To stay up-to-date on the latest runway shows, digital presentations and behind-the-scenes buzz, sign up to receive Glossy’s daily Fashion Month Briefing (February 10-March 7).

In 2019, the formerly powerful mall brand Forever 21 —- which had once boasted more than $4 billion in revenue — went bankrupt. An overextended retail footprint led to continued losses, like many retail brands in the last four years. In 2020, when the brand was bought jointly by Authentic Brands Group, Simon Property Group and Brookfield Property Group, Glossy reported that the plan was to get the brand’s retail footprint under control. The new owners closed 200 stores and refocused on profitability.

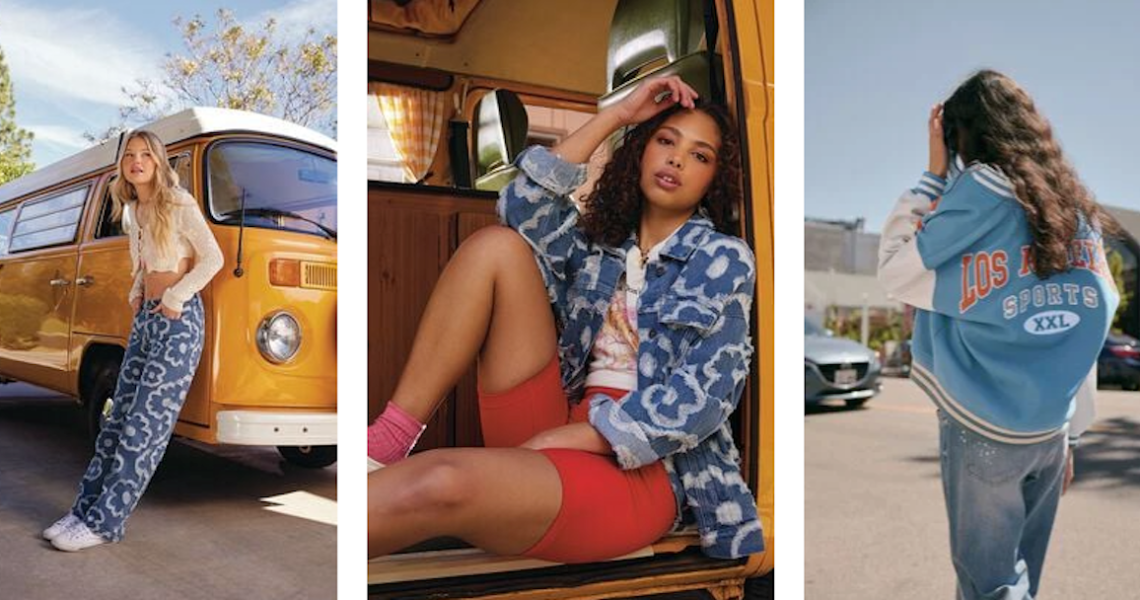

Now, two and a half years after bankruptcy, Forever 21 has overhauled its business in a slew of changes under new CEO Winnie Park, who took over for Daniel Kulle after he resigned in October 2021. Park joined the brand just over a year ago, overseeing the opening of dozens of new stores, the launch of high-profile collaborations with brands like Barbie and Frederick’s of Hollywood, and the growth of Forever 21’s TikTok presence.

“Since I started at Forever 21, my North Star has been for us to build meaningful relationships with our shoppers and authentically meet them where they are,” Park said. ”We’re looking through the lens of our customer and zooming in on what is happening in their world and how we can create a lifestyle that represents fashion as means of self-expression.”

For much of 2022, “meeting customers where they are” meant e-commerce. But as online spending has died down, Forever 21 is one of many brands reinvesting in brick-and-mortar retail. The 14 new stores are different than the sprawling, multi-floor experiences that Forever 21 is known for, as the brand is trying to avoid the mistakes of the past. Instead, Forever 21 is favoring smaller and better merchandised stores with a selection curated for local buying habits, based on e-commerce data.

Simon Property Group, one of Forever 21’s parent companies, reported $39 billion in profits last November, saying at the time that brick-and-mortar retail was a main driver and that e-commerce at its brands owned with ABG was down. The company doesn’t provide financial data for the brands it owns through its partnership with ABG. Park also declined to share revenue information about Forever 21. Brookfield sold its share of the brand for $63 million in 2021.

Fara Alexander, director of brand marketing and communications at retail tech company goTRG, said the increase of e-commerce returns is one reason brands like Forever 21 are better off looking to brick-and-mortar for growth opportunities.

“Among the biggest concerns for these brands is the cost of processing returns, particularly e-commerce returns,” Alexander said. “For stores like Forever 21, where the average item value is likely less than $50, retailers can spend almost the entire value of the item simply processing the return, not leaving much for them to recover on a potential resale.”

On the marketing side, one of ABG’s main goals for Forever 21 was to revitalize the brand’s popularity among younger consumers. Most of the acquisitions ABG made in the pandemic years were of brands popular with millennials and older generations. Those included Brooks Brothers and Reebok. Forever 21 is one of its few brands with a youth audience. But pre-bankruptcy, that popularity was waning. In 2019, support for the brand among shoppers ages 13-30 dropped by 13%, according to research firm Ypulse.

But in the last year, a heavy investment in TikTok has helped Forever 21 turn that around. The company has over 100,000 followers on the platform and regularly enlists influencers like Stephany Andrea (174,000 TikTok followers) and Karla Jara (443,000 followers) for sponsored videos, which it reposts to its main account. Park said TikTok has been key in pinpointing the trends Forever 21 customers are most interested in, like the prep trend it’s pushing for February.

The brand is also using those influencers to promote its store openings. For example, in September, TikTok influencer May Serafim (65,000 followers) posted a video tour of a newly opened store in Chicago.

“We’ve been able to use the platform to drive buzz around all the exciting things happening in our world,” Park said. “That includes everything from showcasing our amazing seasonal collections and co-branded limited-edition capsules to working with influencers on fun user-generated content showcasing their in-store and online shopping experiences.”

Melissa Tatoris, vp of retail at marketing company Zeta Global, said Forever 21’s brick-and-mortar strategy could also help it regain its Gen-Z audience.

“While Forever 21 is behind [competitors like Shein], it’s critical to build an all-channel strategy, [inclusive of] store windows,” Tatoris said. “Gen Z is known to be the ‘social’ generation, wanting to return to stores for the socialization aspect of shopping.”

Forever 21’s collaboration strategy has also shifted. In the pre-ABG days, Forever 21 collaborated with companies like the U.S. Postal Service and Cheetos. The company’s most recent collab partners are aimed at boosting its fashion credibility. They’ve included the hip-hop supergroup Mount Westmore, the women’s luxury brand Hervé Léger and the lingerie brand Frederick’s of Hollywood, which have garnered a positive reaction from fashion media.

Throughout the rest of 2023, Park said an increasingly diverse set of collaborators — both with brands and designers for product collaborations and with content creators for marketing — will be key to continuing to grow the business.

“We love partnering on collaborations with brands and content creators who share our values and have a diverse cultural following, an emotional resonance, like nostalgia, or a visceral connection, like music,” Park said. “These collaborations allow us to meet our consumers where they are while also keeping our brand relevant and fresh.”