Table of contents

- Introduction

- Methodology

- Summary of research: Dos and Don’ts

- Brand sponsorships are conducive to certain format types

- Instagram starts the consumer purchase journey

- Instagram plays favorites – siding with video

- While video format outperforms, still images have their place

- Instagram comment engagement shifts the conversation

- Conclusion: Top Trends

Introduction

From a hot topic and niche tactic, influencer marketing has grown to become an essential page in the modern brand’s playbook. The burgeoning influencer economy has grown so quickly and tremendously that, in November 2019, the U.S. Federal Trade Commission (FTC) released an online brochure laying out legal guidelines governing influencer marketing and partnerships to add a layer of transparency to a practice that was surreptitiously crowding consumers’ feeds. Since 2019, the release of the FTC’s online brochure, influencer marketing spend has increased from $2.42 billion in 2019 to $3.69 billion in 2021, a 52% increase in just two years. Influencer marketing has vaulted into the standard, respectable business it is today.

But as influencer marketing increasingly becomes table stakes, brands have to cut through the hype and glitter to carefully choose partnerships that are right for their target audiences. Glossy took a first step in navigating this challenge by creating a list of fashion and beauty influencers changing the industries. To better showcase their impact, Glossy evaluated their performance on Instagram, as the platform is more developed, houses more mature brand partnerships, and shows both video and still image content types. That’s opposed to other platforms – like TikTok, which only show video content. Glossy’s Instagram Index aims to measure each influencer’s strength and focus as a brand partner. Here’s how.

Methodology

The Glossy Instagram Index collects data from a list of 40 influencers and their Instagram handles, scoring them across a set of key dimensions to create a total index average score. Each influencer is then given a deviation percentage from the index average to denote above- or below-average performance. Of course, these results are dependent upon the list of influencers and the time period of data collection, generating a snapshot of the influencer space at a specific moment in time.

Glossy’s inaugural index collected Instagram data for 2021, with collection occuring in February 2022. The influencers were selected based on Glossy’s list of Gen-Z influencers disrupting the space from our Fashion, Beauty and Glossy 50 lists.

The index uses four main dimensions to measure an influencer’s performance. They are presented here in the order in which they impact our model, from least to most heavily weighted:

- Audience Reach: A measure of the influencer’s audience size and average engagement. Audience reach highlights not only the influencer’s base audience size, but also their overall post activity.

- Non-Sponsored Engagement Ratio: A measure of the influencer’s engagement compared to their following size for non-sponsored content. The dimension measures the impact of the influencer’s non-sponsored content and showcases the quality of their following — a high engagement ratio shows an interactive following and an influencer who resonates with their following.

- Brand Prominence: A dimension that focuses on the presence of branded content, the type of branded content, and the synergy between the influencer and partner brands to measure if the influencer makes for a good collaboration partner. This dimension is also used to assess the ultimate category of an influencer while tracking which and how many brands are reaching out to the influencer for partnerships.

- Sponsored Engagement Ratio: A measure of the influencer’s engagement compared to their following size for sponsored content to approximate its effectiveness. Sponsored engagement, similar to non-sponsored engagement, indicates whether and to what degree the brand-influencer sponsored content resonates with the influencer’s following.

Influencers were grouped into three categories – beauty, fashion and other – based on their partner brands’ main product category and the number of those brand sponsorships present within their sponsored content. An influencer with five sponsored posts, three of which are beauty brands, would be categorized as a beauty influencer. In the case of a tie between categories, influencers were manually categorized based on the dominant category of their non-sponsored content and in which of Glossy’s list they appeared. The “other”-type influencers included those that collaborated most heavily with gaming, tech hardware, food and alcohol brands.

Along with the influencers, the Instagram posts themselves were categorized into two main groups: still posts and video posts. Still posts consisted of static photos and other images including both single and multi-image carousel posts. Video posts consisted of any moving-image-based post, including Reels, Instagram videos, boomerangs and GIFs. The index categorized multi-image carousel posts based on the post type of the first image in the series. The index measured a total of 5,374 unique posts, 4,034 still and multi-image carousel posts, and 1,340 video posts, across 40 influencers. The influencers were categorized into 18 beauty, 15 fashion and 7 “other”-type influencers.

