Table of contents

- Introduction

- Methodology

- Online marketplaces, e-concessions and drop-shipping expand beauty brands’ distribution options

- Social commerce and marketplaces are popular, but tried-and-true channels drive the highest profits

- Brands are enticing customers on shoppable livestreams

- Brands up their social game with innovative influencer events, new shopping apps and cross-channel social strategies

- Shifting trends affect not only social strategies, but also distribution: Prestige beauty expands, while mass still sees wins in old-guard channels

- Skin-care brands prefer owned website distribution, while color cosmetics have turned to Ulta.com

- Conclusion and key takeaways

Introduction

After a bleak 2020, beauty industry sales were up in 2021 and the market is expected to flourish in 2022. The industry began to rebound last year after a 2020 of pandemic-driven lockdowns in which color cosmetics sales fell by 33% globally and overall retail sales in the beauty category declined by 15%, according to McKinsey. As many as 47,000 chain stores, including beauty specialists and department stores like Sephora and Macy’s, were forced to shut down during the pandemic, according to Baird, playing a huge part in the revenue decline for color cosmetics. Without in-person social and work-related events to attend, consumers stopped spending on makeup. However, skin-care and self-care products remained a priority. By 2021, brands had found a workaround in e-commerce, and beauty and personal care categories increased sales 16% compared to 2020, largely driven by e-commerce sales, according to NielsenIQ.

Just one year before the pandemic, e-commerce accounted for only 11% of 2019 beauty sales, and more than 70% of beauty purchases involved a visit to an offline location. But with stores shuttered, brands had to reinvent their distribution strategies. Many turned to third-party seller platforms, like Amazon or Walmart’s Marketplace, giving retailer websites a run for their money as a leading distribution channel. Retailers too began expanding business by offering e-concessions and drop-shipping distribution options. And some shoppers found alternative sources for beauty products in the “essential” big box and drug store chains that remained open.

Beauty marketers have also been experimenting with selling products directly on social commerce platforms like TikTok and Instagram where they can reach a younger audience, often livestreaming so shoppers can interact with brand representatives and purchase products in real time. But reigning supreme over all e-commerce channels are traditional brand-owned websites, which still outpace other e-commerce offerings as the most profitable and most often used distribution channel.

Although the pandemic accelerated e-commerce, that doesn’t mean brick-and-mortar stores are a thing of the past. Brands that shifted to DTC during the pandemic are finding digital marketing costs sky high — CPMs on Facebook, Instagram and Google has gone up, as have shipping costs — and many are finding they still need retail partners instead of going it alone. Additionally, with vaccines widely available in the U.S. and stores reopened, consumers are once again venturing out to try on makeup and skin-care products in person.

Aware of increasing in-store traffic, brands are expanding in-store options like “shop-in-shop” partnerships, as in the case of Sephora with Kohl’s and Ulta with Target. Some are even merging their social media strategy with their brick-and-mortar approach by bringing influencers into stores to try out their brands. And the types of stores brands are distributing in often depends on their product category, with prestige beauty brands tending to place products in beauty specialty stores, while mass beauty brands stick to big box and drug store chains.

With numerous traditional and e-commerce distribution channels available to brands and with the pandemic phase of Covid-19 reportedly drawing to a close, Glossy’s Annual Report examines the state of beauty sales and distribution channels to understand emerging trends and to provide brands with the intelligence needed to shape marketing and merchandise planning for 2022 and beyond.

Methodology

To assess the current state of beauty product distribution and to understand which channels may drive success in a post-pandemic world, Glossy asked industry professionals how merchandising efforts have changed in the past two years, where they see the intersection between e-commerce and in-store shopping leading and which of the following distribution channels they’re using:

- social commerce

- retail partners’ websites and stores

- owned-and-operated platforms

- brick-and-mortar stores

- livestreaming platforms

- gaming platforms

- direct sellers

- third-party sellers

- pop-up stores

- blockchain-based marketplaces

Glossy collected responses through an online survey of beauty brands and retailers and a focus group of senior management executives who oversee marketing, sales and retail partnerships at beauty companies. For more insight, we also constructed a database of 32 brands across prestige beauty and mass retail price points and color cosmetics and skin-care categories to analyze brand distribution channels, assess the rise of social commerce and map out brand presence across platforms.

