This week, we take a look at the looming supply chain crisis as tariffs cause cargo shipments to the U.S. to plummet. Experts predict rising prices, decreasing quality and companies turning away from the U.S. market entirely.

In March, dockworkers at the Port of Los Angeles moved more than 700,000 containers of goods. It’s one of the busiest ports in the nation and the gateway for many of the shipments that come to the U.S. from China and other parts of Asia.

But soon, it’s going to look a whole lot emptier. The port’s executive director, Gene Seroka, warned consumers earlier this week that the number of ships coming into the port would plummet by 35% in the coming weeks. The tariffs imposed by the Trump administration on incoming goods, particularly those from China, are making shipments to the U.S. unappealing and unaffordable.

Other ports along the West Coast held similar predictions. The Port of Long Beach is expecting a 38% drop in incoming ships. The Port of Oakland receives about 29% of its trade volume from China, its largest trading partner. The Port of Oakland hasn’t yet released April numbers, but its executive director, Kristi McKenney, said tariffs could have immediate negative effects on the port and the region.

“The Port of Oakland is an economic powerhouse that supports nearly 100,000 good-paying local jobs”, McKenney said in a press release. “A tariff-induced downturn in the Port’s cargo volume, whether from import slowdowns or retaliatory export losses, ultimately could jeopardize job stability and our region’s economic health.”

The emptier ports are a direct result of the Trump administration’s 145% tariffs on goods from China, which produces a vast number of products and materials used by American fashion brands, including everything from swimwear to cotton, sunglasses and more. But with tariffs affecting goods coming from China, the American consumer will soon see the tangible impact of tariffs in the form of reduced inventory on shelves. Higher production and shipping costs will likely lead companies to implement higher prices and accept lower quality for goods that do make it to the U.S.

Guido Campello, the owner and co-CEO of the luxury lingerie company Journelle, told Glossy that this is just the tip of the iceberg. When Campello purchased the company in 2019, its goods were entirely produced in China. While Journelle successfully transitioned all of its manufacturing from China to Italy over the last four years, insulating it from the worst of the tariff cost increases, Campello said that the issues will ripple out to affect the entire industry.

“We actually ship everything by air because intimates are so light,” Campello said. “But in the last three weeks, my shipments have made it from Italy to Memphis, Tennessee, and then they’re getting stuck there. FedEx and UPS are struggling to keep up with what the rules du jour are. Air shipments from Europe only take three or four days to reach their destination, but we’ve had a shipment sitting there for three weeks now.”

Shipping by sea – the most common route – is a long and slow process. It can take a month for a cargo ship to make its way from China to the U.S., and orders are often placed several months in advance of their actual arrival. With tariff rules changing regularly, it’s become nearly impossible for companies to plan ahead. Some have resorted to simply ignoring the U.S. market altogether.

Popular consumer electronics companies like Ratta and 8BitDo are pausing all their U.S. orders, as is the luxury beauty and skin-care retailer Space NK and the China-based athleticwear manufacturer Woodswool.

Isaac Hetzroni, founder of the sourcing company Imprint Genius, told Glossy he’s telling his clients to consider selling in other markets besides the U.S. Hetzroni is also an internet personality, known as @thesourcingguy on TikTok, where he has over 125,000 followers. His posts feature him visiting factories around the world and talking about sourcing.

“That’s my recommendation if you have stock you’re sitting on,” he said. “Larger legacy brands are planning out their collections a year in advance. They can negotiate longer payment terms with their factories. But a lot of smaller brands are doing just-in-time inventory. They only have 30 days worth of stock. And if they don’t sell through it, they’ll be out of business.”

For companies that do have to bring inventory into the U.S. first, Hetzroni also mentioned bonded warehouses as an option. Bonded warehouses allow companies to store products, sometimes for years at a time, without paying the local duties on it. Those duties will only be owed when the product leaves the warehouse, meaning brands can wait until tariff rates come down before disbursing products. But that’s not always possible.

While the holidays are still months away, it’s not unusual for companies to import holiday goods in the spring to ensure they’re here in time for the holiday shopping season, which can start as early as September. With China producing 90% of Christmas goods in the U.S., that’s also set to be disrupted.

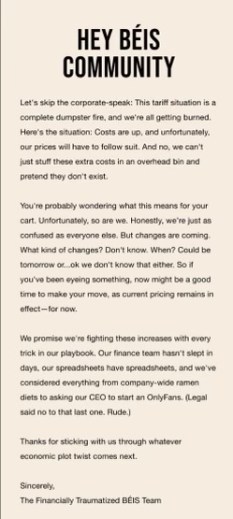

Brands have struggled to explain these changes to their customers and clients in manufacturing and wholesale. The luggage brand Beís opted for a frank appeal to their consumers, writing in an email stating that “costs are up and, unfortunately, our prices will have to follow suit.” Glossy viewed an email one brand sent to its wholesale partners informing them of a “temporary hold on all shipments until we can assess the full impacts” of the tariffs. The brand in question manufactures partially in Madagascar, which was hit with a 47% tariff.

Journelle’s own letter to its retail and wholesale partners in the U.S. touted its European-focused supply chain and encouraged them to place orders for made-in-Italy goods as an alternative to goods from higher-tariff regions.

“We are in for some life-changing prices,” Campello said. “For the premium segment, you see Hermés and LVMH raising their prices all the time. But others won’t be able to eat that. You can’t pivot every two weeks the way [Trump] is having us pivot. The quality of products will suffer.”

Stat of the week

Clothing stores increased their TV ad spending by 24% since the April 2 announcement of tariffs, according to data from TV ad company EDO. Those ads on television saw a 48% conversion increase, likely due to the current, tariff-inspired urgency around shopping, the company told Glossy. Apparel ad spending overall is down, however, dropping 13% in the same time period.

Other news to know

- Shein is reportedly weighing a restructuring strategy ahead of its London IPO due in part to the disruption of U.S. tariffs. The changes could include diverting product initially meant for U.S. consumers to other regions like Brazil.

- A number of fashion brands reported earnings this week. While companies like Etsy and Prada reported revenue increases, Lanvin Group saw its revenue fall, and Adidas said its earnings sales targets would have been higher if not for tariffs.

Inside Glossy’s coverage

It’s not just about a dress code: How RTO is reshaping workplace fashion and culture

Inside Puma’s strategic turnaround

Glossy 101: The dos and don’ts of influencer partnership disclosures