Summary of research: Dos and Don’ts

Perhaps expectedly, the influencers who performed above the average percentile had both wide audience reach and elicited strong engagement for both non-sponsored and sponsored content. Influencers who performed below average are not necessarily “bad” or ineffective influencers, but rather, they did not have high sponsored post engagement or many brand partnerships during the period studied. The top influencers in the index also had a wide range of audience size, with influencers with followings from the 100,000 range to mega-influencers boasting 47 million or more followers. For brands looking to partner with influencers, audience size no longer stands as the only indication of success.

Instagram posts have grown more complicated, in terms of determining which content type is most ideal for certain categories of influencers. Glossy’s research has found that brand and influencer categories determine which content type best optimizes engagement. For fashion brands and fashion influencers, predictably, the use of still posts results in a higher likelihood of strong engagement. On the other side, beauty influencers and beauty brands had strong engagement through video posts. Interestingly, “other”-type influencers outperform fashion influencers for video posts.

Among content types agnostic of influencer and brand category, video has higher engagement ratios than still image posts due to Instagram’s push for video content. To combat the presence of video-centric TikTok, Instagram favors Reels and video content and surfaces them more often by providing additional video focused exploration pages. Paid promotions also play heavily into the performance of sponsored posts, further boosting video view counts.

Notably, when broken out by non-sponsored and sponsored post types, the two categories also had preferred content types. Non-sponsored still posts performed better, while sponsored videos outperformed their non-sponsored counterparts.

Brand sponsorships are conducive to certain format types

Within the index of influencers, beauty collaborations were the most common, followed closely by fashion collaborations. As mentioned earlier, the “other” type collaborations included gaming, tech hardware, food and alcohol brands. For brand collaborations, influencers did not always limit themselves to one category of brands. Many influencers tested the waters with other categories but typically focused on one particular area.

Video format works best for beauty brand sponsorships

For sponsored video content, most collaborations saw a high average engagement ratio – views to follower count – across the board. Beauty brand sponsorships are most conducive to video and saw high engagement ratios when posted by both fashion and beauty influencers, with a slightly higher average when posted by fashion influencers. The synergy between beauty brands and fashion influencers could be attributed to the idea of “completing the look” with color cosmetic products or the inclusion of a fashion-native brand name within the name of a beauty brand. Everett Williams (@everettwilliams) showcases the idea of including both the brand’s fashion and beauty brand names through their fragrance partnerships, including Mugler and Calvin Klein. Both fashion brands licensed their names to other companies, and the resulting beauty products have name recognition for a fashion audience, despite being in the beauty category. Beauty sponsored videos underperformed when posted by “other”-type influencers, indicating a potential lack of synergy between beauty content and influencers without the necessary aesthetic expertise.

With fashion brand sponsored videos, brands saw similar performance when posted by either fashion or beauty influencers, as well, but “other”-type influencers had much better success in fashion brand collaborations than they did with beauty, perhaps indicating a higher bar for credibility for the latter. Notably, fashion brands saw relatively similar engagement with video content regardless of influencer type, unlike beauty brands that saw stronger performance from fashion and beauty influencers.

Videos sponsored by “other”-type brands saw the most success from beauty influencer pairings. Interestingly, “other”-type influencers had the lowest video engagement for “other”-type branded videos. This could be due to the fact that the data for “other”-type brands included larger brands paired with mega influencers, like Doja Cat and Pepsi or Bretman Rock and The Sims. These pairings of large brands and influencers for video content could come off as more commercial and dissuade viewers from engaging with or continuing to watch these videos.

Still image format highlights fashion brands and influencer synergy

Within sponsored still content, in an about-face, beauty brands saw the highest engagement ratio from “other”-type influencers. Beauty and “other”-type influencers saw marginally better engagement ratios outside of their category, but overall, beauty brands’ engagement stayed relatively the same regardless of influencer type.

While beauty brands saw strong video partnerships, fashion brands saw strong synergy in sponsored still content by aligning with fashion influencers: Fashion brands and fashion influencers paired together had the highest average still content engagement ratio by a wide margin. Fashion brands may be increasingly prioritizing video in their marketing efforts and budgets, but the trends favoring still content signal that fashion brands should think twice. And unlike in sponsored video content, “other”-type influencers underperformed when it came to fashion sponsored still posts.

