In this week’s Luxury Briefing, a look at the fashion brand winners of this year’s Wimbledon, the designer response to the changes happening with London Fashion Week, recent moves from Marni and Galeries Lafayette, and news to know. For tips or comments, you can email me at zofia@glossy.co

At Wimbledon 2025, Ralph Lauren once again showed that longevity, when paired with strategic cultural execution, drives measurable results. The American heritage brand, which has served as the tournament’s official outfitter since 2006, topped the fashion earned media value rankings.

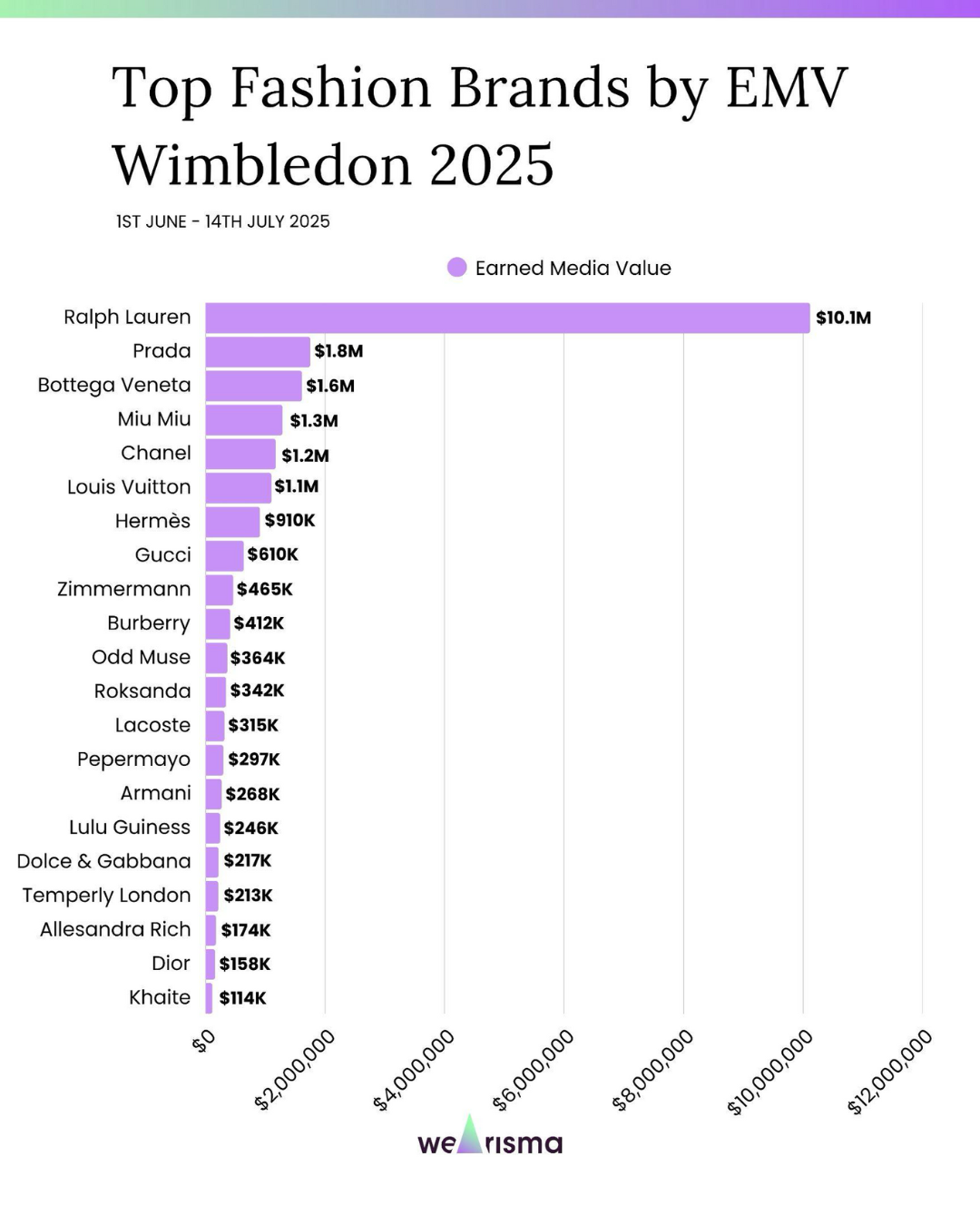

According to creator marketing platform WeArisma, fashion brands collectively generated $29.7 million in EMV during the June 1–July 14 tournament window. EMV is a metric that estimates the dollar value of exposure a brand receives through unpaid media, such as influencer posts, press coverage and social engagement. Ralph Lauren led all brands with $10.1 million, outpacing Gucci, Louis Vuitton and Bottega Veneta by a wide margin. The brand was unreachable for comment.

The brand’s highest-performing moment came via Enhypen, the South Korean K-pop group and Ralph Lauren global ambassadors. Their Wimbledon-themed Instagram carousel — featuring their Ralph Lauren looks worn to both the All England Club, which hosts Wimbledon, and Ralph Lauren’s Bond Street flagship — drove $1.7 million in EMV and nearly 957,000 engagements.

