 million) over five years to support anti-exploitation initiatives and stated it would strengthen oversight across its supply chain.

Back at Chanel, the bigger challenge is how to reinforce trust without leaning on price as a proxy for prestige.

The proposed 50% U.S. tariff on European luxury goods poses another risk for Chanel. However, on May 27, the U.S. government announced a delay in implementing the tariff until July 9, following negotiations with the European Commission. This postponement gives luxury brands like Chanel a short window to reassess pricing and sourcing strategies without making abrupt changes. Chanel had been strategizing to absorb the anticipated tariff costs to maintain consumer trust and avoid further price increases, according to its latest earnings. Most luxury brands, according to analysts, have been holding products in bonded warehouses in the U.S and Canada to deal with the tariffs.

“Raising prices further isn’t a straightforward option,” Roth Mendez said. “They’ve just paused their pattern of aggressive hikes and shifted to more modest, inflation-based changes. Reversing that now could undercut credibility and damage trust.”

“As the industry transitions away from aspiration toward authenticity, Chanel’s strategy feels ahead of the curve,” said Berg. “They’re investing in what makes luxury credible again: not exclusivity for exclusivity’s sake, but products and experiences that feel genuinely worth it.”

What Chanel is doing now, Berg suggested, is shoring up value without fanfare. “They’re not chasing the hype. They’re rebuilding from the inside out. And that’s what real luxury looks like right now.”

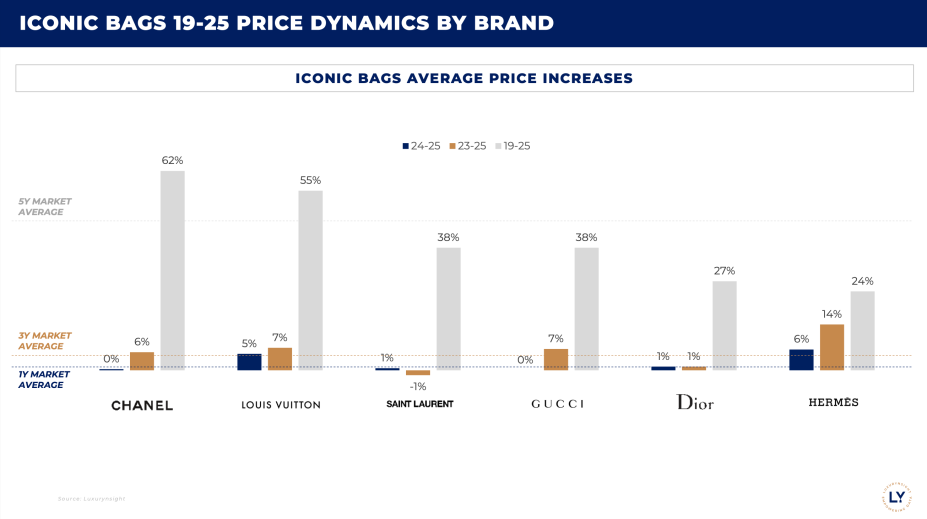

Data slides from Luxurynsight, an AI data intelligence platform for luxury.

EBay leans into data and editorial with new resale trend report

EBay’s new Watchlist Trend Report, launched on its website on May 9, tracks what’s trending in secondhand fashion, much like the reports of other resale platforms that have entered pre-loved pieces into the fashion trend conversation.

Helmed by fashion consultant and stylist Brie Welch, who has worked with Proenza Schouler, Khaite and La Ligne, the report draws on real-time marketplace data to identify spikes in interest for specific categories and items. Think: raw Japanese denim, 1950s silhouettes and the Chloe Paddington bag, the latter of which saw a 900% increase in searches in the last 12 months.

“It’s like forecasting, but for resale,” Welch said in an interview with Glossy. “These pieces are always out there. Now it’s about giving them a second life with context.”

For fashion companies, the report offers a case study in how to editorialize resale to drive engagement, support circularity and capitalize on consumer sentiment.

