In this week’s luxury briefing, a look at earnings from LVMH and Kering, as well as the reformatting of runway shows from their brands. Also, why TikTok educational creator Tanner Leatherstein is joining British leather bag brand Stow as creative director, and how smart glasses are winning the game. For comments or tips, email me at zofia@glossy.co

Tariff deal news and earnings announcements have dominated the week. Europe’s luxury sector breathed a sigh of relief on July 27, when the U.S. and the European Union agreed on a trade deal that places a 15% tariff on most E.U. goods headed to the U.S., averting the feared 25% rate threatened earlier this month. The move avoided what Robin Mellery‑Pratt, founding partner of brand intelligence company Matter, called a “potential demand shock” that could have forced “a pricing and margin rethink across the industry.”

Even with that relief, luxury’s biggest names are still under pressure. LVMH reported its first-half results on July 25, and Kering followed on July 29. Both underscored the challenges of balancing slowing demand, structural change and shifting cost bases.

LVMH’s revenue reached €42.2 billion ($46.3 billion), up 4% year-over-year, while recurring profit fell 2% to €11.5 billion ($12.6 billion). The group’s fashion and leather goods division, which includes Louis Vuitton and Dior, grew 3% year-over-year but at a slower pace than the double-digit growth seen in recent years. Kering posted €7.6 billion ($8.4 billion) in revenue, down 16% year-over-year, with Gucci down 25% on a comparable basis and a group operating margin that contracted 470 basis points to 12.8%.

Both groups cited currency volatility, tourism shifts and ongoing softness in China as key challenges, but tariffs are now an immediate consideration. “How companies execute their pricing strategies will be very significant for their success in the near and mid-term,” said Mellery‑Pratt. “The pushback [to price increases] is getting noisier in some channels, where consumers are coalescing via short-form video apps or Reddit threads or interest groups.”

Kering CFO Armelle Poulou said on the earnings call the company has already taken selective price adjustments and may consider more, “making sure that we apply it in a smart way, mindful of consumer sentiment.” Francesca Bellettini, Kering deputy CEO, added that Gucci’s reset under new creative leadership is beginning to gain traction, highlighting the importance of product “novelty in the stores basically every month [and] accelerating the injection of net [sales] in the store.”

The earnings calls also revealed another area of focus: the format and scale of upcoming runway shows.

Cecilie Cabanis, LVMH CFO, stressed the need to free up resources, saying, “Efficiency is sustainable, cost‑cutting is not. We’re looking at everything, from how we define store cost per square meter to how we structure relationships with agencies. It’s about freeing up resources so we can keep investing behind our brands.”

That likely includes cultural activations and shows, which are increasingly under scrutiny for cost and relevance. “The scale of cultural presence that luxury brands have enjoyed or achieved over the last three years may not be the strategy moving forward,” said Mellery‑Pratt. “If budgets around amplifications and even shows are being scrutinized, it could be the beginning of a different approach with regard to cultural relevance. Rather than ubiquity, there could be a more targeted, tailored strategy.”

Recent presentations from the two luxury groups illustrate this shift. Dior’s Summer 2025 men’s show (June 21, Paris) featured an art‑installation‑style set rather than a stadium-scale spectacle, while Louis Vuitton’s Fall 2025 show (March 3, Paris) was staged in the former Gare du Nord station with a limited audience.

Beyond tariffs and show formats, both conglomerates flagged portfolio developments. At LVMH, speculation has grown around Marc Jacobs, one of the group’s U.S. brands. Analysts believe its strong youth appeal and social media momentum — it’s a consistent TikTok favorite — could make it a candidate for external investment or even divestiture. A deal worth $1 billion is allegedly being floated to Authentic Brands Group, owner of Reebok.

As Mellery‑Pratt said, “Marc Jacobs has proven itself to be one of the most culturally relevant brands. Its relationship with TikTok really built another chapter of cultural relevance for the brand.”

