Over the last six months, Glossy has been covering the sales surge in fragrances, from niche to luxury. Data from market research company Statista shows that, in 2024, the U.S. fragrance market is expected to generate $8.9 billion in revenue. Globally, that number is projected to be $59.9 billion.

The shift in fragrance culture has been a major contributor to the category’s popularity. New brands entered the category with the goal of democratizing fragrance. And subcategories including body mists and perfume mists sprouted up.

A “body mist” search on TikTok generates over 172,100 posts. The current most-liked post, with over 232,500 likes, features creator @jusderose breaking down Sol de Janeiro’s different viral body mists.

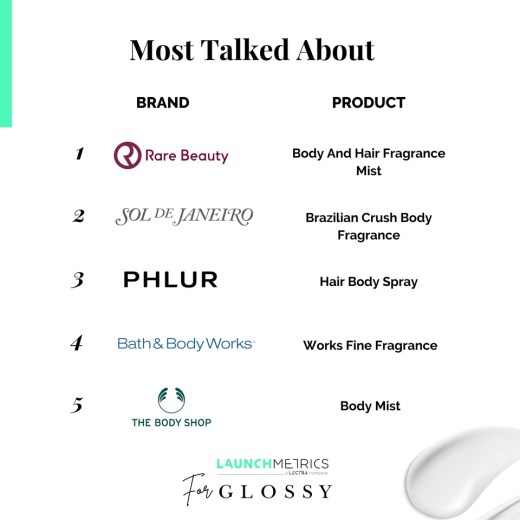

For Glossy, Launchmetrics ranked the top five most-talked-about body mists in December, based on media impact value. A proprietary Launchmetrics metric, MIV tracks the impact of influencers, print media, celebrities, official third-party partners and a brand’s own media channels.

Launchmetrics found that, though Selena Gomez’s Rare Beauty only launched its body-care line in December, its new-to-market Body and Hair Fragrance Mist claimed the No. 1 spot. Following Rare Beauty was Sol de Janeiro’s Brazilian Crush Body Fragrance, with Phlur’s Hair Body Spray ranking No. 3. Bath & Body Works’ Works Fine Fragrance and The Body Shop’s Body Mist rounded out the list at No. 4 and 5, respectively.

Across Instagram and TikTok accounts, Rare Beauty boasts over 10.8 million followers, an impressive feat for a brand that launched less than five years ago. Its celebrity founder has no doubt played a part.

What’s most noteworthy about this month’s list is the mall brands versus digital brands represented. Rare Beauty, Sol de Janeiro and Phlur, all founded less than 10 years ago, launched during a time when digital and omnichannel presences were top priorities for brands. As such, leaning on the power of strong brand messaging across multiple platforms, celebrity and influencer collaborations, and trendy marketing campaigns helped chart profitable paths for each brand. For Bath & Body Works and The Body Shop, transitioning away from their original “mall brand” status hasn’t come without obstacles. However, the ability to maintain relevancy in this current landscape proves that nostalgia still has purchasing and marketing power.

“In 2023, brands had to reevaluate their marketing strategies to increase their ROI. As a result, we saw brands leveraging their owned media voice more, as they’ve learned that engaging social content can drive similar results,” said Alison Bringé, CMO at Launchmetrics. “Rare Beauty ranked first, thanks to their strong owned media promotion, which resonated very well with their highly engaged audience.”