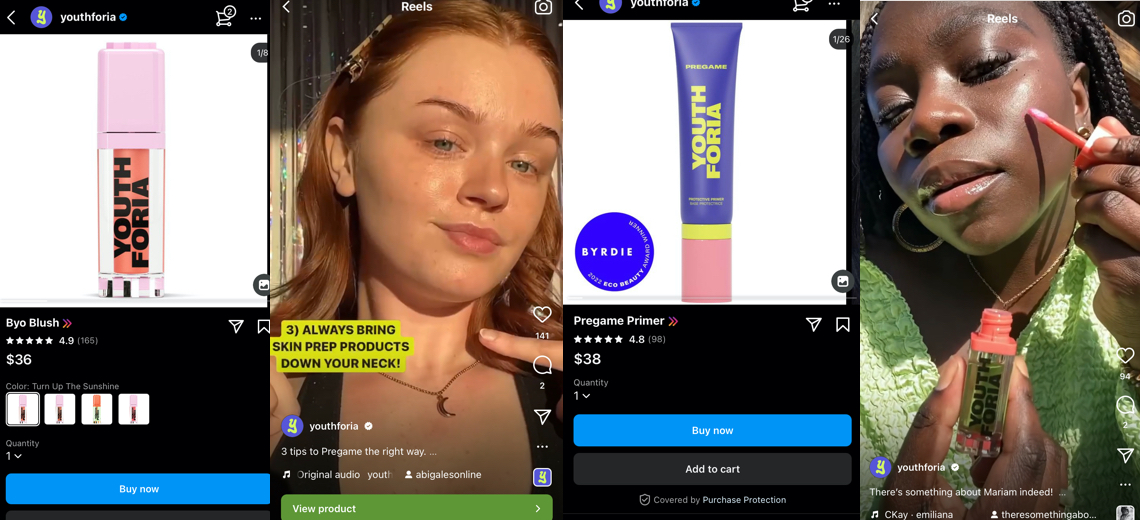

With its viral color-changing blush and Pregame Primer, makeup brand Youthforia has been dubbed a “TikTok-famous beauty brand.” It’s had TikTok product videos receive over 1 million views, and the brand hashtag has over 33 million. Only a year old, it is already stocked at Ulta Beauty.

Despite Youthforia’s success on TikTok, founder and CEO Fiona Chan joined a Meta event earlier this month to help hype up the potential for its competing platform, Instagram Reels. She shared that, when it comes to sales, it’s actually Reels that is the “source of the best-converting organic content” for the brand.

Meta’s ad revenue has taken a hit in the wake of Apple’s new opt-in requirement for data tracking. Now, the company is working to show brands what can be achieved through marketing on Instagram and Facebook with dramatically diminished data tracking. For a December Zoom panel discussion with press on the topic, the company highlighted Youthforia as a brand that has been able to find success on the platform.

“It’s definitely a dynamic and challenging time for businesses,” Katherine Shappley, vp of the commerce business group at Meta, said during the talk. “We know it’s gotten harder to measure campaigns and, in many cases, that’s due to under-reporting because of the changes with Apple.”

According to research by Glossy partner publication Digiday, 42% of agency professionals said in Q3 that they’re “confident” that Instagram “drives marketing success for their clients.” That was down from 49% who said the same in Q1 of this year. The platform came in fifth place for platforms driving the most confidence in Q3, down from third place in Q1. Facebook, meanwhile, remained in second place from Q1 to Q3, with 51% expressing confidence in the platform.

In its third-quarter financial results, Meta reported a 4% year-over-year drop in revenue for July-September. Following that report, the company laid off 11,000 employees in November.

Apple’s new privacy rules on iOS, which require apps to ask users permission before tracking their data, went into effect in April 2021. According to data from app monetization startup Flurry, only around 25% of users currently opt in to allow app tracking.

According to Shappley, Meta is defining the time period after the changes went into effect as its “direct-to-community” era, when “brands are relying on a mix of paid and organic strategies.” The company is heavily encouraging the use of Reels by brands, highlighting that Reels usage is up 50% from six months ago with 140 billion daily plays across Facebook and Instagram.

“Businesses are behaving more like creators, in some ways, and using organic content to source feedback from customers,” she said.

In the case of Youthforia, that has meant focusing on organic Reels posts, “whether that’s on our own or through customers or influencers, and supplementing that with ads,” said Chan. And the brand still uses targeting where it can: When it launched in Credo Beauty and Ulta Beauty, for example, it used geolocation to show Instagram ads to customers near store locations.

In addition to Youthforia, body-care brand Soft Services also saw more sales from Reels than TikTok, according to co-founder Rebecca Zhou in June this year.

But with limited data availability, the brand’s focus has been much more on the content itself, relying on Instagram DMs for post ideas.

“A lot of our most-engaging ads or best-performing ads came off the back of community-driven questions,” said Chan. In addition, “A lot of our growth came when we shared something very unique, [like] why we created the products or what experiences I was going through as a first-time founder.”

Meta has been creating content to advise brands on how to adjust their ad strategies to the new changes. For example, it created a five-point list of best practices that include minimizing spending on new ad sets and investing more in creator content. It has also been emphasizing the use of its social shopping features, as well as its Advantage+ program unveiled August. The latter uses AI to automate ad testing of up to 150 creative combinations at once.

“We’ve been very focused on investing in technology, machine learning and privacy-enhancing technology, and that’s helping us deliver better ads to people while using less data,” said Shappley. She added that Meta has “closed the under-reporting gap due to the iOS changes from 15% in September of last year … down to about 8%.”