While mobile apps have been around for decades, the pandemic era has sparked a rise in their popularity among fashion brands and retailers.

In the last three months, brands including Muji, Grailed and Kenny Flowers, as well as retail platform NewStore, have put a new focus on mobile apps. Their reasons are manifold, but a common thread among these new apps is that they’re targeted at loyal customers and are used as a way to communicate inventory at a time when supply chain issues make that paramount.

According to Kenny Haisfield, founder of his eponymous resortwear brand, the company’s app, which launched on Sunday, took around six months to develop. In addition to serving as a shopping channel, the app can immediately notify customers when a desired product is back in stock and when all-new collections drop.

“Last year, we were constantly selling out of specific products,” Haisfield said, citing the ongoing supply chain and inventory issues across the industry. “We couldn’t always get things back in stock right away, and people missed out. The app, and the push notifications, in particular, help us reward loyal customers by letting them know the second something is back in stock.”

As with the brand’s SMS subscribers, Haisfield said that its app downloaders, of which there have been several hundred in the first three days, and often among the company’s most loyal repeat customers. More than a third of Kenny Haisfield customers are signed up for SMS messaging and most are repeat customers. A big difference with an app is that a push notification can be sent to thousands of customers at once, essentially for free, while traditional SMS marketing charges by the message.

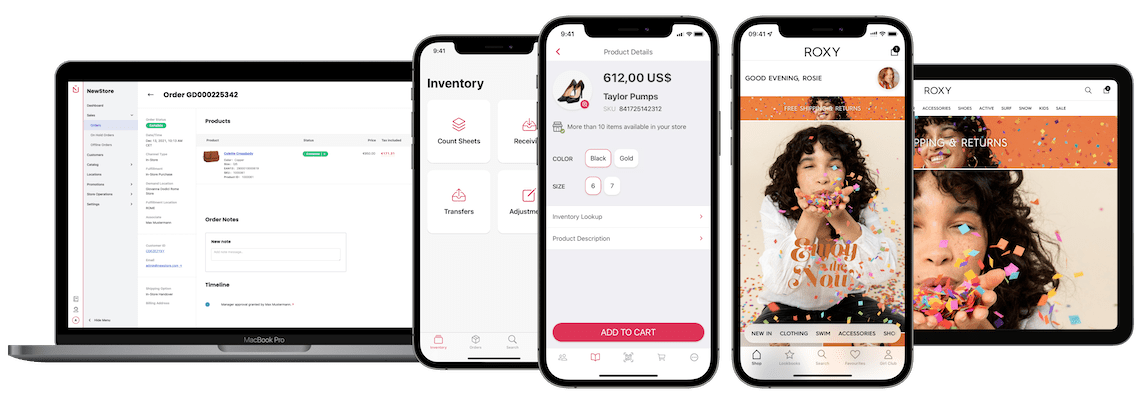

Stephan Schambach, founder and CEO of retail platform NewStore, said that, in the last month, more than 30 brands have already begun using mobile apps through NewStore’s app platform, which officially launched on Wednesday. They include Rebecca Taylor, Golden Goose, Scotch & Soda and Moose Knuckles. Schambach said that the brands that launched an app through the company in the three-month pilot period tripled their site’s engagement rate and quadrupled their lifetime customer value, on average. Most are launching an app to combat inventory problems, improve the brick-and-mortar experience by including in-store functions or increase loyalty among top customers, Schambach said.

The results are especially encouraging, depending on the target age demographic of the brand in question.

“Brands that cater to the Instagram generation have had the most success [with apps], we’ve found,” said Thijs van Schadewijk, general manager of consumer apps at NewStore. One brand targeting a younger audience, which van Schadewijk declined to name, saw 25% of its sales swiftly move to the app.

But mobile apps, good ones at least, are not cheap. Unless you are a giant company like Nike that can afford to build an entire app and its associated ecosystem from scratch in-house, you’ll have to hire an outside partner, such as NewStore. Kenny Flowers worked with a third-party developer, Tapcart, and spent $5,000-$10,000 upfront to get the app up and running, not counting monthly fees to keep it updated. NewStore declined to share its app pricing.

“Nike has billions of dollars to play with,” Schambach said. “They can make their own app with no problem. Most brands can’t do that.”