On February 28, Glossy and Google hosted a dinner in NYC for leaders in the beauty industry. Executives from companies including Unilever, Coty and Estée Lauder came together to discuss their current challenges and opportunities. Talk tunrned to what brand loyalty means today, how to manage de-influencing, and what investments in sustainability certifications and web3 make sense.

Below are highlights from the three main topics of focus.

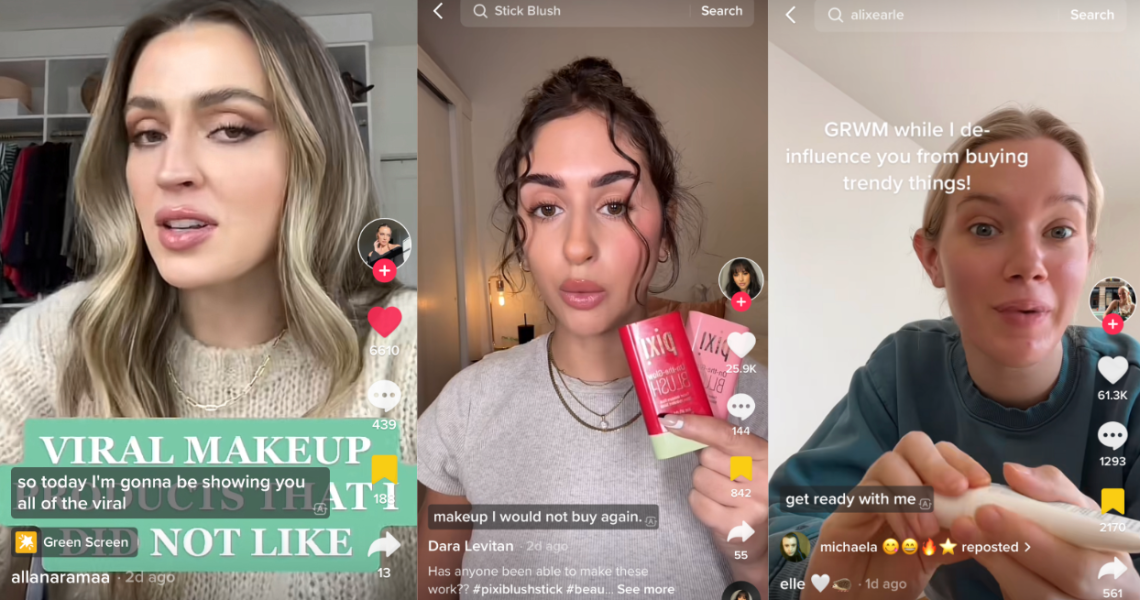

De-influencing prompts accountability

Executives talked about the trend of de-influencing, where influencers take to social media to give negative reviews of a product. The concept swept TikTok in January, leading to 21.4 million views of posts with the corresponding hashtag. The trend has led to customers being turned off of products by certain brands, negatively affecting brands’ sales and popularity. Some of the attending execs said they’re worried that the trend is leading more influencers to focus on negative reviews to bolster their views.

An executive speaking off the record pointed to the power of the trend by describing an intentional way it’s being leveraged: “At our company, we’re even working with agencies that have experience with [de-influencing by] intentional sabotage and terrorists. So we’re working to understand and see social patterns, so that we can identify how to protect ourselves from a cyber attack of influencers to our brands.”

For some of the brands, the issue with de-influencing is that it’s unpredictable and mostly without grounds. “It can happen to anybody at any time, and it doesn’t matter what the facts are. It’s just what people want the story to be,” said another executive. “There is this culture among influencers, where, if something is picking up traction, they jump on it for exposure and personal gain.”

“From a brand perspective, it’s a very scary landscape because, yes, influencers do so much for you, but they can do so much to hurt you at the same time,” they added.

However, some of the executives called out a bright side, noting that de-influencing promotes brand accountability with the customer and enforces transparency about product efficacy.

Loyalty beyond the product

With customers reportedly buying just four cosmetics products a year, brands are limited in their ability to introduce a beauty item they’ll buy into and remain loyal to. “Even the leading brand, or the three leading brands, will all be at 1.2 or 1.4 units [sold per year],” said a beauty executive.

Color makeup doesn’t often drive much loyalty, the executives agreed. However, some categories, like foundation, foster great loyalty, one executive said, adding, “If you find a foundation that matches your type of skin and it’s in your shade, there is a [hesitancy] to change, which develops into loyalty to one brand.”

Today, competing for beauty customer loyalty also means manning a competitive, strategic loyalty program.

“It’s time to consider channel loyalty. We’re trying to make sure our direct-to-consumer business is the best place to shop for our brand,” said one executive, speaking about their brand’s loyalty program, which gives shoppers buying the brand at Sephora points to use in the brand’s DTC channels. “The idea is, how do you create an omnichannel loyalty program that drives loyalty to your preferred channels.”

Careful investment for the long-term

The state of the economy is forcing brands to be increasingly thoughtful about their investments, including investments of time in sustainability accreditation and capital investments in innovation and emerging opportunities like web3.

“We saw a great halo on the brand from some of our early projects in web3,” said a leading beauty brand executive. “Reporters still want to write about the NFT project that I launched with my team in summer 2021. … But now, for any related investments, we’re really thinking about whether it’s worth it. These projects require so much investment. They require long-term vision and consideration of a long-term roadmap, as well as prioritization and budget.”

But NFTs as a loyalty tool can be well worth the investment, some execs said. “NFTs as a loyalty play is very nascent,” said one executive. “It was in Q4 of 2022 that Nike launched Dot Swoosh and when Starbucks launched Odyssey — those are two premier brands that are playing on the blockchain, as it relates to community and loyalty. But there’s appetite from the community, especially when you stop talking about web3 and just focus on offering an experience that feels seamless and rich. That’s where some of the magic is unlocked.”

Some attending leaders also reported fallout from early brand jumps into sustainability certifications. “We signed on way earlier than any large brands to [a sustainability-centered pact],” said one executive. “We are now locked into the biggest handcuffs, bigger than you could possibly imagine, because 80% of suppliers are off the table. We’re not a luxury brand and every innovation has to now be accredited, so we can’t use certain components and materials. But it’s 2023 — so, do we back out of the [pact]? No, because then we would get the backlash. Most consumers still don’t know we have it or just think it’s a nice-to-have.”

However, for some brands, the investment is worth it, especially considering the legislation that is set to affect the production of consumer products in the E.U. from 2023. “We had to make a decision on our B Corp certification: Do we invest all this time — 900 hours of work — on this? We decided it would matter to our customers who are most loyal to the brand and have the highest repeat rates of purchase. For them, the response was, ‘What took you so long?’ They expect you to be B Corp. It helps to engage and drive brand love among the core consumer.”