At Kering, the focus remains on Valentino, where it holds a 30% stake acquired last year from Qatari investment group Mayhoola for €1.7 billion ($1.87 billion), with an option to acquire full control by 2028. Executives said the brand’s wholesale cleanup and aesthetic evolution are ongoing. Jean‑Marc Duplaix, Kering deputy CEO, meanwhile, emphasized that portfolio activity remains “disciplined” and that 2026 “would not be the best year to exercise” the Valentino investment option, given industry trends.

TikTok creators are taking over luxury’s creative director roles

Luxury’s latest creative directors aren’t coming from design schools or heritage maisons — they’re emerging from TikTok feeds. British luxury bag brand Stow London appointed Tanner Leatherstein (real name Volkan Yilmaz) as its new Director of Craftsmanship and shareholding partner. Leatherstein is a leather educator known for deconstructing luxury bags on social media. The move signals how influence is turning into operational power.

“Two videos from Tanner drove pre-orders [for one of our bags] up by thousands of percent,” said Stow founder Carol Lovell. “For us, it was a no-brainer. He shares our values and has already proved he can move product.” The company declined to share financial details of the long-term partnership.

Leatherstein built a 1.2 million–strong following on TikTok by cutting open luxury bags from brands like Prada, Louis Vuitton and YSL to show the quality of what’s inside. He will now shape Stow’s product development, sourcing and material choices while continuing his transparency-first content. He will also continue to post content and advocacy around leather supply chain issues. “Instead of me waiting to build my brand toward this idea, we decided, ‘Why don’t we join forces and build this together?’” he said.

The appointment comes as luxury faces pressure over its supply chain ethics. On July 29, Italian trade group Confindustria Moda urged a “concrete dialogue” after scandals linked Dior, Armani, Valentino and Loro Piana to sweatshops outside Milan, warning brands to align cost targets with fair wages and commit to long-term contracts.

Stow’s small-batch manufacturing in Ubrique, Spain, transparent pricing and elimination of plastic reinforcements are designed to address these issues directly. But Leatherstein’s shift from external critic to internal creative leader suggests something larger: consumers now trust creators to hold brands accountable, and brands are betting that credibility can translate into commercial and creative success.

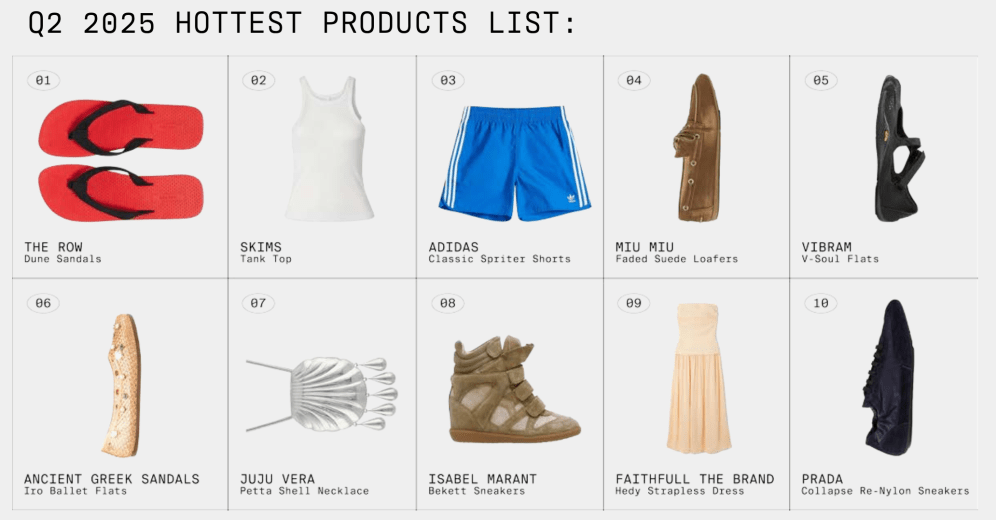

Lyst’s Q2 2025 Index: Footwear dominates

This quarter’s Lyst Index shows shoppers swapping polish for personality as economic anxiety fuels demand for expressive, lower-cost accessories and statement shoes.

