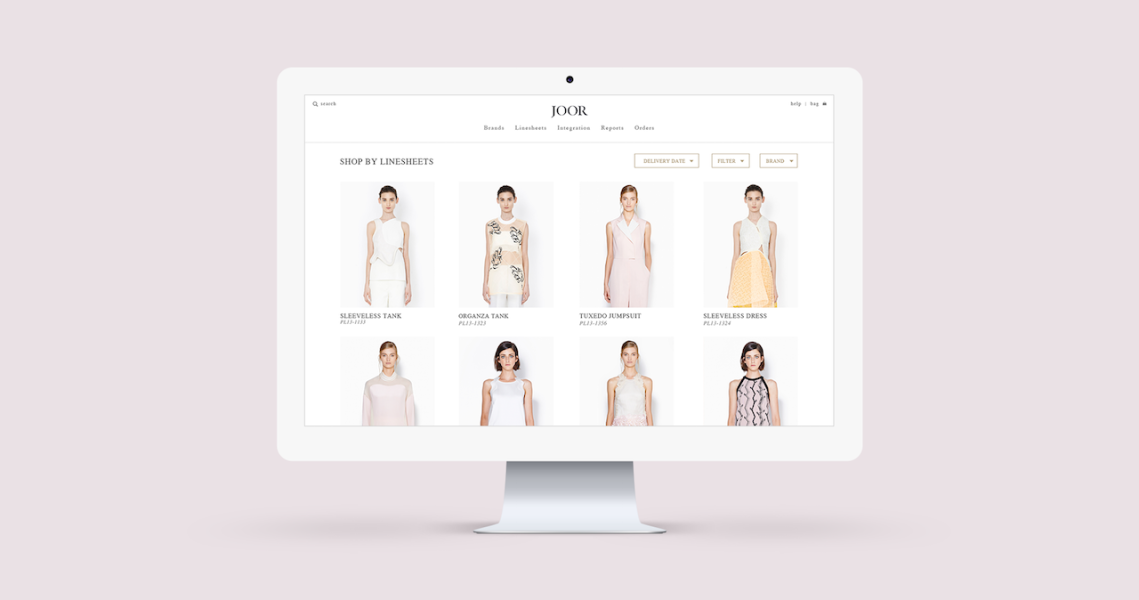

The retail landscape is in a state of flux, with DTC brands taking on wholesale partners and wholesale brands realizing the value of selling direct to consumer. As brands adjust their business models to strike a more modern DTC-wholesale mix, Joor is looking to eliminate the friction long associated with selling through retailers.

Joor, which is wholesale’s largest global platform based on inventory, according to the company, announced today a $16 million Series C funding round, led by Japanese conglomerate Itochu. The company plans to use the investment to drive product innovation for brands and retailers and to expand into the Asian market, starting with Japan. With the latter, it will facilitate seamless brand-retailer relations between Japanese companies, assist Japanese brands in expanding to Joor’s core markets of the U.S. and Europe, and help American and European brands establish a presence in Japan. According to McKinsey & Company, Japan is the second-largest luxury market, behind the U.S. and ahead of China.

The problems Joor looks to solve for brands and retailers are the inefficiencies in the ordering process and lack of access to each other’s data at opportune times. It used to be that each retailer had a different go-to ordering format, requiring different information from brands (like a style’s country of origin or UPC code) at various deadlines. With the shared platform, brands can enter data when they have it, to be shared across their retail partners and expedite the time to market. At the same time, brands can access real-time data on the platform, like sell-through rates of specific styles.

“We are wholesale’s data exchange,” said Kristin Savilia, CEO of Joor. “Transparency is missing from this industry, and our goal is to change that by streamlining the wholesale process and getting everyone on the same platform — one ecosystem to advance and grow the industry.”