Sachin Tendulkar, the former Indian cricket captain and global sports personality, followed with a post from the Club’s Royal Box, seated alongside Ralph Lauren executive David Lauren, ex-tennis player Pat Cash and British actor Benedict Cumberbatch. The post delivered $1.29 million in EMV and reached more than 50 million users.

Actress Sienna Miller drove $763,900 in EMV with her appearance in Ralph Lauren at the men’s final, while TikTok creator Tim Schaecker added another $276,200 with a preppy Wimbledon styling video aimed at the platform’s Gen-Z audience.

“Ralph Lauren demonstrates how sustained commitment to a sport can translate into meaningful cultural equity,” said Jenny Tsai, founder and CEO of WeArisma. “From collaborations with global stars to authentic moments that span generations, the brand has proven its ability to turn long-term partnerships into cultural momentum.”

Since becoming Wimbledon’s first official outfitter in 2006, Ralph Lauren has released annual limited-edition Wimbledon capsule collections that fuse British sporting tradition with American prep. The 2025 drop featured striped rugby knits, crest-emblazoned jackets and branded caps, sold through Ralph Lauren stores, e-commerce and select luxury retailers including Mytheresa-owned Mr Porter.

While EMV measures attention, it doesn’t always guarantee conversion. As i-D editor-in-chief Thom Bettridge recently pointed out in an Instagram Story referencing the Bezos wedding, millions in EMV can be misleading when audiences are just there to gawk – no one’s buying the bride’s look.

But Wimbledon is different. Fashion insiders and fans track what players wear through accounts like @thetennislookbook (54,000 followers on Instagram), and Substacks like The Tennis Edit, SportsVerse and Bigger Than Sports, which explore how tennis aesthetics influence fashion. On the June 14 episode of the Retail Therapy fashion podcast, host Will Defries admitted to buying Paul Mescal’s tie after discussing his Wimbledon look. In this case, EMV aligns with real demand: Ralph Lauren’s Wimbledon apparel sales rose 54% in 2024, according to All England Club retail head Daniel Ashmore. This year’s figure is still being counted.

Other brands that leaned into Wimbledon-fashion integrations included Kering-owned Gucci, which hosted a pre-tournament dinner at Claridge’s with ambassador Jannik Sinner and actors Paul Mescal and Joe Keery. The event drove $151,000 in EMV via British Vogue coverage, while Sinner winning the tournament also worked to Gucci’s advantage. Sinner famously brought a monogrammed Gucci duffle bag to Centre Court in 2022, marking a turning point in tennis fashion. It signaled the sport’s shift toward luxury branding and cemented Sinner as a global style ambassador.

LVMH’s Louis Vuitton outfitted ambassador and tennis player Carlos Alcaraz in custom tailoring. Styled by Pharrell Williams, Alcaraz wore Nike performance wear, a Rolex watch and LV branding for the men’s final on Centre Court on July 13. The athlete has been sponsored by Louis Vuitton since June 2023.

For its part, Bottega Veneta, under creative director Matthieu Blazy, partnered with Italian tennis player Lorenzo Musetti for a campaign that drove $1.6 million in EMV, with a single Vogue Instagram post generating $801,400. And Italian outerwear brand C.P. Company debuted a custom all-white look on player Mattia Bellucci, earning a 296% engagement rate, the highest of any brand at the tournament.

Fashion brands are not the only ones tapping, and building, Wimbledon’s link to luxury. British luxury travel and lifestyle brand Antler, founded in 1914, also used Wimbledon to sharpen its fashion positioning.

Antler’s 360-degree campaign included hosting a tennis-themed event at Berkshire hotel Oakley Court, gifting VIP and sponsoring British tennis player Julian Cash, who wore the brand and went on to win the men’s doubles final. The brand declined to share the sponsorship amount. As a result, Antler saw social engagement increase by more than 100%, compared to an average day, plus its reach grew by 62% and impressions rose by 34%. Website sessions from organic social traffic rose over 45% year-over-year, while press coverage surged by 187%.

“Wimbledon significantly enhanced our brand visibility and reinforced the positioning of our British heritage and summer capsule collection,” said Kirsty Glenne, managing director of the brand.

Antler’s “made in the UK” Heritage Tote Bag also gained visibility through partnerships. Actresses Emma Appleton, Millie Brady and Saffron Hocking carried the tote courtside, generating strong social and PR pickup. Their combined reach of over 1.29 million followers amplified the brand across fashion media, with placements in fashion publications including Who What Wear and Marie Claire.

“This activation did more than drive awareness. It cemented Antler’s status as a modern British lifestyle brand,” Glenne said.

Can new BFC CEO Laura Weir save London Fashion Week?

In her first 77 days as CEO of the British Fashion Council, Laura Weir has wasted no time diagnosing the industry’s pain points and attempting to fix them. “It is time to reset,” she said at the BFC’s annual summer gathering on July 14, before laying out a series of changes aimed at reversing London Fashion Week’s slide in global relevance.