Prestige beauty was defined as brands with products at a higher price point that primarily target consumers with above-average expendable income.Mass beauty was defined as brands with products at an affordable or entry-level price point that primarily target consumers of any income level.

Our database included the following brands:

Online marketplaces, e-concessions and drop-shipping expand beauty brands’ distribution options

Glossy’s survey asked brands what channels they use for beauty product distribution. As expected, brands said retailer stores and brand-owned websites are their most common distribution channels. But increasingly, brands are also jumping into selling on marketplace channels, such as Amazon or Walmart’s Marketplace, with 58% of respondents saying they sell through a marketplace. In particular, marketplace offerings have inched past brand partnerships with retailer websites, signaling a major shift in traditional retailer-brand relationships.

Retailers themselves have been major drivers of that shift, as they now offer e-concessions and drop-shipping marketplace distribution options for brands. Both options allow brands to sell through a retailer’s website while inventory storage and fulfillment is completed by the brand. Also in both options, the retailer takes a commission from product sales, but typically the brand sees better margins than traditional retailer-brand partnerships since brands are not selling at wholesale prices. E-concessions and drop-shipping differ in branding — for e-concessions, brands must maintain the digital storefront and merchandising; for drop-shipping the retailer handles both.

Brands considering using these marketplace distribution options must weigh the pros and cons of e-concessions versus drop-shipping. E-concessions allow for more branding control by allowing the brand to manage its digital presence on the retailer’s site. Drop-shipping, on the other hand, gives the retailer branding control, but, because brands have lower involvement, brands have more bandwidth to expand drop-shipping to multiple retailers for wider distribution. Prestige beauty brands find e-concessions a better choice to maintain brand consistency, but mass brands may prefer drop-shipping to provide more widespread product distribution. Regardless, both of these newer distribution models give brands, especially smaller ones that would otherwise have a barrier to entry to traditional retailer-brand contracts due to lower margins and higher product quantity requirements, more channel options to reach consumers.

Social commerce and marketplaces are popular, but tried-and-true channels drive the highest profits

As seen in the previous chart, 50% of the surveyed brands also sell through social commerce platforms, such as Instagram or TikTok. With the recent expansion of social commerce and its lower costs of entry, this distribution channel has surpassed owned brick-and-mortar stores as a leading pathway to provide products to customers. And it’s starting to catch up to retailer websites, too: Only about 57% of respondents said they distribute through that channel.

With this speed of adoption, social commerce may soon become as ubiquitous as retailer partnerships. Below, Glossy lists the social commerce offerings of the four leading social media platforms — Facebook, Instagram, Pinterest and TikTok.

But despite the high adoption rates of both social commerce and marketplace platforms, the two channels still lag behind more traditional channels in a key area: profitability. In Glossy’s survey, respondents by far said that brand-owned websites are most profitable — likely due to more favorable product margins — followed by retailer stores and websites. While marketplace channels are close in profit to retailer websites, established retailer partnerships still exceed both by providing clearer distribution processes to which brands are accustomed.

According to NielsenIQ, 29% of total beauty sales came from online shopping in 2021, and 65% of consumers have by now ordered beauty products online. Estée Lauder echoed that sentiment in its financial report — for its fiscal year ending June 30, 2021 — in which it noted that digitals sales grew for nearly every brand as the company continued its online platform expansion across owned websites, retailer sites and digital marketplace offerings.

While brand-owned websites represent the highest rates of profit and, as a result, are the leading distribution channels for beauty brands, newer online distribution channels can also expect to see growth as consumers continue to increase digital purchases.

