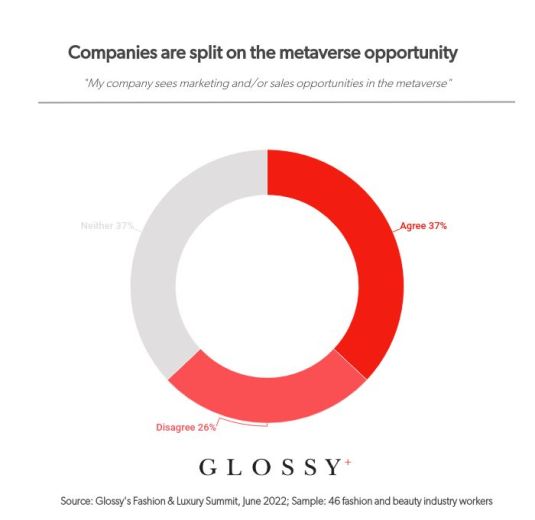

When it comes to one of the most talked-about new frontiers for fashion and beauty brands today — the metaverse — headlines make it seem like the industries are universal in their embrace of web3.

But new Glossy research indicates that brand executives’ opinions on the metaverse are split. In a June 2022 survey conducted by Glossy at the Fashion & Luxury Summit, 46 beauty and fashion executives were presented with the prompt, “I see marketing and/or sales opportunities in the metaverse.” Opinions were almost evenly divided, with a slight lean toward agreement. A combined 37% agreed or strongly agreed with the statement, while a combined 26% disagreed or strongly disagreed.

The hesitancy is warranted. While NFTs and the metaverse have had their highlights in the last year, both areas come with baggage. Some brands, like MeUndies, have backed out of the web3 space after harsh criticism from their audiences, and NFT sales have dropped significantly in 2022 compared to last year.

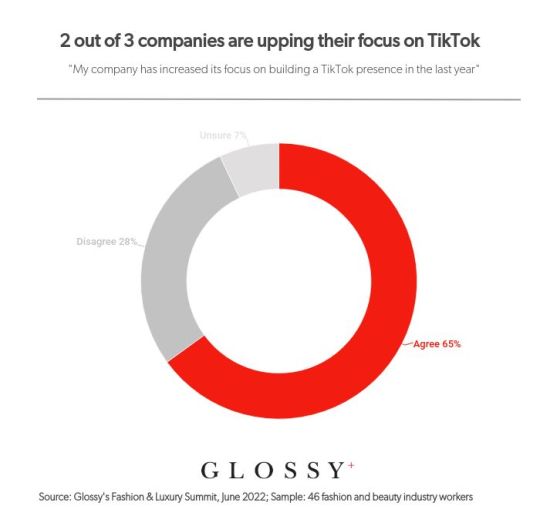

There was much more universal agreement among the respondents to the prompt, “My company has increased its focus on building a TikTok presence in the last year.” Sixty-five percent agreed, compared to 28% who disagreed.

TikTok is undeniably an important marketing lever, boasting more than a billion monthly active users globally as of the end of 2021. For reference, OpenSea, the largest NFT trading platform, has about 250,000 users actively trading each month.

“Tiktok is powerful,” said Junior Scott Pence, CMO and creative director of Peace Out Skincare, speaking at the Glossy E-Commerce Forum in May. “There’s nothing better than a viral moment to sell your product. One 15-second viral moment will sell six months of your product in a heartbeat.”

But the prevailing feeling among brand executives is that TikTok is also unpredictable. Posts on the platform can go viral and bring in huge amounts of new consumers, but it’s hard to tell what will go viral and what won’t.

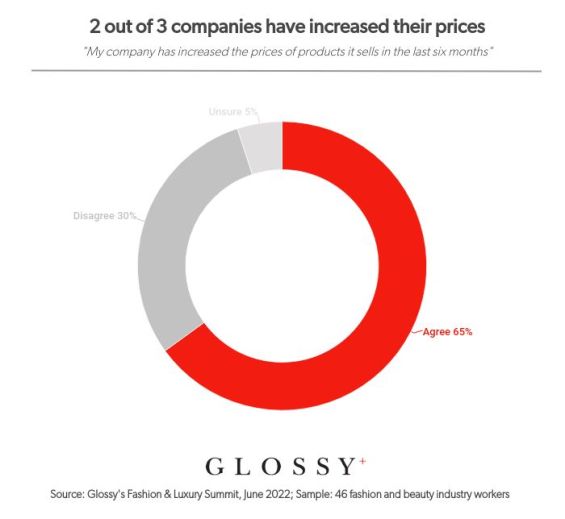

Outside of marketing opportunities, the survey also gauged brands’ readiness for an oncoming recession. Sixty-five of respondents said they had increased their prices in the prior six months. This is a common tactic that companies are using to deal with rising inflation that will likely continue through the rest of the year.

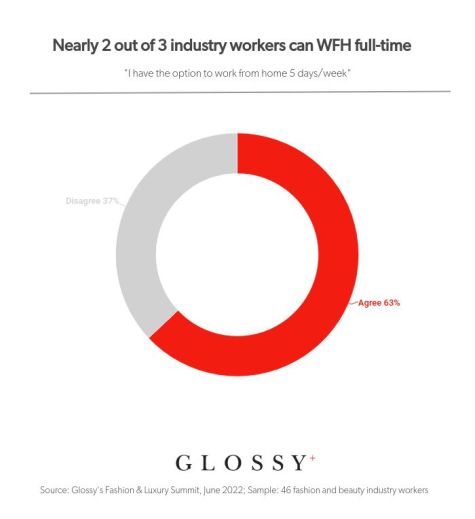

Sixty-three percent of industry workers said their companies permit them to work from home full-time.

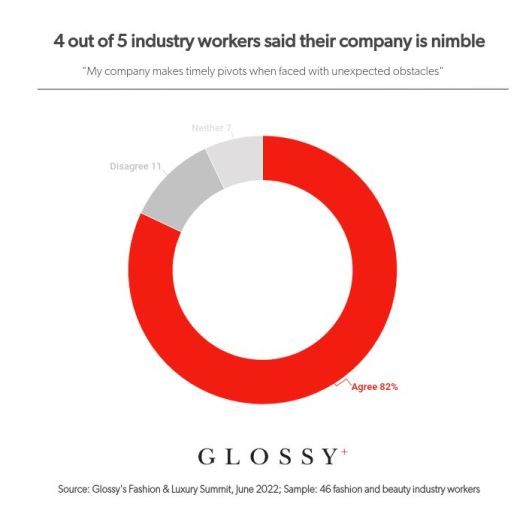

A combined 82% of respondents said they agreed or strongly agreed with the statement, “My company makes timely pivots when faced with unexpected obstacles.” As a recession seems increasingly likely, those timely pivots — which Glossy will be covering throughout this week in a series of stories on recession preparations — will be tested.