The concept of male beauty is beginning to go mainstream.

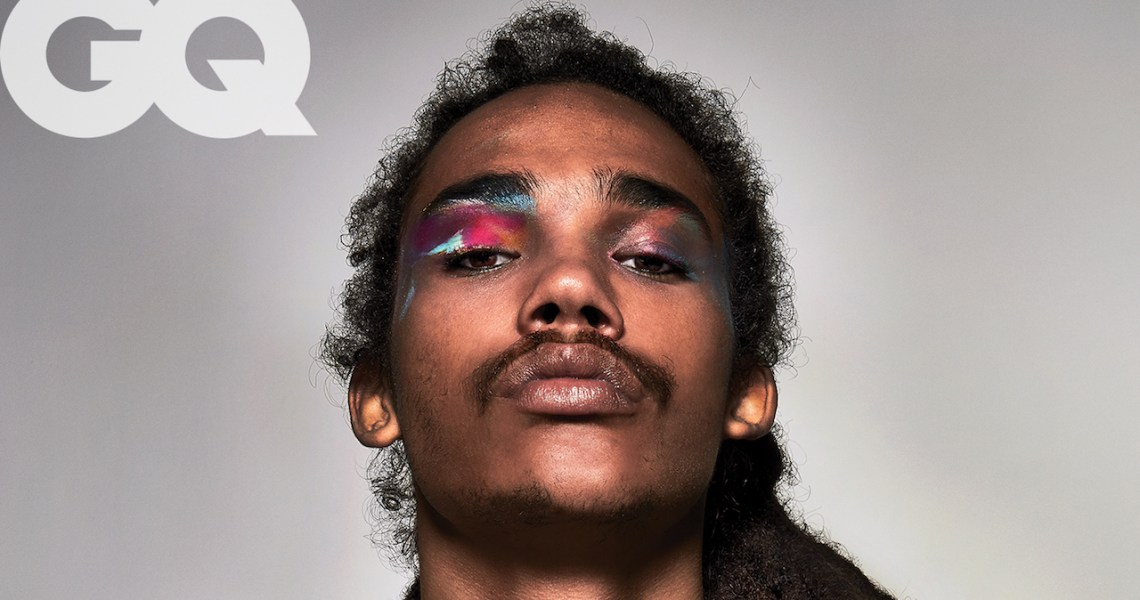

In the November issue of GQ, the Condé Nast-owned title put color cosmetics and skin care front and center. Take “The Glorious Now of Men in Makeup” feature: It shows seven actors, influencers and musicians, including model-actor Luka Sabbat and Billy Idol, in makeup, accompanied by their personal beauty tips. Elsewhere in the issue, E.J. Johnson, Magic Johnson’s son, discusses how he expresses himself with cosmetics and female clothing.

“There has just been a conversation around toxic masculinity and gender, and it became increasingly important to me to say something. The new masculinity is about knowing who you are and feeling free to express that,” said Will Welch, GQ editor-in-chief. “That has all kinds of implications for fashion and style, but also beauty and grooming, ”

Since Welch took the reins at GQ in January, its magazine and digital properties have become more progressive, and younger readers are responding to its inclusive positioning. Though GQ’s median age is 38 years old, readers 21 to 34 have increased 16% year over year, and digital subscriptions have increased 55% among this age set, according to August Comscore data.

GQ’s timing is apt, as the male shopper has become increasingly willing to spend more on beauty and grooming. According to market research firm Euromonitor International, the $8.9 billion U.S. men’s grooming market is forecast to grow by over 7% by 2023, to $9.5 billion, and the hair-care segment is set to increase by 17% to $904 million.

Micaiah Carter

Despite Koa’s push into men’s makeup and GQ’s, the title selected to feature the brand’s cleanser, as it is more of a bridge product instead of its Tinted Anti-Pollution SPF. However, the tinted product outsells its clear counterpart by 40%, and Koa has plans to produce and sell six additional shades.

While there are indie competitors in publishing like a Very Good Light that have spoken to the trend of male beauty and grooming, according to data provided by GQ, its readers are 200% more likely to spend $500 or more on grooming and beauty products, and spend $2.2 billion on grooming annually. This presents a ripe opportunity for GQ, when more traditional men’s titles like Esquire have not fared as well, from both a culture conversation perspective and a revenue point of view.

“We’ve seen really quick growth among our younger audience, and we think the future is bright for GQ,” said Welch.