Joor specializes in advanced contemporary and luxury fashion. Among its 8,600 current brand clients are Kering, LVMH, Richemont and Michael Kors, and it works with 200,000 retailers across 144 countries. Twenty-five global retailers, including Neiman Marcus, Bergdorf Goodman and 24 Sevres, have moved their buying process exclusively to its platform. Joor reports that, since its launch in 2010, the platform has seen $23 billion in gross merchandise volume across 3.7 million orders.

As for the Japanese retail market, Savilia said it’s much different from U.S. The direct-to-consumer model is less popular, and consignment retail is more dominant. To get its bearings, Joor plans to lean heavily on investor Itochu, which has already rolled out 150 U.S. and European brands in Japan.

Next up, Joor wants to further expand internationally to markets including the Middle East and India. It also plans to provide a service to brands that aggregates non-private data from partner retailers. As a result it will be able to inform brands of information like regional buying habits — for example, the size curve for their brand in a specific city.

“Brands want that guidance, and the industry needs this,” said Savilia. — Jill Manoff

The rise and fall of sneaker bots

Gone are the days of massive lines outside of sneaker retailers for the latest highly anticipated drops. It’s a relief for some, as those line were sometimes less than friendly, as the famous “Your Sneakers Or Your Life?” Sports Illustrated headline attested,

While the drop has only increased in popularity, it is executed very differently today. Online drops and digital raffles, where randomly selected winners are guaranteed a pair of whatever shoes are dropping, have eliminated much of the uncertainty and occasional hostility between customers. But for streetwear veteran Wil Whitney, who co-founded Nom de Guerre and worked at Nike before before moving on to sneaker retailer Sneakersnstuff, there is a new problem facing the hype sneaker drop: bots.

“I’m not a tech guy, but some people have created programs that will automatically try and snap up every spot when a sneaker drops online,” Whitney said. “They can be really tough to weed out, and it’s terrible for our customers since they don’t get a chance at the drop. These bots can click and type faster than a person can, so people have no chance.”

Bots are the bane of many a sneakerheads’ existence and the cause of much gnashing of teeth on various sneaker forums like Reddit’s /r/sneakers subreddit. While digital tools have helped eliminate many of the problems plaguing the drop model, bots prove that online drops can be just troublesome for brands and retailers. Luckily, Sneakersnstuff has been doing this for a long time. Whitney said the team is hard at work figuring out ways to prevent bots from taking up all the new product; it is a major priority for Sneakersnstuff and likely for its competitors, as well.

“Our engineering team is working on this all the time,” he said. “They’ve got ways of detecting if someone is a bot or not. It’s not perfect yet — they can still slip through — but we’re getting better at rooting those people out.” — Danny Parisi

Wellness gets the subscription box treatment

With wellness continuing to become more entwined with beauty and monopolizing the self-care concept, it was only a matter of time before the movement became a subscription box offering.

While wellness boxes in the form of crystals and bundled sage have existed for some time, we are seeing more beauty boxes integrate wellness and vice versa. For example, skin-care brand Sunday Riley began offering a quarterly wellness-themed subscription box in October 2018. And in March, a new monthly subscription box called Smudge will debut (featuring five products relating to the mind, body, earth, universe and humanity) that equates wellness with a morning workout or beauty routine. Katie Huang, co-founder of the wellness-and-beauty subscription box Moonbox, said that adding beauty products allowed the idea of wellness boxes to be more palatable to the mass consumer.

“Beauty products are so ritualistic in a way, especially skin care. If we can align the wellness practice with that, it would have a healthy positive effect on people,” she said. “We want to reach the people who are on the border edge [of mysticism], but we don’t want to intimidate them. There are already so many boxes that are extremely niche, and we don’t want to be the box that’s just witchcraft.”

More traditional beauty subscription boxes, like Birchbox, Ipsy and Glossybox, have hinted at wellness, too. Birchbox currently offers supplements on its e-commerce shop, while Ipsy offers wellness sets like one from Grace & Stella Co. that includes a jade roller and sleep mask, among other products. Glossybox, meanwhile, offers wellness content through a dedicated vertical on its editorial page, “Glossy Report.” — Emma Sandler