This story is part of Glossy’s series breaking down the big conversations at Shoptalk.

For fashion brands, offering resale has graduated from a sustainability and marketing play to a significant business opportunity.

According to Emily Gittins, co-founder and CEO of 4-year-old resale-as-a-service provider Archive, several of the company’s brand clients have a goal of growing their resale offering to make up 5-20% of their total business. Currently, the resale program of women’s workwear brand M.M.LaFleur makes up 3% of its business, and the programs of several other Archive partners are inching toward the 5% mark. On a related note, based on the “massive” resale business it’s grown in the U.S., Archive client The North Face is currently expanding its program to the U.K., Gittins said. She noted that Archive’s brand partners are growing their resale programs profitably.

“In the last year, brands have gone from thinking, ‘Let’s [launch resale] because it’s a good marketing thing,’ to, ‘Let’s do this because it’s a business,’” Gittins told Glossy this week at Shoptalk. “People’s biggest misconception has been that resale won’t break even, let alone make margin — and yet, we’re seeing some brands’ [resale programs] achieve double the margin of their core business. And we have brands where [resale] is more profitable than their full-price business. There are now proof points from major brands that this can be a big business [driver].”

Archive has adjusted its pitch to brands accordingly. “Initially, it was like, ‘This is the right thing to do,’ and the first brands signed on for that reason,” Gittins said. ‘But [our client] Oscar de la Renta definitely did not launch resale because of sustainability; they’re in it to [drive sales].”

Over the last year, Archive has doubled its number of brand partners, which include Ulla Johnson and New Balance, to 50. Many are turning to resale to monetize product returns instead of sending them to a landfill, she said.

“We’re starting to secure bigger brand [partners],” Gittins said. “They have a larger supply [of resale], so resale can be a big business for them.”

In addition, Archive has grown to a team of 50, with a large percentage of employees focused on product and engineering. And it’s actively expanding to new markets, including the U.K., Europe and Canada.

“We’re investing in our business layer, which is all the tools for pricing, merchandising and processing of products that allow brands’ resale programs to be profitable,” Gittins said.

ThredUp co-founder and CEO James Reinhart said his company is also focused on scaling its business in the name of profitability. “The math is better at scale,” he said. “A number of us [resale companies] have proven there are real economic [possibilities] in this [market]. And the more profit you make, the greater purpose you can have. So we’ve spent a lot of time internally focused on the scale piece.” ThredUp’s resale-as-a-service partners include Madewell, Frame and Reformation.

Jim Davis, chief marketing and customer officer at the 17-month-old resale site GoodwillFinds.com, also noted the costs associated with offering resale, including verifying the authenticity, doing the photography and creating the product listings for the unique products being sold. “The quicker you can speed up those aspects of it and [figure out] what technology can be put in place to take the variability out of individuals’ hands, the better off you’re going to be,” he said.

GoodwillFinds.com, which partners with Goodwill stores to sell their products online, leverages AI to scale its product listings, of which there are currently around 225,000 from 14 Goodwill partners. By the end of the year, the company aims to have 500,000- 600,000 listings from 40 partners. Within 6-12 months, Davis said the company’s product listing process will work like an automated “seamless engine.” Selling all products within 30 days is a focus.

Davis, who has worked for retailers including Urban Outfitters, said he’s surprised any brands offering direct resale are making money on the effort — particularly those working with third-party providers, considering the additional hit on margins. For its part, GoodwillFinds.com takes a small commission and a subscription fee from its partners, whose products are obtained through donations.

Gen Z’s buying habits are a big factor in the growing success of branded resale programs, as is the new accessibility to involved technologies as more resale businesses gain awareness and scale. According to a 2023 Resale Report by resale company ThredUp, on average, 40% of Gen Zers’ wardrobes are made up of secondhand clothing. A December 2023 report predicted that a top trend among Gen Z in 2024 would be “buying less new clothes.”

“The rise [of resale] is scary for brands,” Gittins said. “They’re realizing they need to take a piece of a secondhand market to keep growing.”

