This is part of a series of stories on how the fashion and beauty industries are preparing for a potential recession. Click here to read others.

With the highest inflation in 40 years causing skyrocketing prices of staples like gas and groceries, more consumers are on the search for cheaper alternatives to cult beauty products.

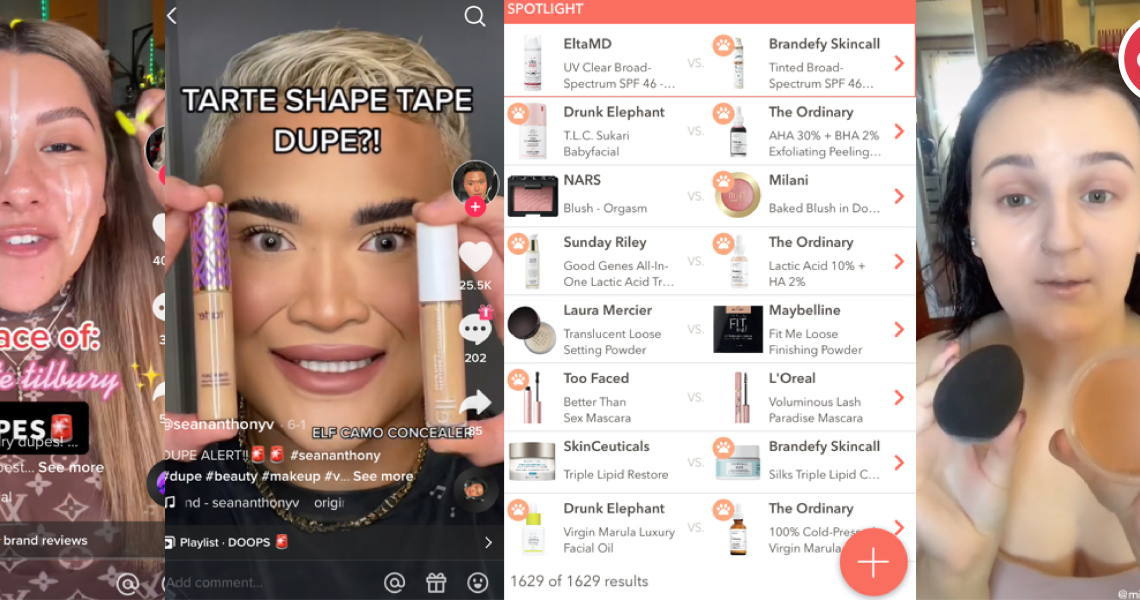

According to data from Google’s marketing research platform Think with Google, searches for the term “dupe” rose 40% globally year-over-year in June as multiple price-conscious search terms saw significant upticks. A longtime favorite subject for beauty influencers, affordable dupes for luxury beauty products have gone especially viral on TikTok with quick comparison reviews.

“Consumers are self-reporting that they’re looking for more affordable alternatives because of inflation,” said Meg Pryde, founder of Brandefy, an app that provides side-by-side comparisons of luxury beauty products and similar items from mass brands. “Searches per community members have gone way up as consumers are trying harder to find ways to save.” Each comparison page offers a “similarity score” based on a range of factors including color, wear time, finish, ingredients, consistency and smell.

April survey data from The Harris Poll found that 84% of Americans are planning to cut back on their spending due to inflation, with areas of discretionary spending such as “restaurants” and “impulse purchases” taking the biggest cut. When it comes to shopping online, people are increasing their use of a range of search terms to find deals. In addition to “dupe,” Google’s data found that searches for “buy 1 get 1” have increased 60% year over year, and searches for promo codes have doubled.

“Consumers generally are looking to spend intentionally and carefully amidst rising inflation,” said Brian Murdock, vp of marketing at Seed Beauty, the parent company of ColourPop and Sol.

Sol’s $15 Face & Body Bronzing Balm has gained the status of a dupe to Chanel’s $50 Soleil Tan Bronzing Base after it was first featured in a viral post in 2020 by TikTok beauty influencer Mikayla Nogueira, who regularly makes affordable dupe videos and causes products to sell out.

“When Mikayla Nogueira posted about the Sol balm we saw the conversation spread like wildfire,” said Murdock. He said the company sees a “lift in site traffic, and in turn, sales” when a product goes viral on TikTok as a dupe. “We are so appreciative of our amazing influencer community who discover and share these insights and hacks,” he said.

Beauty influencers have been a driving force in the popularity of dupes. This is especially true on TikTok, where the #dupes hashtag now has 1.4 billion views.

On Lottie London’s social channels, it reposts influencers’ dupe videos featuring its products. In March this year, it reposted TikToks featuring its $10 Diamond Bounce Highlighter as an alternative to Fenty’s $40 Diamond Bomb highlighter using the hashtags #dupe and #fentydupe.

“Our Product Development team is super agile and able to react to trends we see coming through on social media,” said Nora Zukauskaite, the marketing director for Lottie London. For example, the brand’s $6.95 Oil Slick lip oil has been featured on TikTok and in media this year as a dupe for Dior’s Addict lip oil that went viral on TikTok in January this year.

TikTok beauty trends often lead to secondary dupe products going viral. Clinique’s $20 Black Honey lipstick that went viral on the app in August 2021 gave rise to E.l.f. Beauty’s similar $7 Hydrating Core Lip Shine in Ecstatic also gaining buzz as a dupe. Clinique’s Black Honey lipstick was No. 1 in a top 10 list of June 2022 Google searches for beauty dupes compiled by Spate.

“We let our community share the premium comparisons on our products, and we love seeing them compare E.l.f. versus higher-price competitors,” said Laurie Lam, chief brand officer of E.l.f. Beauty, which has multiple products in its lineup that are known for being dupes. Its $6 16HR Camo Concealer has been regarded as a dupe for Tarte’s $27 Shape Tape since being crowned as such by beauty Redditors in 2019. That status has carried through to the present price-conscious era, as the page comparing the two products is one of the most-searched on Brandefy.

Beauty is one of the major categories driving the overall concept of “dupes” online. While Google’s data incorporated dupes in all categories, it specifically listed a beauty product — Dyson’s AirWrap — as one of the top products searched with the “dupe” term, joining products like the Restoration Hardware cloud couch. The AirWrap was also listed as the second most-searched beauty dupe by Spate.

Even categories known for high consumer loyalty, such as foundation, are seeing more searches for cheaper options. According to Pryde, searches for foundation have risen to make it a top category on Brandefy in 2022.

Premium and luxury brands have long been averse to dupes flooding TikTok, especially in cases where IP infringement is in question.

But experts believe that consumers are savvy about researching and discerning the differences between products, with influencers going into detail on pros and cons, and the reasons the luxury versions are more expensive.

“No two products are exactly the same. Customers are getting smarter and just trying to understand what they really need from a product,” said Pryde.