Popularized by beauty YouTubers, the search for the perfect beauty “dupes” has been streamlined with a mobile app.

During the pandemic, beauty app Brandefy has been one of the emerging paths to product discovery with its format focused on recommending affordable dupes. The app has recently secured official partners including Flower Beauty and Acure for its subscription box that launched in September. According to its founder, Meg Pryde, the app’s offerings are reflective of most beauty consumers’ beauty collections, which are a mix of products with high and low price points.

Launched in April 2018, the app started with a mix of beauty and other categories like personal care, but beauty lovers became its driving force. “We originally started out comparing all kinds of products. Consumers were just insistent on finding alternatives to really expensive beauty products,” said Pryde, who created the app while in business school. The app has raised $950,000 in seed funding and is currently in the middle of another raise. It has around 30,000 monthly active users and 293,000 total downloads, and saw 330% year-over-year growth in new user accounts in 2020.

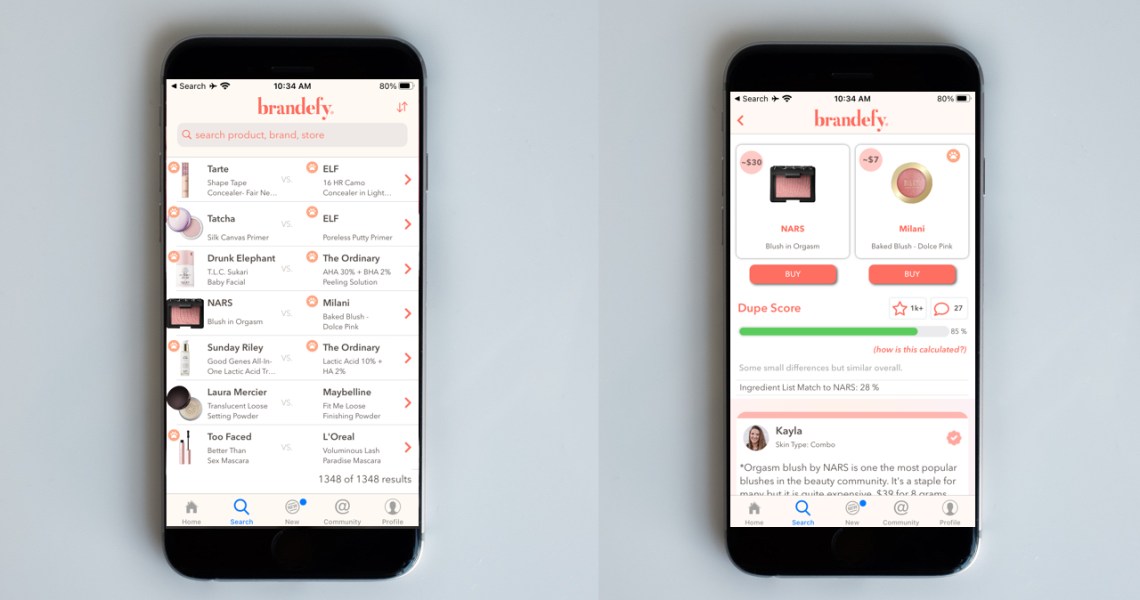

The app offers a curated library of low-priced alternatives for popular premium beauty brands, complete with reviews and a “dupe score” calculating the products’ similarity. Users searching for a cheaper alternative to Nars’ cult $30 Orgasm blush, for example, are recommended a $7 option by Milani that the app says is 85% similar. The most-liked dupe on the app, so far, is E.l.f.’s $6 16 HR Camo Concealer, which is listed as an 80% match for Tarte’s $27 Shape Tape product.

Dupes have made their way from the YouTube vlogger world to other social media channels, becoming a hot topic on beauty Reddit and inspiring popular Instagram accounts. For example, the “Dupe That” beauty account has 1.3 million followers and is verified. As TikTok has emerged as a hotspot for affordable beauty recommendations, the hashtag #makeupdupes has 63.5 million views and #dupes has 154.4 million.

The trend is especially popular with younger beauty consumers. Over 85% of Brandefy users are under the age of 34, with a “significant portion” still in college, according to Pryde.

“Consumers are no longer one-brand people,” she said. A survey of the app’s Instagram followers found that 54% of respondents said they buy a mix of prestige and affordable brands, while 40% said they only buy affordable. Each dupe’s page contains affiliate links to purchase both the premium and the affordable item. “The consumer nowadays has a mix of items in her bag,” she said. “She doesn’t have all Skinceuticals. That doesn’t make any sense. Maybe she’ll spend a lot on the Skinceuticals vitamin C serum, but she’ll also have a NYX eyebrow pencil.”

Affiliate link partners include Amazon and Ulta, which both offer a mix of prestige and affordable brands. “Ulta is one of those retailers that does really well with that shift, and Sephora adding Inkey List and The Ordinary to their stores is reflecting the need to accommodate that consumer more,” said Pryde.

The app entered the subscription box business this fall, offering four full-size products from participating brand partners for a monthly price of $15. Brands provide the products to the app for free in exchange for exposure — the app promotes the brands to its entire user base. For some participating brands, users have the choice between two different products — Flower Beauty, for example, provided a choice between its skin-care elixir and its setting spray. So far, the box service has 1,000 subscribers with “thousands” on the waitlist, said Pryde.

“The age of brands lacking transparency is over,” said Pryde. “The consumer is so much more educated. They recognize that the margins in beauty and skin care, especially, are just enormous, and that there are certainly companies out there that aren’t trying to capture that insane margin.”