However, the primary goal is to provide fashion shoppers with a guide to the current trends they can find in resale channels and the pieces they should sell to maximize their return on investment.

“You might find the trending item, but it’ll be a little off, that’s what makes it yours,” she said.

Earnings

- Ralph Lauren beat expectations in its fourth quarter 2025 earnings, released on May 22, with 10% revenue growth and record sales in Europe and Asia. Growth was driven by 9% AUR gains, low discounting and strong full-price DTC sales. The brand’s pricing power, double-digit growth in core categories like handbags and outerwear, and ability to offset looming tariff pressures with diversified sourcing and selective price hikes also served it well.

Executive moves

- Moose Knuckles has named Ellen Kinney as CEO, tapping the former A.L.C. and Kendall + Kylie chief to steer the brand through its next phase of growth and innovation. With over 20 years of experience, including top roles at Derek Lam International, Kinney brings a proven track record of scaling fashion businesses.

- Gucci’s chief industrial and supply chain officer, Massimo Vian, has exited the brand in line with CEO Stefano Cantino’s ongoing reorganization. Product divisions now directly report to Cantino to streamline operations and accelerate decision-making.

News to know

- In response to recent exploitation scandals, Italian authorities and fashion leaders have signed a pact in Milan to boost supply chain transparency via a voluntary digital platform and “green badge” certification. Calls are mounting for national legislation to ensure wider accountability.

- Dsquared2 and Staff International have settled their legal dispute, agreeing to continue their partnership through spring 2027 with a structured handover plan as Dsquared2 founders Dean and Dan Catens prepare to internalize their ready-to-wear business.

- The U.K. department store Harvey Nichols has launched a 3-year transformation under CEO Julia Goddard, which includes a Knightsbridge flagship revamp, 75 new fashion brands, and cuts including 70 jobs and noncore categories. The aim is to steer the British retailer back to profitability amid a luxury retail slowdown.

- With Willy Chavarria, Alain Paul, Zomer, Meryll Rogge and EgonLab named 2025 ANDAM Grand Prize finalists, the award is reinforcing its status as a launchpad for Paris Fashion Week’s most promising disruptors.

- Zegna has unveiled a global multi-year partnership with Art Basel, expanding its legacy of supporting socially engaged art through an artist development platform that spans all four fairs.

- The Hub, a new 6,000-square-foot lifestyle lounge in Bridgehampton, opened over Memorial Day weekend. Featuring fashion, fitness, facials and rotating brand pop-ups. it’s designed to keep Hamptons shoppers coming back all summer. Featured brands include Bronx and Banco, Teddy Cashmere, Buddha to Buddha Jewelry and Maison Palo Santo.

- At VivaTech 2025, held June 11-14, LVMH will spotlight 11 maisons and 13 tech partners under the unified theme “Dreamscape,” consolidating its technology innovation awards and innovations into a showcase of luxury’s tech evolution. VivaTech is open to professionals, such as startups, investors, executives, students and academics during the first three days, and to the general public on the final day.

- Hermès’s bespoke workshop Ateliers Horizons is unveiling its first luxury headphones this summer, blending industrial design and artisan craftsmanship in a $15,000 headset that epitomizes the brand’s quiet, bespoke approach.

- Gucci opened its rarely seen archive at its Cruise 2026 show at the Palazzo Settimanni. It spotlighted over 46,000 pieces that trace the brand’s century-long evolution and reaffirm its Florence-rooted heritage in a moment of creative transition.

Listen in

On this week’s Glossy Podcast, Danny Parisi and Zofia Zwieglinska unpack Richemont’s jewelry-driven resilience, Mytheresa’s Yoox Net-a-Porter integration, Chanel’s sharp profit drop and hiring freeze, and the tariff strategies fashion brands are using to stay nimble amid global trade shifts. Listen here.

Read on Glossy

Vivrelle on why inventory is key to winning at resale and rental. Tariff fears are pushing footwear brands to innovation. The growing market for luxury fitness tools. Armani’s comeback fragrance.