“Economic uncertainty is driving shoppers toward expressive, lower-cost accessories that deliver maximum impact per dollar spent,” said Katy Lubin, vp of brand and communications at Lyst. “When budgets tighten, people gravitate toward pieces that tell stories and signal identity rather than just demonstrate wealth.”

Top five hottest products:

- The Row Dune flip-flop, a $690 minimal luxury sandal

- Skims Cotton Rib Tank, a viral basics leader

- Adidas Adicolor Sprinter Shorts, a retro athletic revival

- Miu Miu Suede Logo Boat Shoes, a preppy staple

- Vibram FiveFinger V-Soul, a performance-fashion hybrid

Miu Miu was the quarter’s top brand, powered by the popularity of suede boat shoes, while Burberry re-entered the top 20 brand list after a year out, boosted by menswear shirting and swimwear, alongside trending women’s flats and mini bags.

Other notable trends in the latest Lyst Index include Y2K-fueled revivals, like Isabel Marant’s Bekett wedge sneaker; nostalgic talismanic jewelry, such as Juju Vera’s shell pendant necklace; and niche accessories with craftsmanship and narrative value, including Jacques Marie Mage eyewear.

The Lyst Index ranks brands and products quarterly based on global shopper searches, sales, browsing behavior and social media engagement.

Earnings

EssilorLuxottica’s second quarter 2025 results, reported July 28, showed Ray-Ban Meta sales up more than 200% year-over-year, driven by new AI features that make the smartglasses more useful than earlier iterations. They include real-time translation and the growing adoption of prescription and transition lenses. CEO Francesco Milleri said, “Meta, also with less margin, is making a lot of money. Volumes are growing very, very fast,” while confirming capacity will exceed the previously planned 10 million units. The company declined to comment on sales.

“Smart glasses have definitely ceased to be an oddity — like Google Glass had been — and are becoming mainstream,” investment fund Bernstein analyst Luca Solca told Glossyn. “They are soon to become glasses, full stop, with traditional eyewear superseded by more functional smart products.”

News to know

- Instead of a runway show, Dario Vitale’s first Versace collection will debut via an intimate presentation with a video component on September 26 in Milan. In April, Prada Group acquired Versace for €1.25 billion ($1.44 billion), and Vitale was appointed the brand’s chief creative officer after leaving Miu Miu.

- Victoria’s Secret confirmed via Instagram that its runway show will return this year, following last October’s Brooklyn-based comeback led by CEO Hillary Super, as the brand works to revive sales amid pressure from activist investor Barington Capital.

- Ermenegildo Zegna Group sold a 5% stake (14.1 million shares) to Temasek Holdings for $126.4 million at $8.95 per share, raising cash to support organic growth and making Temasek a 10% shareholder while the Zegna family stake falls to 60.3%.

- Jeremey Tahari, named CEO and creative director of Elie Tahari in February, released his first collection for the brand, sold exclusively through elietahari.com and select U.S. stores. The collection features modernized, seasonally driven designs developed in collaboration with Elie Tahari, the father of Jeremey Tahari. Prices range from $148-$498.

Listen in

This week on the Glossy Podcast, Danny Parisi and Zofia Zwieglinska discuss New York Fashion Week’s move to a more centralized venue setup, a major International Court of Justice ruling pushing wealthier countries to curb emissions, and a money laundering case in the Netherlands involving Louis Vuitton that highlights luxury’s vulnerability to financial crime. Plus, Jill Manoff speaks with Patience Anoe-Lamptey Battle, a 15-year fragrance specialist, as part of Glossy’s Store Associates Strategies series. Listen here.

Read on Glossy

The return of Ty Haney to Outdoor Voices. Personal shoppers are leading luxury store sales. Hair care is winning for L’Oréal. Procter & Gamble has a new CEO.