Instagram starts the consumer purchase journey

Instagram as a marketing space for brands is strongly evident in influencers’ post captions. Words like “ad”, “link” and “code” appear in our list of the top 10 most frequently used terms, and the most common word pairing was “link bio.” These terms can indicate a sponsored post or promotion of some sort from the influencer, with “ad” almost always indicating a sponsored post.

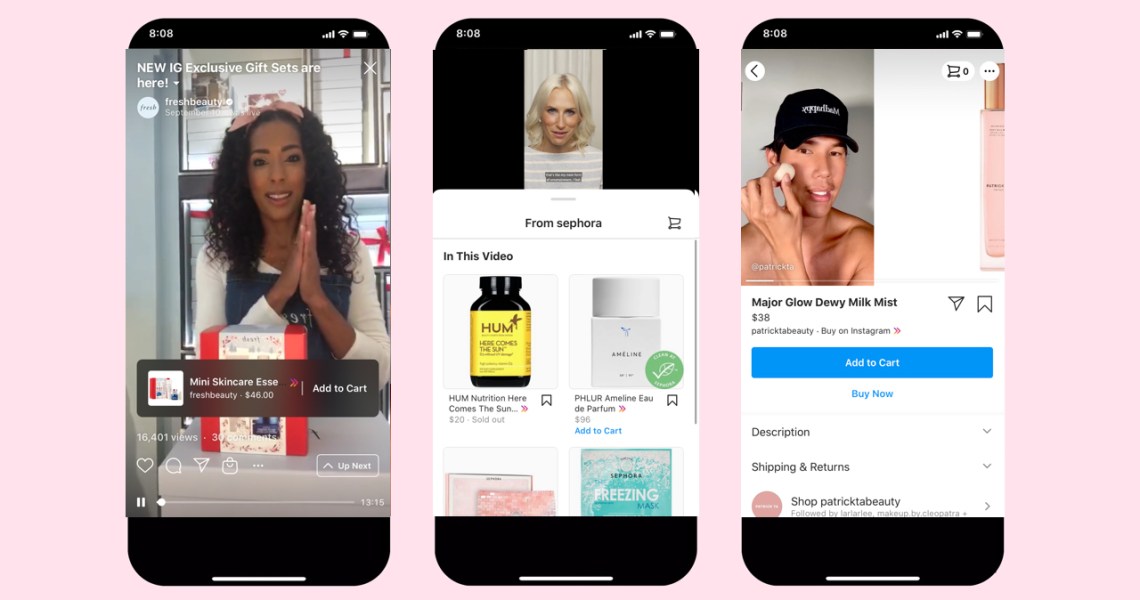

While “link”, “code” and “link bio” do not always denote sponsorship, they do indicate influencers pushing their followers to take some off-platform action. When brands themselves use or demand this language, they aim to direct viewers to their main commerce touchpoints. While Instagram has grown as a marketing platform beyond an awareness tactic, brands and influencers have emphasized using it as a starting point for the consumer purchase journey and not an endpoint. That’s despite increasing on-platform commerce options.

Other terms like “new” and “collection,” and product terms like “skin,” “makeup” and “hair” also appear in posts frequently. When combining “new” with the top product terms and measuring Google search volume, interest increases toward the end of the year, while “new skin” and “new hair” also show spikes in the first half of the year.

These two data points together show that Instagram has been a place to feature new product offerings through influencer collaborations. With spikes during the holiday season, advertising newness can coincide with gifting by focusing influencer collaborations on new holiday products and more during that active buying period.

Instagram plays favorites – siding with video

Brands and influencers aren’t just posting when and how they’d like. Both groups have content calendars and planned intent behind post content and frequency. And interestingly, post frequency did not seem to have a strong impact on engagement, with neither the number of still posts nor the number of video posts versus the ratio of engagement having no clear correlation. But type of post definitely mattered: Engagement ratios for video content clearly outpaced still posts – video content averaged to 20% and still content averaged to 7% in the below chart.