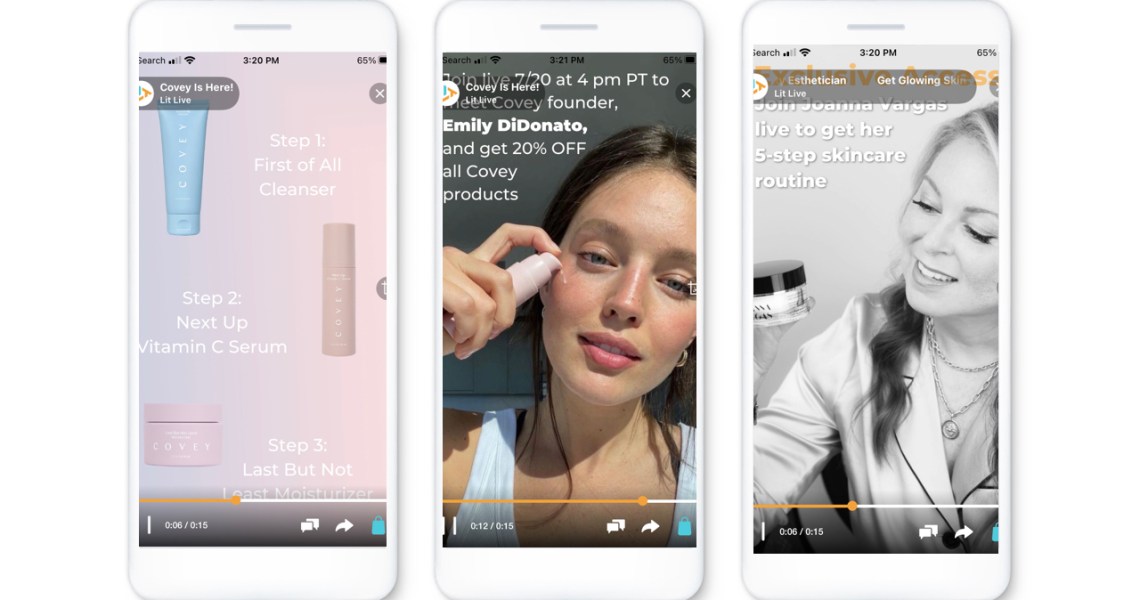

Brands are enticing customers on shoppable livestreams

Brands also noted that livestreaming is a growing space in its ability to attract new customers. In fact, livestreaming exceeded social commerce spaces in our survey results as the distribution channel in which companies think they should invest most to attract new customers.

In a focus group of senior beauty brand executives conducted by Glossy, many of the participants echoed the idea that livestreaming was the next hot spot for selling consumer products. “We’ve seen huge success on livestreaming through our ‘Blooming Skin Show,’” said Brad Farrell, CMO of Beekman 1802, a skin-care brand. “It’s a great mix of selling exclusive products and gifts and [offering] exclusive access to things.”

Beekman 1802 has been working with livestream shopping software company Livescale to host its livestreams (with a dedicated landing page) on the Beekman website, and it also livestreams Facebook and Instagram, as well. It treats livestreaming as a distribution channel rather than a pure marketing channel by adding exclusive products and different product assortments to entice consumers to seek out and shop in the space.

Among the top three social commerce platforms, each offers livestreaming capabilities, but only Facebook and Instagram offer shoppable features during livestreams. In Glossy’s survey, brands noted that they use Meta-owned platforms for social commerce the most.

TikTok, on the other hand, only allows non-shoppable livestreaming; but Douyin, its Chinese counterpart, does offer shoppable livestreams, a feature TikTok users will likely see in the future. Pinterst also added a livestreaming feature, Pinterest TV, in 2021. Pinterest TV differs from the other livestreaming options in that Pinterest selects brands and creates specific shows to feature them rather than allowing the brands to stream on their own schedule.

While the conventional social platforms are building out livestream features, competitors like Twitch, which until now has focused on video game livestreaming and creative content, are beginning to see the light — or at least the green. Beauty brands have started partnering with influencers on Twitch to introduce themselves to the Twitch audience, as with Charlotte Tilbury’s partnership with the Girlgamer Twitch channel. Other brands like E.l.f. have launched Twitch channels of their own.

Brands and influencers alike are seeing high viewership on Twitch and other livestreaming platforms and services, with Twitch viewership increasing by 83% from 2020 to 2021. As livestreaming becomes a more common marketing and commerce tactic, platforms like Twitch may increase their offerings and become as central to brands’ and influencers’ playbooks as other social platforms. Old-guard platforms will also likely grow their livestreaming capabilities to compete for attention and budget, as seen with the recent development of Pinterest TV.

