Instagram continues to roll out new ways to encourage users to shop on the platform, and a growing number of beauty brands are getting on board.

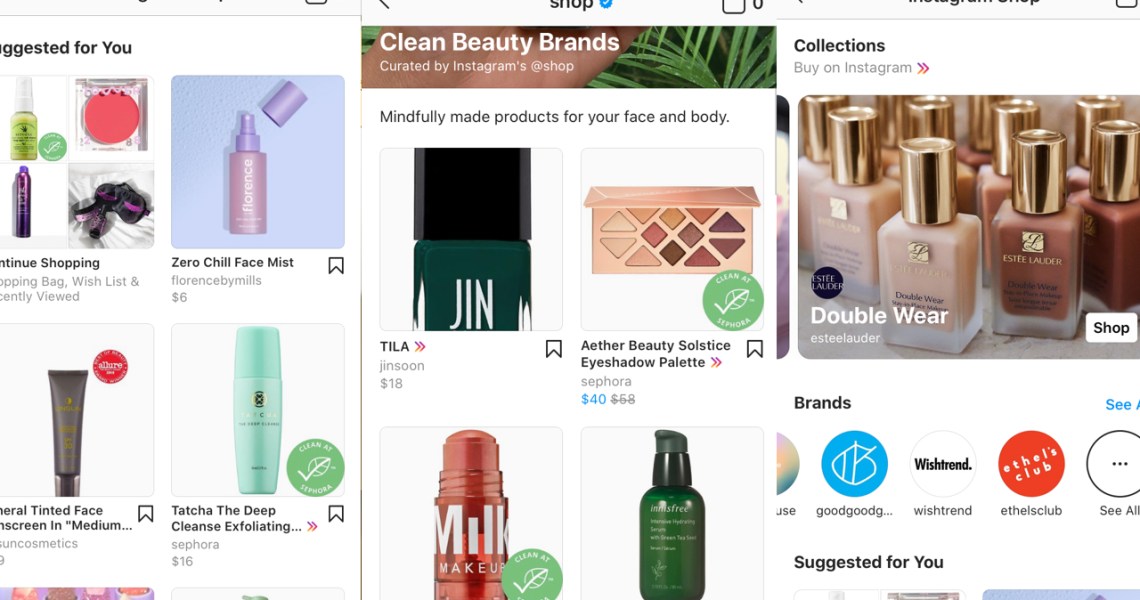

Instagram introduced the Instagram Shop feature on July 16, which features a shopping page with curated product collections, brand shops and items personalized to a user’s interests and brands they follow. According to Instagram’s announcement, brands can be featured by tagging products in content and making their own product collections. For some users, the heart-shaped “Activity” button in Instagram’s bottom menu has been replaced with a shopping tab linking to Instagram Shop as part of a test run of the feature. Facebook Pay, which can be used across Facebook platforms, was also launched for Instagram.

“Instagram is the new mall,” said Jeff Rosenblum, the co-founder of media company Questus. “You can interact with your friends; you can interact with brands.”

As Instagram places a greater emphasis on shopping, a wide range of beauty brands have now adopted the beta Instagram Checkout feature that allows shoppers to purchase within Instagram sans a link to an external site. Launched in March 2019, the feature is now used by multiple brands in the portfolios of top conglomerates including Estée Lauder Companies, L’Oréal Group and LVMH. These include Estée Lauder, Benefit Cosmetics, Clinique, MAC Cosmetics, NYX Cosmetics, Urban Decay, La Mer and Bumble & Bumble. They are joined by a wide range of independent brands offering the feature, including Anastasia Beverly Hills, Beauty Bakerie, Dr. Barbara Sturm, Dr. Brandt, Cover FX, Beautyblender, Huda Beauty, Mented, Sol de Janeiro and Osea, among others.

Rosenblum said that the value of Instagram’s shopping feature is that it “removes friction in the buying journey,” noting, “Any time you can remove any friction, it’s going to generate probably the strongest return on investment that a brand can can find. Just being able to get people when they’re ready to buy is so powerful.”

The total number of brands available through Instagram Checkout is multiplied further by the fact that many multi-brand retailers also offer it, including Sephora, Verishop, Cosbar, Revolve Beauty and Chillhouse.

Instagram’s expansion of shopping is “reaffirming the idea that social commerce is where the world is moving,” said Alex Barinka, the head of external affairs at Verishop, which launched direct Instagram Checkout last week. Beauty brands available for purchase through Verishop using Instagram Checkout include Tata Harper, Kosas and Pai Skincare. “We feel like we need to be there as part of our overall marketing mix.” The e-tailer has also been adding social shopping features to its standalone app.

Instagram also offers curated collections featured on the page via its @shop account. For example, its “clean beauty” curation features a wide range of brands including Aether Beauty, Milk Makeup, Josie Maran and Ilia.

A growing number of brands is also starting to embrace Instagram-exclusive “drops” — for example, Bumble & Bumble launched a Day-to-Night repair set exclusively on Instagram three weeks ago. Others are making sure to create alerts for product launches that show up as notifications for followers: Huda Beauty announced an upcoming mascara launch this month, while Sephora did as well for the launch of Patrick Starrr’s new brand One/Size.

But selling through Instagram is a “double-edged sword,” said Rosenblum. “I find it very analogous to Amazon. Almost every brand is on Amazon, and they’re benefiting from it, but there’s certainly frustrations because Amazon doesn’t share the data. If you want to leverage the data, you have to spend more money with Amazon. That’s what’s going to happen on Facebook and Instagram,” he said.

Brands currently do not need to have Instagram Checkout enabled to show up on Instagram Shop. Many brands still opt for shopping links that direct out of Instagram to their mobile shop, such as Bobbi Brown, Becca Cosmetics, Lancôme, Dior Beauty and YSL Beauty.

Vic Drabicky, the founder and CEO of January Digital, said that the “actual process is clunky” for Instagram Checkout so far. “Someone places an order, then Facebook turns around and sends the brand the information for which you need to fulfill it. But then you have to fulfill it within the guidelines that Facebook has given the brand.”

In addition, Instagram Checkout is costly for brands, he said. “Generally, you’re taking somewhere between 5-10% of your revenue and paying it to Facebook.” According to him, Instagram Checkout is not a high priority for his beauty clients yet, but “if all of a sudden consumers start really shopping on Instagram, that will force brands hand a little bit more to adopt the platform.”

For now, brands are testing the waters with Instagram shopping to see if it does emerge as the next go-to beauty shopping destination. Rosenblum recommended that brands invest in a shopping presence on the platform, saying, “Nobody knows what the future of shopping looks like until we’re a few months or years into it, but I would certainly say, tap into it; there’s very little downside risk.”