It’s been one year since clean fragrance brand Skylar launched a monthly fragrance subscription program called Scent Club, marking a shift in the brand’s e-commerce strategy. Launched in 2017, Skylar previously only sold full-size 1.7-ounce fragrances for $78. When Skylar’s Scent Club debuted, it was an unusual proposition to sell a subscription of fragrances to customers who could not smell the products beforehand; unlike fellow fragrance subscription company Scentbird, Skylar’s monthly fragrances are exclusive to the brand and not available elsewhere.

Today, Scent Club has over 10,000 subscribers and the club boasts approximately an 85% month-over-month retention rate, said Cat Chen, Skylar founder and CEO. The retention has held steady as of April 1, despite coronavirus, although Chen said she expected to see a drop-off. Over the past 12 months, Scent Club has been able to attract new customers to the brand by serving as a low-cost and low-effort entry point to Skylar; fifty percent of subscribers have never purchased from the brand. Additionally, subscribers are buying more full-size products a year, in addition to the $20 a month subscription for a 10-milliliter rollerball. Skylar customers typically buy one fragrance once a year, but Scent Club members are buying six times a year.

The appeal of buying fragrance online, an already tough sales channel for the category, during unprecedented economic and cultural upheaval is questionable. According to Nielsen data, fragrance sales declined by nearly 18% for the week ending March 14, compared to 2019. Meanwhile, things are only getting worse for the overall beauty category, as sales declined by 58% in the week ending March 28, compared to the same time in 2019, according to NPD Group.

Chen said that although morning beauty routines are disrupted, with products like makeup seeing less use, a fragrance is the easiest beauty product to apply and maintain as a habit. And even if a customer may not be venturing out into the public, they may still reside with one or more people and have the motivation to buy fragrances, she said.

“I think it gives people a sense of normalcy,” said Chen. “We have also heard [from customers] that fragrance serves to uplift people.”

There is scientific evidence to support the relationship between scent and mood, and much like with CBD products, customers are trying to find ways to de-stress.

NPD data reveals that other scent-focused products like body oils and home scents saw a sales increase of about 10% for the week ending March 28, compared to 2019. With e-commerce as the main sales channel available, these developments indicate the relative comfort customers have with purchasing scent-focused products online. And, Skylar is not alone in seeing continued consumer interest in fragrance in a digital-only environment. Sol de Janeiro recently launched its first fragrance, which sold out on Sephora.com after five days, according to the brand. Other brands are continuing to launch new fragrances in April, such as KKW and Kenzo, and British jeweler Graff launched six fragrances on Monday. Midori Sakano, Skylar creative director, said she believes Scent Club’s current success has been based on its ability to translate the in-person shopping experience to e-commerce.

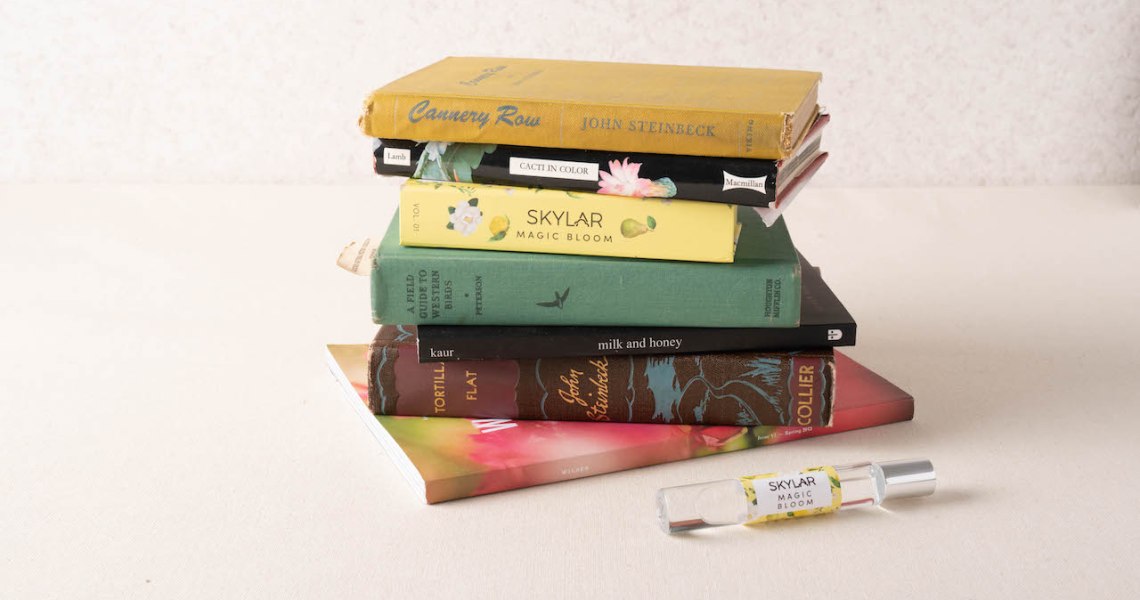

“People are staying with us even in a difficult economy, and part of the reason is that we made the experience [of receiving the product] fun for customers,” she said, pointing to the uniquely designed boxes every fragrance comes in and the community engagement aspect through its invite-only Facebook group.

Overall, the Los Angeles-based brand, which manufactures in California, has not faced significant disruptions with shipping, inventory and customer service due to coronavirus, said Chen. But the brand has changed its overall marketing message, to amplify how its portfolio of fragrances, hand creams, deodorant and body care fit into the current realm of self-care and self-quarantine.

“The Scent Club is not a functional replenishment program like most subscriptions out there,” said Chen. “In today’s world, people are probably slashing their functional purchases and trying to reduce their household expenditures, but we offer this relatively inexpensive product that offers people a [token of] happiness.”