Brands up their social game with innovative influencer events, new shopping apps and cross-channel social strategies

With the increasing popularity of social commerce and brands eyeing the future of livestreams, brands have allocated major portions of their marketing budgets to social channels. More respondents to the Glossy survey allocated 41% or more of their budget to social media advertising than did for either other digital advertising or offline marketing — though, to be noted, offline marketing such as in-store events was paused abruptly during the pandemic and has only started to trickle back into brands’ marketing strategies.

As brands spend more on social, they’re experimenting with different platforms and strategies beyond the usual suspects. Among others, executives in Glossy’s focus group mentioned the Flip app. A social app that launched in 2019, it mimics TikTok’s short-form video format but focuses specifically on shopping, essentially operating as a digital retailer. This new player only works with beauty brands, and by September 2021, it had over 1 million downloads and had shipped over 30,000 orders. In the focus group, Amanda Kahn, svp of marketing and e-commerce at RéVive Skincare, highlighted the app. “Flip has been very successful,” she said. “And now Flip is really starting to scale because it has a much more loyal following.”

Executives also highlighted “influencer immersion” as another notable social strategy. “We invite influencers into retailer partner stores to experience the brand,” said Dawn Hilarczyk, head of global sales at Noble Panacea, a skin-care brand. “It allows us to use their social network to give us visibility and brand awareness, and to educate.” The strategy merges influencer strategy with retailer strategy — a strong play, as retailer stores and websites have higher profitability than social commerce, as mentioned in our earlier analysis.

With the number of platforms increasing, each with its own set of effective strategies, Akash Mehta, CEO and a growth and digital marketing specialist at Fable & Mane, a hair-care brand, spoke about social media from a cross-channel perspective. “Don’t sleep on the TikTokers on Instagram,” he said. “They might have 3 million followers on TikTok and 16,000 followers on Instagram but the duality of briefing influencers to repost TikTok content on Instagram has led to a lot of success [for us].

“TikTokers can charge a lot, but a story with a checkout code on Instagram is a lot cheaper and can have huge conversion, as well. There are creative ways to not isolate the two entities but instead think of them as one and make it even more affordable for brands.”

This approach to social as a set of platforms with overlapping users that boost each other, rather than separate spaces with niche markets, underscores the need for the complex marketing plans that beauty brands are putting behind social media advertising.

Shifting trends affect not only social strategies, but also distribution: Prestige beauty expands, while mass still sees wins in old-guard channels

As brands expand their social strategies, they have also been solidifying their distribution strategies as the pandemic and consumer buying trends have changed up the beauty retailer landscape. In Glossy’s survey, more than half of surveyed brands retail with department stores, and an overwhelming 81% of respondents said they distribute through beauty specialty stores such as Sephora or Ulta. Brands tend to favor specific retailers depending on their pricing category — prestige being higher price points and mass being more affordable prices.

In analyzing Glossy’s database of 32 brands within prestige beauty, Sephora is the most-common retailer distribution channel, closely followed by Ulta. Both retailers offer shop-in-shop partnership programs and, through these partnerships (both online and in-store), brands participating in the partnership program at Sephora and Ulta have been able to reach new audiences. In particular, prestige beauty brands saw the strategy unlock a bounty of prestige beauty consumers who were inaccessible when those products were confined to traditional department stores and high-end stores.

Sephora’s partnership with mass-oriented retailer Kohl’s has allowed Kohl’s to break into the prestige space — although not all Sephora-distributed brands allow sales through Kohl’s. Ulta’s partnership with Target has not been as successful at convincing as many prestige brands into that mass retailer. Despite its lower number of prestige beauty brands, Heather Duchowny, executive director of global engagement and digital marketing at Smashbox, a color cosmetics brand, noted the benefits of its Target distribution strategy. “We launched with Ulta and Ulta at Target,” she shared during Glossy’s focus group. “We found it incredibly successful in reaching a totally new audience. We’ve found that a lot of our sales there are Gen Z.”