The core of her plan addresses what many designers and industry observers have long critiqued: the lack of infrastructure and commercial support for emerging British talent. In February, Glossy reported that U.K. brands were increasingly skipping the runway altogether, citing dwindling sponsorships and rising costs. Designers including Chet Lo and Tolu Coker have moved their production elsewhere or focused on wholesale appointments in Paris, while the June London Fashion Week men’s showcase was scrapped in favor of a showroom across the Channel.

Weir’s headline announcement included waiving listing fees for designers physically showing their collections in September, directly targeting this challenge. “Fashion Week is a valuable piece of national IP and our shop window for what creative Britain looks like,” she said.

Designers are welcoming the shift. “Waiving the entry fee is a hugely welcomed move, especially in today’s climate where designers are balancing so many costs,” said Deborah Latouche, founder of Sabirah, a modest fashion label launched at LFW in 2020. “It’s encouraging to see the BFC recognizing this and responding. The U.K. is a hotbed of talent, and I am hoping the BFC will start working to build an industry that keeps us here.”

Additional moves by Meir have included tripling the funding commitment from the BFC’s Department for Culture, Media and Sport to the designer incubator Newgen program, doubling the guest program budget and launching the Fashion Assembly, an education initiative that will bring designers back to their former schools across the U.K. to inspire students. The guest program initiative invites and hosts key international industry stakeholders at LFW, including global press, buyers, influencers and cultural commentators. Exact financial figures were not disclosed. “Young people need to see the many pathways into fashion,” said Latoya. “This could be the spark that opens doors.”

While designers like Patrick McDowell also expressed optimism about the changes, the long-term success of Weir’s reset hinges on sustained funding and follow-through.

Designer Karina Bond of her namesake brand said, “It’s no secret that LFW is nowhere near what it once was, and I want to stay loyal to my city and keep showing here. Promising to double the investment to bring more buyers and- press sounds fantastic, but is it also too good to be true? What will the competition be like for the on-schedule spots, now that they’re free? How oversaturated will LFW become among graduate designers with hopes of catapulting their brand due to all the new promises?”

In her speech, Weir called for industry-wide support. “Fashion gives us a preview of society’s next chapter,” she said. “It’s time to write a new story together.”

Executive moves

- Marni has appointed Belgian designer Meryll Rogge, founder of her namesake label and former design lead at Dries Van Noten, as creative director, following Francesco Risso’s departure in June. No official date has been set for her first presentation.

- Galeries Lafayette has appointed Guillaume Houzé as chief image and innovation officer after serving 11 years as director of image and communications; Emmanuelle Greth, formerly director of human resources and sustainable development, is now chief human resources and CSR officer; and Matthieu Caloni, previously head of finance, strategy and transformation since 2016, has been promoted to chief financial officer, replacing Ugo Supino, who stepped down in June after 25 years at the company.

News to know

- A Milan court has placed the cashmere company Loro Piana under judicial administration due to allegations of labor exploitation by unauthorized subcontractors of one of its suppliers. This prompted the LVMH-owned brand, led by new CEO Frédéric Arnault, to cut ties with the supplier within 24 hours and pledge full cooperation with authorities.

- Macy’s is borrowing $500 million by selling new long-term bonds to help pay off older, due-soon debts and reduce its financial burden. Credit agency Fitch gave the new bonds a good rating, saying Macy’s is managing its money well, despite challenges like closing 150 stores and dealing with cautious shoppers.

- French knitwear brand Molli has received a minority investment from LVMH Luxury Ventures, marking its first external funding since being revived in 2014 by CEO Charlotte de Fayet. The investment will go toward international expansion, new flagship stores, product innovation, and team growth. The brand is on track to surpass €10 million ($11.6 million) in annual sales.

- U.S. President Donald Trump announced 30% tariffs on all imports from Mexico and the European Union starting August 1, via letters posted to social media platform Truth Social on July 13. He cited ongoing trade imbalances and border security concerns, despite prior negotiations proposing lower rates and warnings from E.U. leaders about potential economic fallout and retaliatory measures. The E.U. and U.S. share a significant trade relationship, with goods and services exchanged between them totaling €1.68 trillion (approximately $1.95 trillion) last year, accounting for nearly 30% of global trade in goods and services.

Listen in

On this week’s Glossy Podcast, senior reporter Danny Parisi and editor-in-chief Jill Manoff discuss Amazon’s Prime Day, where early data showed slower spending and most purchases under $20, and the response by competitors including Walmart. They also unpack Meta’s $3.5 billion investment in EssilorLuxottica, signaling the launch of more smart glasses after the success of Ray-Ban Meta. Plus, they explore Heron Preston’s move to reclaim his brand from the now-bankrupt New Guards Group. Later, Jill interviews Laura Meyer, founder of Envision Horizons, about how fashion brands can better navigate Amazon. Listen here.

Read on Glossy

How Citizens of Humanity is building up its menswear business. How fashion is addressing declining tourism. Condé Nast and Hearst are getting in on AI. Brands like J.Crew are activating in Europe following American interest.