Tiffany & Co. has been a major success for its new parent company, LVMH. But last week, some of its moves drew criticism. Elsewhere, layoffs continued to hit major fashion retailers, and the Swedish-American brand Blk Dnm announced it’s rebranding as luxury — which may be a dangerous path to tread. Don’t forget to subscribe to the Glossy Podcast for interviews with fashion industry leaders and Week in Review episodes, and the Glossy Beauty Podcast for interviews from the beauty industry. –Danny Parisi, sr. fashion reporter

Is Tiffany trying too hard?

As mentioned in the latest Glossy Week in Review podcast, Tiffany’s executive creative director, Ruba Abu-Nimah, is departing the company, about a year and a half after joining. She was responsible for Tiffany’s advertising and branding, and helped shift the company’s public persona from a proper legacy institution to one more in touch with modern trends.

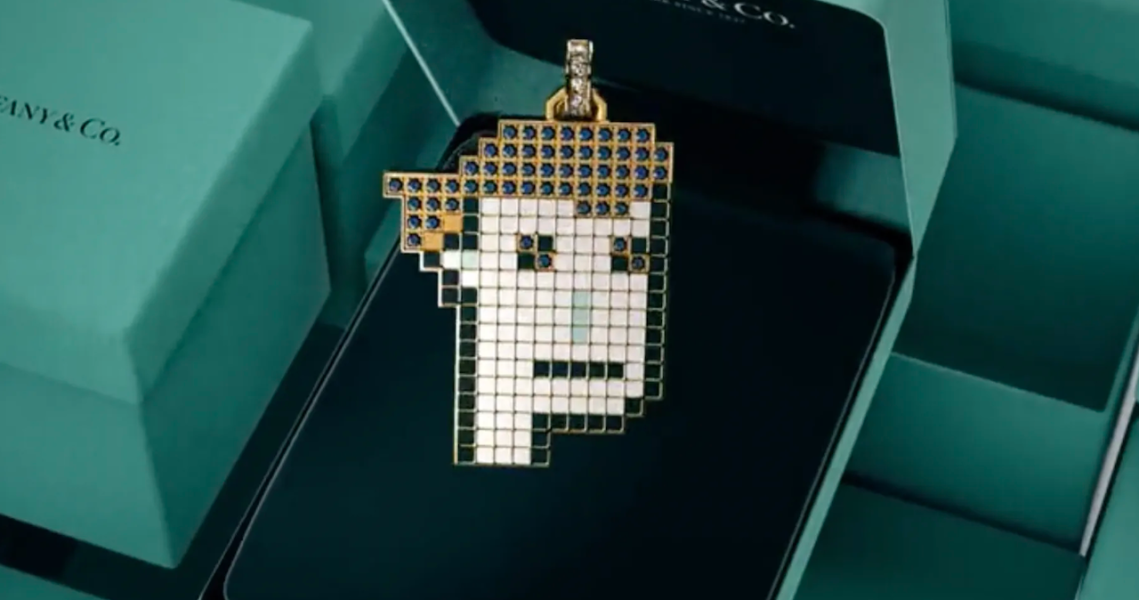

But the direction Tiffany has taken since its acquisition by LVMH in 2021 has been polarizing. Under Alexandre Arnault, the brand has been criticized by some for trying too hard to appeal to sneakerheads and youth culture, rather than sticking to its heritage. The “Not your grandmother’s Tiffany” messaging has been seen as inauthentic, and other campaigns like one featuring the works of artist Jean-Michel Basquiat were also criticized. But the numbers back up LVMH’s direction for the company: It’s doubled its value since the acquisition and has become a crown jewel for LVMH.

More layoffs at online retailers

Layoffs have continued throughout the fashion industry over the last couple weeks: Secondhand watch marketplace Chrono24 laid off 65 employees and Saks.com laid off 100, while Canadian online luxury retailer Ssense also suffered layoffs. Ssense eliminated 138 roles, or about 7% of the company. In a statement, the company said the move was due to a shift back to pre-pandemic e-commerce shopping levels among consumers.

The decline in e-commerce revenue, particularly compared to the bombastic growth the channel experienced throughout 2021, is a current pain point for many online retailers. Even Farfetch reported its first quarter of declining sales at the end of 2022, after years of massive growth. You can even see the effects of online shopping degrowth on Instagram, where the platform has removed the dedicated Shop tab due to low engagement.

This has led a number of brands to start looking more seriously into brick-and-mortar expansion. Brands including Alexander Wang, Rails and Cult Gaia are all opening new stores.

Blk Dnm is going luxury, but is it a smart move?

The Swedish-American brand Blk Dnm, which was previously a mid-market brand, is rebranding with a new logo, new products and new prices, with the aim of becoming an “entry-luxury brand.” The news was first reported by Women’s Wear Daily.

Its first full collection as a luxury brand will debut at New York Fashion Week. Previously, its prices were in the low-hundreds range for denim and leather goods. But the new collection’s styles will sell for as much as $3,000. Blk Dnm also plans to open a New York flagship store next year.

It’s an interesting move to rebrand upward in price and prestige, especially at a time when the average consumer has less purchasing power than ever. On the one hand, luxury brands like those in the LVMH portfolio have been best able to withstand the pressures of inflation, due to their wealthy, mostly unaffected core customer base. On the other hand, J.Crew made a similar bet during the last big recession in 2008. The higher prices and courting of luxury consumers didn’t pay off, and the company lost much of the prestige it had built up in the years prior.