When viewing distribution by brands within the mass beauty price point, Ulta is the only specialty beauty store present in the distribution mix, indicating its wide range of product types and the varied demographics of the beauty shoppers it attracts compared to other retailers. Aside from Ulta, more standard mass retailers like big box and drug store chains make up the top retailer partnerships, indicating that consumers still prefer to purchase mass beauty products in accessible settings like Walmart or Walgreens.

During the pre-vaccine era of the pandemic, big box and drug stores were marked as essential stores, allowing them to remain open while many department stores had to close shop. As a result, brands present in that space had more opportunity to reach consumers, as they were some of the very few allowing in-person shopping. “What’s interesting is launching during Covid,” said Aleesha Worthington, vp of marketing and e-commerce for men’s hair-care brand Scotch Porter, on the importance of having a presence at these essential stores, during Glossy’s focus group. “Target and Walmart became the new date night spots. So for us, they honestly were the ideal places to speak to customers.”

Skin-care brands prefer owned website distribution, while color cosmetics have turned to Ulta.com

When viewing distribution by product category through Glossy’s database of brands, a few more clear strategies emerge. For measured color cosmetics brands, a clear preference appears for beauty specialty stores, which, as mentioned in the previous sections, a significant number of brands distribute through. Among the beauty specialty stores, Ulta outranks brand-owned websites as a distribution channel and claims the spot of top distribution partner for color cosmetics brands. Sephora, the other top performing beauty specialty store, lags behind drug stores and big box stores as a distributor — though remember, Sephora only distributes prestige beauty while Ulta carries both mass and prestige allowing for a larger number of brands.

On the other side, measured skin-care brands overwhelmingly rely on their own websites. The skin-care category has a steeper learning curve for product usage, and as a result, brand-owned websites are a main distribution point of both products and product information. In the skin-care space, unlike in color cosmetics, Ulta and Sephora are neck-and-neck, with both at 63% representation. While color cosmetics brands have a clear bias toward Ulta, skin-care brands remain split.

Conclusion and key takeaways

After an array of pandemic-related challenges in 2020 and 2021, the beauty market is on track to have a healthy 2022, with U.S. beauty and personal care revenue projected to reach $88 billion, according to Statista. E-commerce is expected to continue leading the way as brands continue to experiment with social distribution channels. According to McKinsey, e-commerce is the fastest-growing channel for beauty sales and it will become the most important channel by 2024.

As members of Glossy’s focus group noted, the “store of the future” looks to be a merger of online and in-person offerings, where e-commerce and brick-and-mortar experiences combine to offer a seamless shopping experience. That could be anything from scanning a QR code in-store in order to read an online review and make a purchasing decision, to making the physical store an “entertainment hub” by hosting events that bring online influencers in-store to sample products. The future seems limited only by brands’ and retailers’ willingness to experiment.

Here are some some key takeaways from Glossy’s Annual Report on the state of beauty sales and distribution channels in 2022:

- Brands are increasingly distributing through marketplace channels, with 58% of respondents saying they sell on marketplaces, inching past traditional brand partnerships with retailer websites.

- More retailers now offer e-concessions and drop-shipping marketplace distribution options for brands. E-concessions allow for more branding control, while drop-shipping requires fewer employees to maintain merchandising in exchange for giving the retailer branding control.

- Despite the high adoption rate of social commerce and marketplace platforms, brand-owned websites make the most profit, followed by retailer stores and websites. Newer online distribution channels can expect to see growth as consumers continue to increase digital purchases.

- Livestreaming exceeded social commerce in our survey results as the distribution channel in which companies think they should most invest to attract new customers.

- Newer livestreaming platforms like Twitch, which originally focused on video game streaming, are beginning to partner with beauty brands. Old-guard social platforms likely will grow their livestreaming capabilities to compete in this rising consumer space.

- More respondents to the Glossy survey allocated 40% or more of their budget to social media advertising than did for other digital advertising or offline marketing. The increasing use of social media as a main marketing channel has called for complex marketing strategies that experiment with social media.

- Within prestige beauty, Sephora is the most common retailer distribution channel, closely followed by Ulta. Both have shop-in-shop partnerships and, through these partnerships, brands have been able to reach new audiences.

- For color cosmetics brands, Ulta outranks brand-owned websites as a distribution channel. On the other side, skin-care brands rely on their own websites.