On Wednesday, JLo Beauty announced a partnership with facial service brand Hydrafacial on a product collaboration, a first of its kind for both brands.

JLo Beauty, launched in January, has steadily expanded its distribution from direct-to-consumer e-commerce to an exclusive brick-and-mortar partnership with Sephora. This is its first foray into the professional space and is centered on a booster product used within Hydrafacial services. Hydrafacial has many brand partnerships across more than 20 boosters, from Murad to Alastin skin care. JLo Beauty is its first celebrity brand partnership. Hydrafacial’s business operates by selling $25,000 machines to dermatologists and medspas and its corresponding booster products to operate the machines. The collaboration with JLo Beauty operates through a revenue share agreement, though both companies declined to share how much the booster costs providers. According to the company, pre-sale booster purchases sold out after becoming available around Sept. 22. Andrew Stanleick, CEO of The Beauty Health Co., which owns Hydrafacial, declined to share how many units were available.

“Entering the professional space complemented the [direction] we were going already. We started as a direct-to-consumer business, then we added an exclusive partnership in brick and mortar with Sephora, and we have a presence on Amazon,” said Lisa Sequino, CEO of JLo Beauty. “We have a position at JLo beauty that it’s all about seriously sexy science. Our target of our core customer wants to see instant results, and they’re not going to wait.”

JLo Beauty’s core demo is Latinx women around 35- to 55-years-old. Sequino said JLo Beauty has invested time in understanding this customer base and lifestyle, given the life circumstances such as being mid-career, raising a family and accumulating expendable income. With the competing priorities of this demo — “[Our] customer doesn’t have time to explore [brands] in a retail environment on a Tuesday,” said Sequino — JLo Beauty is focused on delivering its messaging and products efficiently and effectively. To that end, the Hydrafacial partnership is a two-bird, one-stone approach. The booster offers the immediacy of visible results and the ability to service customers who might already have Hydrafacial as part of their regular beauty service routine. According to previous Glossy reporting, the average HydraFacial customer visits just over three treatment providers per year. A typical HydraFacial service retails for about $250 per session.

“Boosters are a unique opportunity for Hydrafacial to offer skin-care personalization for every consumer. And it’s an accelerator for our innovation,” said Stanleick. “Boosters are an important element of our strategy moving forward.”

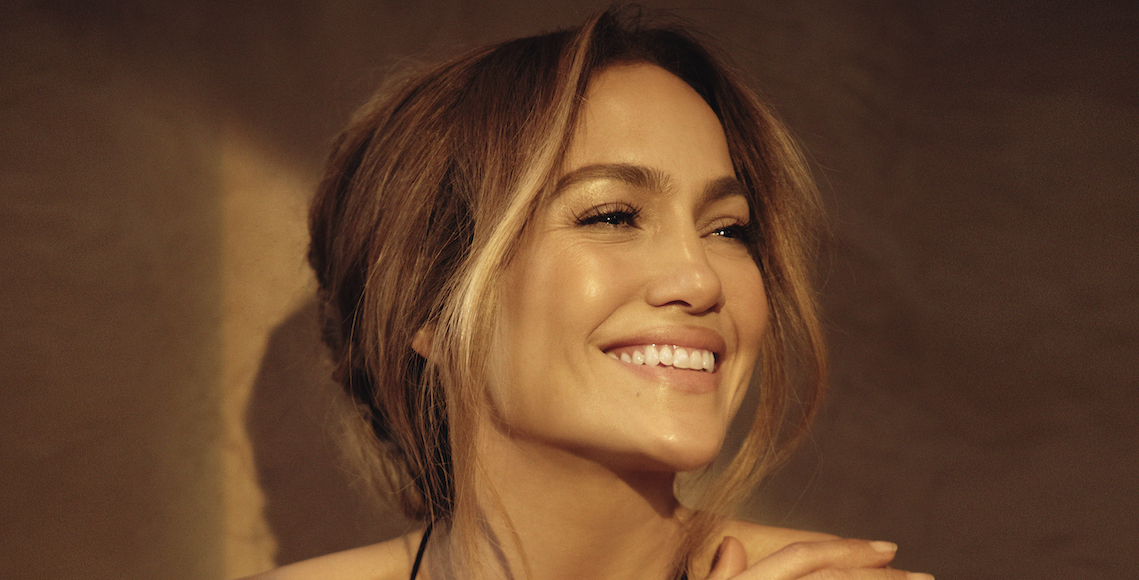

Celebrity-led brands are infrequently thought of as science-backed brands, and a groundswell of pushback toward celebrity brands has been brewing for a while. Most recently, Brad Pitt’s new skin-care brand, Le Domaine, and Travis Barker’s CBD brand, Barker Wellness, have caught the industry’s ire, with many individuals and publications calling out what they view as a cash-grab, especially in light of their $100 or more products. Sequino said that the early conversation around creating JLo Beauty was not about trying to be a celebrity brand but instead developing a “lifestyle conglomerate.” Lopez may be well suited for this, given her rigorous diet, exercise and wellness regimens. On a related note, Lopez supposedly owns her own Hydrafacial device for consistent services at home.

There’s more opportunity for JLo Beauty in the professional space, especially as the brand goes further into body care, said Sequino. Through the Hydrafacial partnership, there is also a dual opportunity for raising brand awareness as it enters international markets over the next 12-18 months. Professionally sold brands are also becoming more attractive to consumers and strategic partners looking to fill whitespaces in their brand portfolios. Clinical brands like Alastin, SkinBetter Science and Obagi, all sold in dermatologist offices, medspas and aesthetician locations, have all been acquired by conglomerates since 2021.

Aside from the obvious move of leveraging Lopez, who has a whopping 223 million Instagram followers, JLo Beauty will also rely on first-party data for marketing. Based on consumer profiles, JLo Beauty will personalize communications via email and SMS to focus on specific areas, such the booster’s ability to offer hydration or a post-treatment glow, or eliminate inflammation. Furthermore, there will be reposting of user-generated content on the brand’s Instagram channel, which has nearly 900,000 Instagram followers, and a Times Square billboard with a Hydrafacial and JLo Beauty ad. Lopez will also host in-person and virtual events for Hydrafacial providers.

“We’re rewriting the go-to-market strategy for a celebrity beauty brand by putting the product in the hands of beauty professionals as part of in-office, aesthetic treatment,” said Stanleick.