New social commerce channels are providing new avenues for brands to make money. Among them are TikTok Shop, which launched last month in the U.S. — though its association with fake products is likely impacting its adoption.

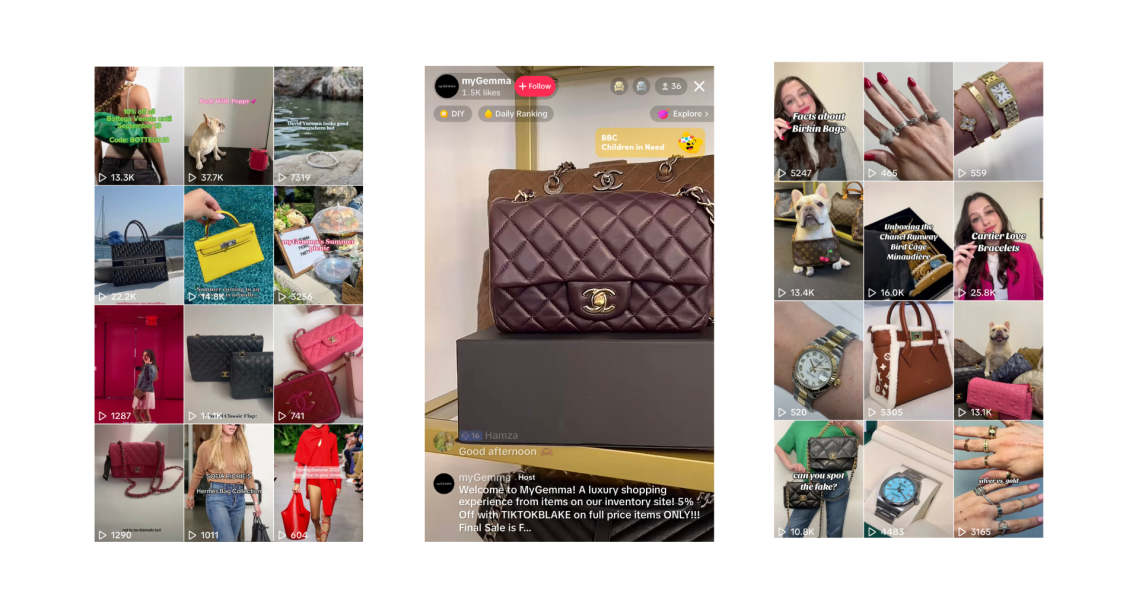

For U.S. luxury marketplace MyGemma, which did $30 million in sales last year, TikTok Shop is its second-biggest revenue driver after its own website. The company resells luxury items like handbags and watches through its DTC site and on TikTok, where it has 15,000 followers. The company expects that 15% of its total revenue for 2023 will come from the livestreams across TikTok, Instagram and Whatnot.

“TikTok ran on a different platform that went through Shopify about six months before TikTok Shop launched,” said MyGemma CEO Andrew Brown. “We had some success on that and built up a nice following before picking up on the Shops launch. [Working with] creators, we’re probably doing 20 lives a week at the moment.” The livestreams average 60-90 minutes long, and MyGemma pays creators a 5-10% commission on every item sold.

According to Brown, anywhere between a few dozen and a few hundred people tune in to watch the brand’s livestreams on TikTok. The conversion rate is “high,” he said, but he declined to elaborate. Currently, 67% of MyGemma’s livestream sales are from handbags, 20% are jewelry and 13% are watches, although Brown expects the breakdown will even out in the coming months. Top-selling brands include Chanel and Louis Vuitton, as well as Cartier jewelry.

The company works with many TikTokers who run the livestreams on their own accounts. “We work with some TikTokers that TikTok pointed in our direction, as well as other established resale companies,” said Brown. “They bring their global audience and sell our product.”

For the established companies that sell MyGemma products to their audiences, MyGemma sells them the products at a wholesale price. MyGemma declined to disclose the companies it works with. Neither Vestiaire Collective nor The Real Real currently use TikTok Shop.

Today, even the mass brand Zara is leveraging UGC content on its site, pointing to the importance of peer recommendations, which TikTok is known for. “The new maxim for the post-pandemic e-commerce age is that all commerce is social commerce,” said Eric Dahan, CEO and co-founder of influencer agency Open Influence. “Real social commerce success will come from understanding your customers, leveraging influencer relationships for trust and validation, and being willing to experiment on emerging networks, especially TikTok.”

However, not all brands can bring the level of trust that MyGemma has to TikTok Shop — the company has been around for five years, and 40% of its customers make repeat transactions. According to TikTok data from September, TikTok Shop has more than 200,000 registered sellers and more than 100,000 creators who use the livestream shopping features. Each seller has to pass an audit to sell, though the screening hasn’t prohibited the sale of counterfeit products.

As a result, TikTok Shop is now focused on mastering the authentication aspect, which is crucial when selling expensive resale products by the likes of Hermès. Announced on October 18, it’s partnered with Entrupy, an AI-powered luxury authenticator.

Entrupy uses AI technology to assess bags that are posted in TikTok videos. And, according to the company, it has a 99.1% accuracy rate. MyGemma is the only luxury reseller that is not required to use Entrupy to authenticate its products, as all of its products are authenticated in person in New York by experts, said Brown.

According to Entrupy data, in 2022, it authenticated over a billion dollars worth of inventory. And its findings have shown that U.S. consumers are unknowingly buying 20% of the world’s counterfeit goods. Most often, it’s reviewing products said to be by Louis Vuitton, Chanel and Gucci.

“TikTok is doing everything they can and is focused on pushing authenticity,” said Brown. “It is the big hurdle to [earning] any [social commerce] sales. But the trust element will come, especially for those native to the platform.”

At 23 years old, Amazon is more established and yet has also faced authenticity issues. Along with eBay and Alibaba, Amazon has also taken action.

Amazon was a keen supporter of the INFORM Act that was passed in the U.S. last year and took effect on June 27. It requires businesses selling online to collect, verify and disclose identifying information about high-volume third-party sellers. That rule applies to TikTok Shop sellers. According to the FTC, violations of the INFORM Act will be treated as violations of an FTC rule, which allows the FTC to obtain civil penalties of up to $50,120 per violation.