Convenience and speed continue to be prioritized in beauty.

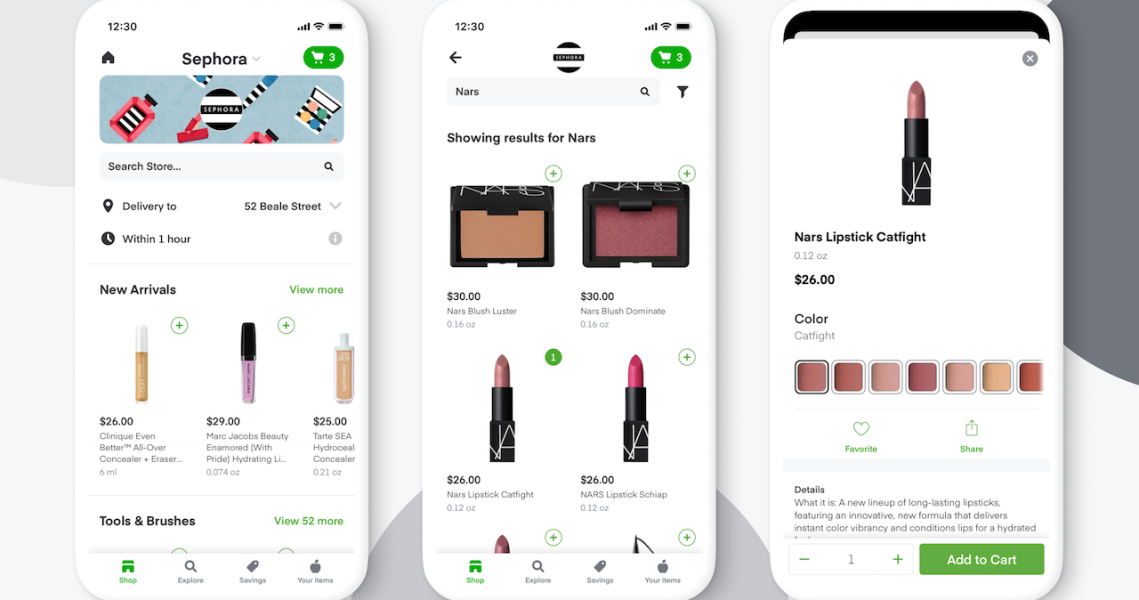

Following Ulta Beauty leaning on curbside pick-up during Covid-19 and Coty partnering with GoPuff, Sephora has announced that it has inked a deal with Instacart for same-day delivery. Beginning on Thursday, select California and Canada Sephora stores will be powered by the delivery service, and over the course of the coming weeks, more than 400 stores will be added. According to Sephora, 300-plus brands will be featured on Instacart — the entire Sephora assortment includes more than 400 brands — and to access the service, members have to either pay a delivery fee to Instacart ($3.99 for same-day orders over $35; fees vary for one-hour deliveries, club store deliveries, and deliveries under $35) or have an existing Instacart membership. An annual membership for Instacart costs $99, and a monthly membership is $9.99 per month.

Instacart has been on a tear; according to The Information, it saw sales grow 450% during the first two weeks of April, selling around $700 million in groceries in that period. It has also expanded its footprint with more partners, including smaller chains and independent grocery stores.

“We’re always looking for unique, yet practical ways to meet our clients at every touchpoint. Now, more than ever, we know they seek ease and convenience. With our Instacart partnership, we can offer a new same-day delivery service option to our existing clients and also introduce some of the benefits of being a Sephora client to Instacart’s marketplace,” said Carolyn Bojanowski, svp and gm of e-commerce for Sephora.

Sephora Beauty Insider members can earn points on every Sephora purchase they make via Instacart, and all promo events will be available through the service.

Chris Rogers, vp of retail at Instacart, said, “Instacart has become part of the household rhythm for people across North America looking to have the groceries and goods they need delivered same-day… The essentials they need go beyond fresh food and pantry staples and, over the last few years, we’ve seen an increase in customer demand for personal care, wellness and beauty products.”

For its part, Sephora has been on the hunt for best-in-class collaborators to boost e-commerce sales. In May, it partnered with Klarna to offer payment flexibility to customers, and in June, it made it easier to purchase online via Instagram Shop. On Thursday, the beauty retailer also announced its take on buy-online, pick-up in-store [BOPIS] with a service called “Reserve Online Pick Up In Store,” where consumers can reserve products and then pick up and pay for them in person within two days.

Simeon Siegel, managing director and senior retail and e-commerce analyst at BMO Capital Markets, said that considering the uncertainty in retail today, “retailers using existing delivery services and outsourcing is where we are going. Same-day delivery is here to stay.”

In a way, Instacart is an extension of USPS or UPS, but obviously offers a much faster service. But like Amazon Prime, Instacart offers quicker shipping for a price. Sephora’s partnership with the delivery service appears to be a test, in that it is treating Instacart almost like an affiliated sale, said Siegel. “Its success depends on how much Sephora markets Instacart and puts dollars behind it,” he said. The way the partnership is set up as is, it puts the onus on the customer to pay for faster shipping, not Sephora. Sephora did not further elaborate on its promotion plans.

Considering this is not a proprietary Sephora service, this delivery partnership brings up the question of data for both brands and customers. Brands will now have two middlemen who will own their customer data, both Sephora and Instacart, and customers have to feel comfortable with that, as well. For shoppers who already use Instacart for grocery delivery, that might not be such a stretch. But for Sephora shoppers who are undecided about speedy delivery and paying the price, they might second guess giving their information to yet another provider.

“Retail is a question of who owns the consumer and who owns the experience. The further away the consumer is from the brand, the less the brand can speak to that consumer. You have to wonder if this is a creative response to the environment or a defensive move,” said Siegel.