In general, Instagram has pushed video content, particularly Reels, since 2020 to remain competitive in an evolving social media space. Shortly after the threat of a potential ban of TikTok by the U.S. government on July 31, 2020, Instagram announced the release of its Reel feature on August 5, 2020. Similar to TikTok, Instagram Reels features short-form video content, differing from Instagram’s original Instagram Video by limiting Reels to a shorter length to capture more casual viewers. To further segregate the two video types, Instagram has added two toggles to user profiles to show either only Reels or only Instagram Videos.

Since the release of Reels, Instagram has continued to buff up the feature, adding shopping capabilities and giving it a prominent placement on its business page as a highlighted offering for brands. The integration of Reels as a business product also allows brands and influencers to place additional ad dollars to further increase engagement.

Three months after the introduction of Reels, Instagram announced a dedicated Reels explore tab on the homepage in November 2020. With its foregrounding of Reels and video content more generally, the platform now heavily favors that medium, a key factor in the higher engagement ratios for video seen above.

While video format outperforms, still images have their place

While Instagram favors the video format, certain circumstances and contexts may benefit from still image posts. Differences of engagement stand out when comparing the non-sponsored and sponsored content.

With non-sponsored posts, video content saw surprisingly lower ratios of views to followers than sponsored video content; however, when the data is reconfigured to a like to follower ratio, non-sponsored video performs better. This can be attributed to a number of factors, such as the ad spend and authenticity. Sponsored content will have higher ad spend behind the post, allowing for the post to have more visibility. With views being a passive form of engagement and likes being an active form, requiring users to double tap or click the like button, the data showcases the difference between interaction types. Similar to the previously mentioned trend of larger influencers collaborating with larger brands to produce video content that comes off as commercial and not as authentic, viewers could see sponsored video content in general as inauthentic and commercial-like. From these two factors, sponsored video content has more spend and gains more views, but lacks the authenticity of non-sponsored videos needed to persuade the viewer to click the like button.

For still image content in the non-sponsored versus sponsored context, stills saw the opposite results of video, performing better in a non-sponsored setting than its sponsored iterations. Notably, still shots show post captions more prominently than video, and users can see text denoting sponsorship more starkly, while video posts cut off caption text or require a click to expand the full caption. This foregrounding of the sponsored byline in sponsored still image posts can feel off-putting or disingenuous for viewers, resulting in lower engagement than non-sponsored still image posts.

When the content format is broken down further by the influencer’s category type, even clearer differences arise. For sponsored and non-sponsored stills, fashion influencers saw higher engagement followed by “other”-type influencers, with beauty falling in last place. This makes sense for fashion content as it follows a long tradition of magazine and editorial still images. In the sponsored and non-sponsored video format, beauty influencers ranked No. 1 and saw high engagement from their audience, with fashion influencers coming in second and “other”-type influencers falling in third.

The transition from beauty placing last in still formats to the clear winner in video could be due to a number of factors. Makeup, in particular, has a need for expertise or authority, and often video-based demonstrations showing the application of beauty products can signal skill, active familiarity and savvy within the beauty world. In the index, top-ranked influencer Abby Roberts (@abbyroberts) showcases this by having a number of beauty tutorial videos, such as alternative eyeliner tutorials. This trend draws heavily on YouTube’s long history (in digital terms) and large pool of makeup influencers focusing on how-to videos.

Also in the beauty category, skin care often relies on video and has a higher learning curve than other product categories due to the complicated and sensitive nature of ingredients. The products often need explanations of benefits and tips for usage, similar to a dermatologist’s explanations – though usually with numerous disclaimers attached. With the limited space in a still post’s caption, video tutorials explaining the product and showing application directions often highlight the product category more effectively.

Fashion influencers also saw strong engagement with video content but underperformed when compared to their beauty counterparts. “Other”-type influencers saw especially low performance from video content. This was in part due to the previously mentioned trend of larger brands working with mega influencers and coming off as more commercial. But also, the category’s diversity of topics and the need to hold a viewer’s attention for three seconds for it to count as view made video results here a mixed bag.

Typically an “other” influencer featured posts across multiple categories. Two influencers, in particular, set the tone for this cross-category theme: Loren Gray (@loren) and Kathleen Belsten (@loserfruit).

