After Ulta Beauty posted a rare quarterly earnings miss at the end of August, shares of the beauty company fell about 20%. CEO Mary Dillon said on its earnings call, “Ulta Beauty continues to drive meaningful market share growth in makeup across mass and prestige, but it’s clear that cosmetics in the overall U.S. market is challenged.”

The softening of makeup in the U.S. has been an overarching discussion point for many companies, from L’Oréal to E.l.f Cosmetics. For Ulta, cosmetics made up 47% of net sales in the first half of 2019, while skin care and hair care followed at 22% and 21%, respectively. But the high-contoured, influencer-led makeup looks favored by millennials since 2015 are being replaced with no-makeup makeup styles that allow skin to, well, look like skin.

For companies vested in multiple categories, focusing on skin care may be an obvious solve. However, it is the hair segment, which is less crowded, that can be better leveraged. Per NPD data, hair saw 18% growth year-over-year versus skin care’s 5% spike. A matter of how is the question.

An indie brand’s content-focused strategy

Eleven-year-old Lime Crime only debuted hair products in 2017, but today, hair care represents 20% of the company’s business. And that is growing, said CEO Stacy Panagakis. The beauty brand carries 66 hair products versus 200-plus makeup products.

While the company would only state Lime Crime is experiencing “healthy” growth across the board, its move into color conditioners this past summer was a way of complementing its newish hair color business and “persevere” in today’s climate, said Bianca Bolouri, Lime Crime vice president of global marketing and digital.

This in line with the increases across hair. Growth in the last year was due to boosts in sales across hair care products like shampoo and conditioner (23%), hair color (25%) and hair product bundles (27%), versus styling products, according to NPD.

“You can’t deny the headwinds in color cosmetics, so we have chosen to go against the obvious and stand out another way in a very crowded beauty space,” said Panagakis.

Through culling Lime Crime’s employees and customers through monthly and quarterly in-person interviews and daily social feedback, the company was able to distill that consumers who enjoyed the brand’s experimentation in makeup wanted that same kind of experience in hair. Interestingly, complexion products, which has been a product many beauty companies have chased, is not one the Lime Crime consumer is eager for. Bolouri said the customer purchasing hair products is a new consumer in nearly all cases — there is a small overlap between hair and lip product shoppers.

To create more consistency and bridge that gap, Lime Crime strategically incorporated both hair products and makeup in a Halloween content series with beauty influencer Lina Bugz. “Instead of launching a new collection of products or banking on our black lipstick selling out, we wanted to leverage how all of our products work together,” said Bolouri. Two of Bugz’s most recent tutorials prove the concept is working from an engagement standpoint: A butterfly tutorial showcasing Lime Crime’s wild color combinations had more than 215,000 views on Instagram, and a more traditional vampire video had 70,000 views. Out-there content plays that tie the categories together more often would be a smart idea for Lime Crime, given its artistic and fantasy roots.

“With the exception of big companies, very few brands can play in both hair color and makeup. Rather than see themselves as two separate arms of the business, we make sure they work as one,” said Panagakis.

A conglomerate leverages its professional business expertise

L’Oréal’s consumer products division made up nearly 45% of its roughly $30 billion annual sales in 2018. Meanwhile, its hair business, which mainly sits in its professional segment, only accounted for 12% of sales. Still, both categories saw about the same level of growth (a 2.7% increase for the professional division and a 2.8% increase in consumer products) in the company’s half-year results. L’Oréal’s latest project, Color & Co, blurs the line between both of these divisions.

The incubated beauty brand launched in May and sells personalized hair color. For now, it is DTC-first, much like Madison Reed and eSalon’s early days. Though Color & Co. technically sits in consumer products, there is a natural connection to hair stylists via its online video consultation tool that features the brand’s Collective team of 50 colorists. This clearly links the business back to its professional division.

“We are in a division which is mostly makeup, but hair can be a more robust [category] because we are less dependent on recent trends,” said Olivier Blayac, general manager of Color & Co. “We are not that afraid of a trend reversal happening overnight or seeing a downward evolution, because 65% of women do color their hair and that number has not changed in decades. If anything, that’s increasing.” According to Euromonitor International data, the hair color market is valued at $1.7 billion.