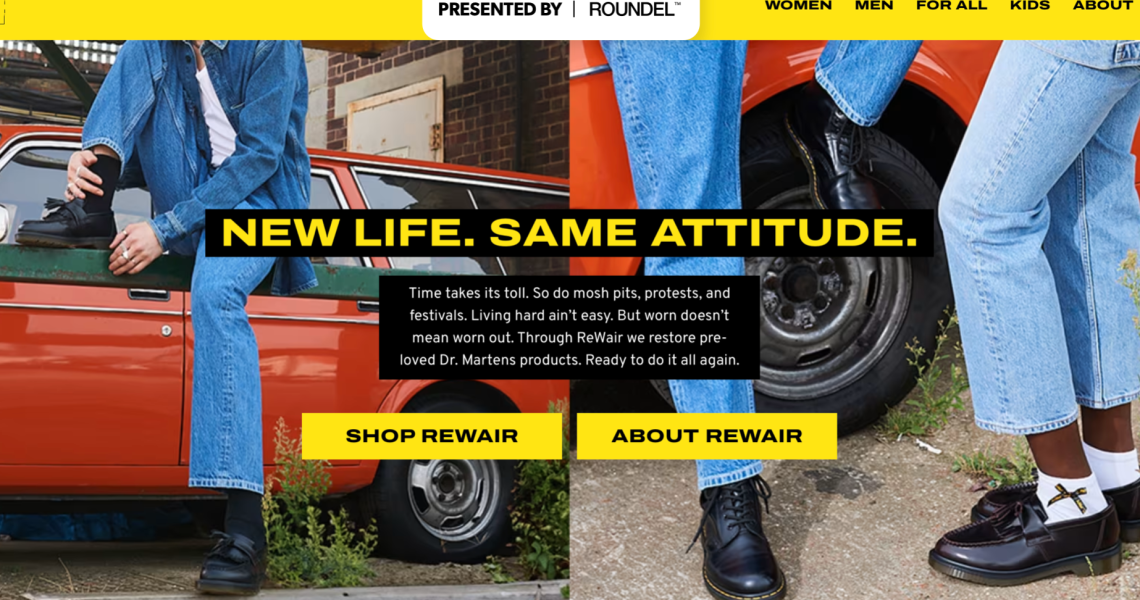

Archive’s newest client to launch resale is Dr. Martens. On Wednesday, the footwear company launched a “Rewair” vertical on its e-commerce site, populated with shoppable secondhand versions of its iconic boots. Moving forward, Rewair’s featured assortment will be updated based on the styles collected through a new takeback program. Dr. Martens shoppers can now exchange a worn pair of the brand’s shoes for a $20 brand gift card. Rewair’s boots sell for $50-$200.

According to Gittins, Dr. Martens has dedicated “a whole team” to its resale program — Archive’s main point of contact is Anna Wickes, the brand’s head of recommerce, which Gittins said is a position that’s catching on at fashion brands. Twenty to 30 brands Archive works with have appointed employees dedicated to resale, including the marketing of their resale programs, in the last two years, Gittins said.

“I imagine that, 10-20 years ago, there was a similar conversation among brands, like, ‘Who’s gonna own e-commerce?’” Gittins said. “They eventually realized they need a [dedicated] team.”

At Dr. Martens, she said, “There’s buy-in from every level of the business; they believe resale is going to be significant for the company.”

According to Gittins, brands can launch resale within a few months and “quickly” see returns from it. Archive’s brand partners can populate their resale programs through product take-back programs, as Dr. Martens does, or they can opt for peer-to-peer or Archive-managed resale programs. Through the former, sellers typically earn 70% of the resale price in case or 100% in a brand gift card.

However, Gittins acknowledged that, in 2024, introducing resale can be a tough sell to brands. “It’s a tougher [economic] environment, so a tough time for brands to be thinking about innovation and disruptions to their business models.”

An interesting revelation to come out of conversations at Shoptalk is that, while Gen Z shops resale, they often don’t resell clothes. During a discussion featuring the Z Suite — the Berns Communications Group-managed focus group of Gen Zers for retail, consumer and technology companies — two of three panelists said they do not resell their clothes. Regular thrifter Olivia Meyer stated, “I’m very busy. … If brands could offer more support by suggesting resale value, [for example,] it would take a lot of guesswork out of the selling process and I’d be more interested.”

Gittins said convenience is a main reason resale via brands is catching on: Unlike most marketplaces, brands can easily furnish photography, price recommendations and descriptions for their resale product listings.

ThredIUp’s Reinhart also referenced Gen Z’s current reluctance to participate on the selling side. ”We spend a lot of time making it easy for sellers,” he said. “The challenge is that [Gen Z] wants it to be easy and they want to make a lot of money, and those things often are not compatible.”

On the same note, Pacsun CEO Brieane Olson said the retailer’s Gen-Z consumers have been slow to latch onto resale opportunities. “Two years ago, we had a program where we said, ‘Bring your denim into the store, and we’ll recycle it for you.’ It had really low engagement,” she said. “So that’s a challenge that we still need to unlock. … Convenience is paramount for this customer — they’re used to easy access.”

Overall, for its part, ThredUp has retargeted its marketing to focus on millennials. “We’ve found that targeting Gen Z is both expensive and costly over the long run,” Reinhart said. “We’d rather they work out all of their peculiarities in their 20s. And then, when they’re ready to shop our site based on our core values, we’ll be there.”