Loren Gray posts mainly still images focusing on fashion and beauty, but occasional videos focus on her music career with clips or sound bites of her music videos. With her main focus on fashion and beauty, her videos differ from her overall category of fashion and beauty and can result in lower engagement. Kathleen Belsten similarly posts about multiple different categories, with video content featuring gaming, fitness, fashion and beauty, among other topics. With a wide array of topics, followers may find themselves skipping past videos that don’t touch on the category they’re expecting from an influencer before the three-second mark to find categories more relevant to them. For brands working with “other”-type or cross-category influencers, this will likely continue to be a challenge, despite the scale.

Instagram comment engagement shifts the conversation

With Instagram itself pushing views and likes as the main metrics, brands have moved well beyond using follower count as a main KPI for an influencer’s reach and impact. When focusing even deeper by using comments as an indication of engagement rather than views or likes, different trends emerge. Notably, still images have higher comment engagement than videos, in part due to the way the platform moves users through videos that make it harder to stop and comment; through the original views and likes lens, video had higher engagement ratios.

Among influencer types, fashion influencers have the highest comment ratios followed by beauty and finally “other”.

When broken out into further subdivisions that include influencer category and content type, fashion influencers have the highest comment to followers ratio regardless of content type while beauty influencers have stronger video engagement when using views as a main KPI. But even the beauty category favors still images when the engagement metrics swap to comments. As previously mentioned, videos for beauty posts provide information and expertise conducive to the passive engagement of video viewing, but still image posts are a better space for the active engagement of commenting.

This change in performance is key for brands and their goals depending on the type of engagement they want from an influencer’s audience. Views and likes favor brand awareness strategies, while comments favor brand feedback and customer satisfaction – things that signal a sense of community. If views and likes highlight the influencer’s reach, then comments highlight the influencer’s ability to connect. Here comments, similar to product reviews, can provide valuable information and feedback about the post or the influencer who posted it – oftentimes indicating higher levels of parasocial attachment.

When translated into sponsored post content, comments can similarly provide brands those same types of feedback.

Conclusion: Top Trends

Influencer marketing spend is estimated to increase to $4.62 billion by 2023, an almost 200% increase over a span of 4 years – spend was $2.42 billion in 2019. The space has no sign of slowing down and with the establishment of Instagram as a strong marketing channel, brands have to integrate social media into their overall marketing strategy to reach this engaged audience. With more business products and new influencers coming out of Instagram, the Glossy Instagram Index has laid out key trends and best practices for brands.

Brand sponsorships are conducive to certain format types

- Beauty brand sponsorships benefit from a video format and saw high view engagement ratios when collaborating with fashion and beauty influencers.

- Within sponsored still content, fashion brands benefited the most from the format and saw the strongest synergy by pairing with same category fashion influencers.

Instagram starts the consumer purchase journey

- Despite increasing on-platform commerce options, brands and influencers have emphasized using it as a starting point for the consumer purchase journey and not an endpoint.

- Instagram has been a place to feature new product offerings through influencer collaborations, especially advertising newness that coincides with gifting time periods.

Instagram plays favorites – siding with video

- Video content averaged 20% engagement ratio of views to followers and still content averaged 7% engagement of likes to followers

- Instagram has heavily pushed video content, particularly Reels, since 2020. With its push, the platform now heavily favors the display of that content format, a key factor in the higher engagement ratios for video

While video format outperforms, still images have their place

- In a non-sponsored context, video content surprisingly saw lower engagement than sponsored video content.

- On the opposite side, still image content performed better in a non-sponsored setting than its sponsored versions.

- For stills content, fashion influencers saw higher engagement followed by “other” type influencers and beauty falling in last place.

- In the video format, beauty influencers ranked No. 1 and saw high engagement from their audience with fashion second and “other” last.

Instagram comment engagement shifts the conversation

- Fashion influencers have the highest comment to followers ratio in both still and video content types while beauty has stronger video engagement when using views as a main KPI.

- Beauty influencers now perform better in still images than video content when the engagement metrics swap to comments.

- Views and likes highlight the influencer’s reach and comments highlight the influencers ability to connect.