But Color & Co is not planning on existing just as a replenishment tool. Early reads show its customer ranges from women as young as 20 to those in their late 70s, and therefore, Blayac said, the company is looking to offer hair color for trend as much as it is for covering grays.

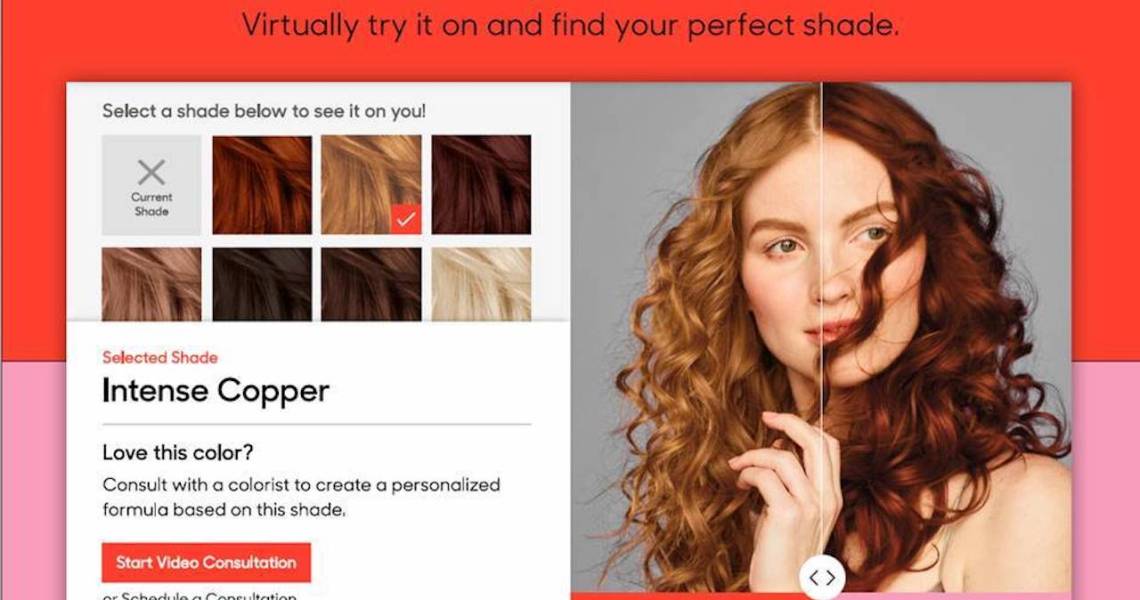

In August, the company launched its pastels and vivid colors set of shades for consumers looking for a more dramatic appearance, and this week, Color & Co is integrating ModiFace virtual try-on into its e-commerce experience. Sandwiched in between its online quiz and the video consultation offered by Color & Co’s Collective team, Blayac sees virtual try-on as a way for L’Oréal’s larger tech efforts to merge with the importance of one-on-one stylist interactions.

“ModiFace is a way of offering inspiration, and then the colorist is there to make sure that color will look good on a customer no matter what. There will be no margin for error,” he said. Later, Color & Co will round out the portfolio with a highlights and ombre offering to continue its focus on the trend side of the business. It will also launch hair-care products for color-treated hair, which is clearly a play at replenishment revenue.

Retailers find ways to bridge products with services

Though the markets for salon services and products are incredibly fragmented, Ulta’s salon business provides a way to link these services with retail easily. In 2018 annual results, the beauty retailer saw its salon business generate only 4% of net sales, but that could change.

Since November 2018, Ulta has slowly been building out what it internally calls its back bar program, allowing one hair brand to provide products, such as shampoos, conditioners and stylers, for its in-store stylist team. Stylists are educated about the products, which are then are used for salon services. Naturally, these products are brought up in client conversations.

“We’re constantly evaluating ways we can better tie the retail product into services,” said Monica Arnaudo, senior vice president of merchandising at Ulta Beauty. In the 10 months the back bar program has been trialled, Arnaudo said participating brands, like Living Proof, Drybar and Sexy Hair, have seen increased sales.

Arnaudo sees this program better serving the coil-y and curly hair customer, especially. Ulta has gone after this shopper more fervently via its the texture shops in-store and the launch of Tracee Ellis Ross’s Pattern Beauty in September.