Coty is trying to meet the beauty consumer where she is. As Covid-19 cases continue to surge throughout the states, Coty announced its partnership with digital delivery service GoPuff, bringing its Covergirl, Rimmel and Sally Hansen brands onto the platform.

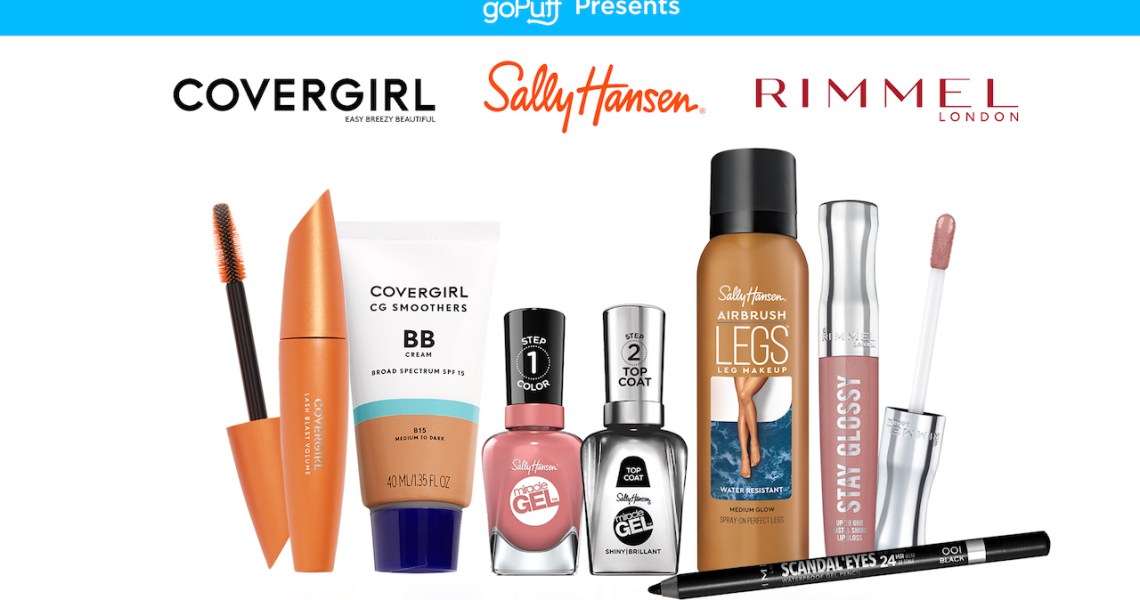

Founded in 2013, GoPuff started as a grocery, alcohol and snack delivery option for university communities. Today, it is in 500 cities and offers 2,500-plus products. Its core demographic is 25- to 35-years-old. As coronavirus continues to impact consumes’ willingness to venture out , Coty wanted to make shopping for its hero products easier , said Kevin Shapiro, Coty’s svp of U.S. marketing of consumer beauty. Over 25 products, like Covergirl’s Lashblast mascara, Sally Hansen’s Miracle Gel nail polish and Rimmel’s Stay Glossy lip gloss, will be in available in 80-plus cities like Atlanta, Boston, Chicago, Philadelphia, Phoenix and Miami. Like Amazon, GoPuff trades on speed, aiming to deliver within 30 minutes.

“We’re always looking for more ways to get product into consumers’ hands, and these are our most iconic franchises that are probably easiest to shop for on shelf,” said Shapiro. “Something like foundation with 30 or 40 shades is more difficult to buy when you have never tried it on before, but Lashblast has been been our best-selling mascara for over decade. Customers already know they love it and feel comfortable buying it.” Globally, Coty is also betting on home delivery: In June, it launched with new DTC platform The Home Edit in the U.K., which bundles Clairol and Sally Hanson products for delivery.

The beauty category is not a dominant force on GoPuff quite yet, and is currently nestled under “Bath & Body,” with everyday shampoos, conditioners and body moisturizers. But Elizabeth Romaine, GoPuff director of communications, said that since Coty’s brands soft-launched in July, the company has seen orders in the subcategory of beauty increase over 200%. Other similar brands in GoPuff’s beauty fold are Yes To, SunBum and Burt’s Bees.

“We are constantly evolving and expanding, in order to instantly deliver all of the everyday essentials our customers want and need,” said Romaine. “Through our research, predictive analysis and conversations with customers, we found that customers were seeking easy, instant access to the beauty products they love. We also identified a recent increase in orders for at-home beauty and grooming products, and knew we wanted to build out our beauty category. This is a trend we saw solidify during the stay-at-home orders and one we don’t expect to go anywhere.”

Covergirl, Sally Hansen, and Rimmel are indeed legacy players, and have been available in mass doors like Target and Walmart that stayed opened during quarantines. Even so, Coty saw sales decrease 13.5% in the four weeks ending July 25, according to Nielsen. Covergirl was down by 21% and Rimmel saw losses of 31%; Sally Hansen did see growth of 0.9%. In May, Coty reported Consumer Beauty net revenues of $602 million, down more than 28%, in third-quarter fiscal results. The company blamed a loss of store traffic, shifts toward personal care and its color cosmetics underperforming for its slowdown. Consumer Beauty makes up approximately 39% of total net revenues for Coty.

Though curbside pick-up has been a popular tool for retailers like Ulta, Shapiro underscored that customers still have to get in their cars and drive to said destinations. And unlike Instacart, which works with Coty’s retailers, Shapiro emphasized the direct relationship and insight the beauty conglomerate will get from GoPuff since product will be shipped from Coty’s warehouses.

“We’re starting with a limited assortment, so we can understand SKU performance: how we are doing every three, six or nine months, and if there are regional or seasonal preferences,” he said. “The hope is that we can expand and grow this to our other brands, as online shopping continues to be the norm.”