Athleta, the Gap-owned athletic brand, is making a push into yoga this week with the release of its first collection of yoga accessories.

Though made up of just three products — a yoga mat, a yoga block and a yoga bag — the collection is part of the company’s play to compete more directly with its contemporaries that have a head start in the yoga category. Those include smaller brands like Alo Yoga and larger ones like Lululemon. As sales of active apparel softened late last year, the new category is also a way for Athleta to diversify and bring in new customers. Athleta is known for its leggings.

Athleta’s head of design, Ebru Ercon, told Glossy that the market growth for yoga accessories was a motivating factor for the new category. She cited August 2022 data from Valuates Reports showing the yoga mat market is estimated to reach nearly $4 billion globally by 2028. What’s more, yoga mat searches on Google were up 14% year-over-year this month.

“With this expansion, we are signaling that we want to enhance [our customer’s] yoga practice and give her everything she needs for yoga in one place, with accessories that complement [our activewear] pieces,” Ercon said.

Athleta made $1.43 billion last year and is expected to make $2 billion in 2023. But Lululemon is still the dominant force in yoga apparel and accessories, with more than $6 billion in annual revenue. While Athleta makes yoga apparel and features yoga imagery in its marketing — it dominates the landing page of its online store, as of Tuesday — it has stayed out of the yoga accessories market until now.

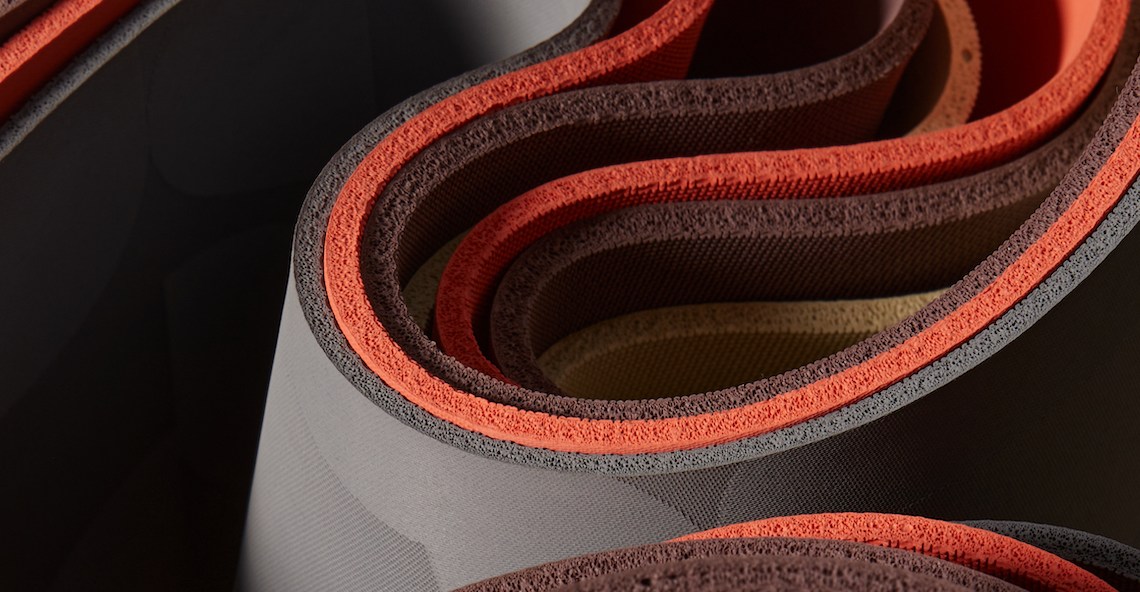

Athleta’s yoga accessories differ from its competitors’ gear in a few ways. For one, its yoga mat is priced at $118 — more than the $98 charged at Lululemon and a bit lower than the $128 mats at Alo. The materials used are also a differentiator, according to Athleta.

“Most yoga mats are still made from fossil fuel derived Poly Urethane and Polyiynyl chloride, which contribute to greenhouse gas emissions,” Ercon said. Athleta’s mats, meanwhile, are made with 70% Yulex, a natural rubber made without fossil fuels. The blocks are 51% renewable sugarcane plants and the bags are 100% recycled nylon. As a B Corp, Athleta has made the new accessories’ lack of fossil fuel-derived materials a central selling point.

In Gap’s third-quarter 2022 earnings call in November, interim CEO Bobby Martin said that, while the market for women’s activewear had softened, Athleta had maintained modest positive growth of 6%. Martin attributed that growth to Athleta’s lifestyle and non-active products. Now, the brand is leaning into new categories outside of activewear to grow.

“Through the introduction of new and expanded categories, like the Flow Freely yoga collection or our recent intimates collection Ritual [launched in September], we are bringing new customers into the brand, fueling our overall growth strategy,” Ercon said.

To market this new category, Athleta has been tapping athletes. On January 18, it debuted the yoga mat at a NYC-based yoga event hosted by Taryn Toomey, founder of fitness and workout studio The Class. Working with big-name athletes and fitness influencers is a well-worn strategy for Athleta, which has also hosted in-person events with Simone Biles, among others. The brand has also posted about the new products to its 830,000 followers on Instagram.

And while the new category is meant to bring in new customers, Hanna Lane, senior account director of fashion at marketing firm Power Digital, said existing customers are best for getting a new category up off the ground.

“Athleta can get a leg-up immediately by leveraging its existing customer base with tailored messaging that makes them feel special,” she said. “These consumers already have a level of loyalty to the brand, so it’s the perfect opportunity to cross-sell the new products while expanding lifetime value.”