As professional skin-care brands and estheticians look to expand their sales channels, a new platform is bringing them an e-commerce opportunity via AI skin analysis.

Founded by entrepreneur and L’Oréal Group and Unilever alum Sean Patrick Harrington, AI skin analysis e-tailer Corelai announced its official launch on Monday after a soft launch in August. It uses AI beauty tech platform Revieve’s skin analysis tools and online appointment booking from shopping platform Clientela. Using an affiliate model, the platform aims to offer a new sales channel to estheticians searching for an e-commerce option to sell products to clients.

According to Harrington, estheticians that took a hit to their revenue during the pandemic are adapting to changes in the way customers are buying skin-care products. When shutdowns happened, customers who purchased professional skin-care products from their facialist shifted to buying online, and Harrington said that many are continuing to do so.

“In order for us to really serve our professional market, we needed to give them a secure private space to conduct business, but also monetize their time to help make up for some of that loss in revenue. We also [wanted to] provide a retail gateway for their clients,” said Harrington, of estheticians.

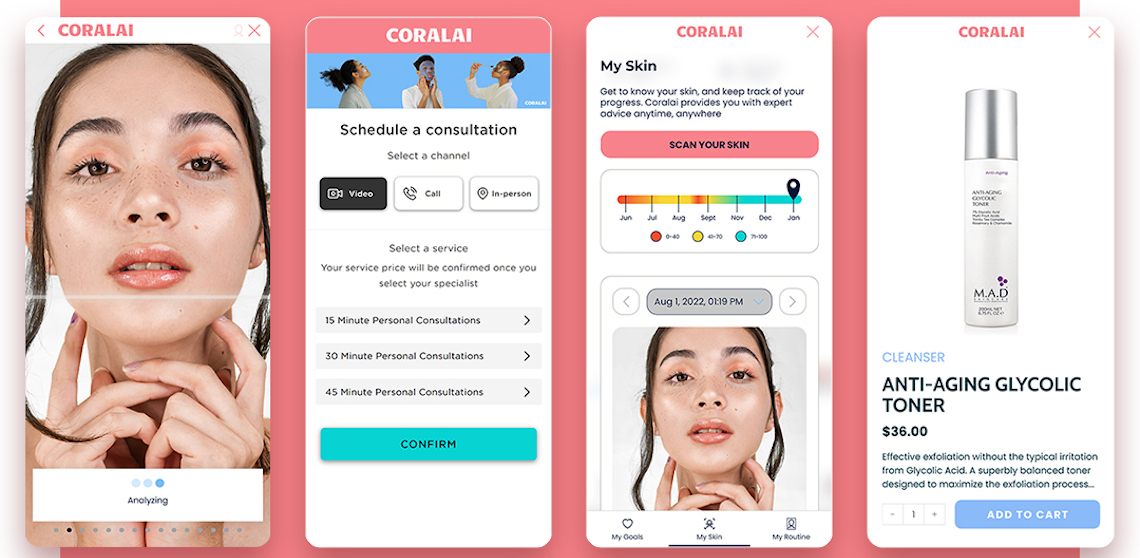

Using Revieve’s AI skin analysis technology, the website allows users to scan their face on either desktop or mobile and receive a “skin score” out of 100. The skin is rated based on nine different skin issues: hyperpigmentation, melasma, smoothness, uneven skin tone, shine, radiance, dark circles, redness and dull skin. It then allows users to complete a skin quiz asking more details about their skin, routine, life changes and product type preferences. Users can then sign up to receive a personalized product recommendation list for their skin concerns.

According to Jenna Blaha, Coralai’s co-founder and a former editor at Elle and Marie Claire, the platform is currently being promoted mainly via estheticians who introduce the platform to their clients. To get the word out about it to estheticians, the e-tailer is advertising on B2B platforms such as Lip Gloss and Aftershave, said community manager Kate Schwab.

Skin-care professionals “have been telling us these stories of when face scanning first became a thing, and they’d have these very heavy, very large, expensive machines. You’d have to go in and you’d sit there, and a client would later have to pay for their diagnostic,” she said.

With a roster comprised exclusively of professional brands, the platform offers estheticians an affiliate link to share with clients to receive a 15% commission on sales.

Professional spa and salon beauty brands have struggled since the start of the pandemic to adapt to the rise of e-commerce purchases. Brands in the hair-care space have also been adding e-commerce affiliate components to their professional sales channels: R+Co, John Paul Mitchell Systems and Olaplex have launched apps for their salon partners with features such as personalized recommendations within the past two years.

“It’s a delicate balance,” said Harrington, of professional brands’ choice of sales channels. “We want to support independent businesses. Their incomes are dependent upon providing services and retailing products.”

In addition to commission, estheticians receive 100% of fees from digital appointments that can be made on the platform using Clientela. Users can also use the platform to book either phone, in-person or video appointments with skin-care professionals.

Among major B2C skin-care brands, online skin-care analysis tools have taken off during the pandemic. Clinique and Beekman 182 are among brands that have recently launched them, while many ELC and L’Oréal Group skin-care brands now offer them.

Blaha said skin-care analysis coming from an e-tailer rather than an individual brand has the benefit of “brand agnosticism, so that when there’s a recommendation for this product over that product, it’s actually coming from a very authentic place.”

“Our partnership with Clientela and Coralai empowers clients with quantitative data to sort the optimal products and services, which are unique to the needs of their skin and personal well-being,” said Sampo Parkkinen, CEO at Revieve, in a statement.

Owned by Corpus Group Inc., Coralai’s next phase will include marketing directly to consumers and skin-care professionals. “We want to engage with a larger consumer market,” said Blaha.

In addition, according to Harrington, the company is expanding from exclusively focusing on estheticians to also including dermatologists, who can also offer bookings through the platform. It also plans to go international.