When it comes to beauty price points officially available on Amazon, “drugstore” is increasingly being joined by “department store.”

Following in the footsteps of the mass brands that have dominated Amazon’s beauty section, premium and luxury beauty has been flocking to the platform during the pandemic. Taking brand equity into consideration, luxury beauty brands have been joining fashion labels like Oscar de La Renta on Amazon’s separate Luxury Stores section. And brands typically found at specialty retailers like Sephora are launching sales on the platform as part of Amazon’s premium beauty program. Brands have been moving onto Amazon for a range of reasons, including logistics management, support against third-party sellers and shifting consumer behavior.

“It’s something I envisioned doing at some point, but following the pandemic with the increase in online shopping, it felt like the right time,” said Kora Organics founder and supermodel Miranda Kerr, who launched her brand on Amazon as part of its premium beauty program in November 2021. “Amazon is growing its premium beauty offering and live shopping network, so it’s been a nice fit and mutually beneficial.” So far, she has hosted three shoppable livestreams for the brand on Amazon, driving sales spikes each time. She has more planned this year.

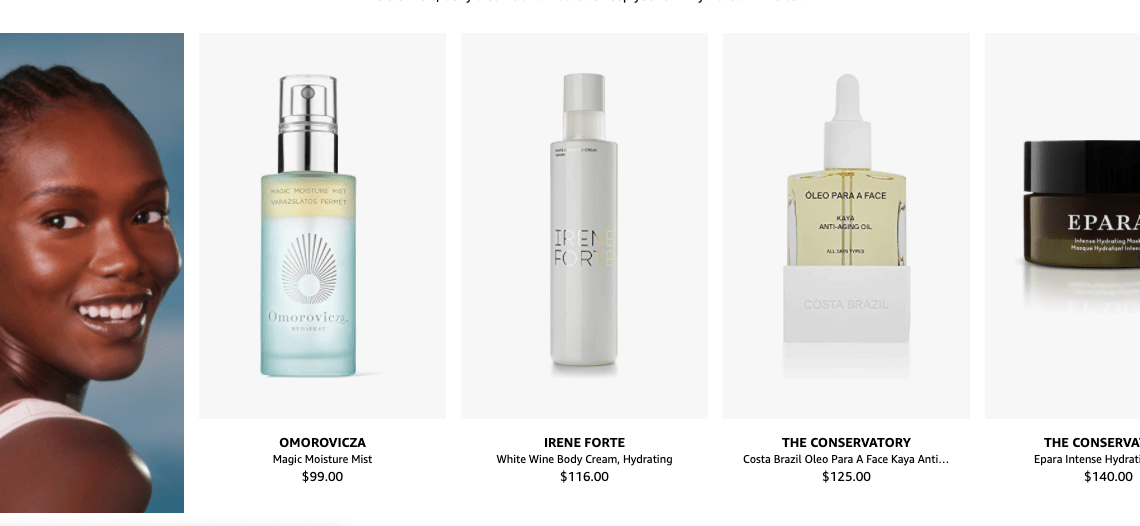

Luxury U.K. skin-care brand Irene Forte, meanwhile, entered Amazon’s Luxury Stores section in December 2021. Amazon was a part of the brand’s U.S. expansion strategy, which also includes DTC e-commerce and exclusive retailers like Shen Beauty. It has an upcoming launch at Bergdorf Goodman.

“It feels like a luxury store space; it doesn’t feel like your typical Amazon,” said Irene Forte, the brand’s founder. Brand equity was a big consideration for Forte. She said she wouldn’t sell her skin-care products, which sell for as much as $155 a bottle, on the regular Amazon beauty platform. “What’s really interesting about being [on Luxury Stores] is the opportunity to grow with [it] and the fact that there’s not a huge amount of brands on there at the moment,” she said.

The brand is one of approximately a dozen beauty labels selling on Luxury Stores, including Edward Bess, Clé de Peau Beauté, Revive and a selection of brands from The Conservatory boutique.

Logistics is one big selling point for brands. According to Forte, Amazon’s two-day delivery is “something that my fulfillment house in Virginia could never do.”

“There’s a stigma around Amazon in the beauty space, and it’s shifting and changing,” said Amanda Gordon Hinshaw, vp of client services at SuperOrdinary, which is the official Amazon distributor for brands including Gisou, Peace Out Skincare, Joanna Vargas, Biossance and Herbivore. “What’s happening right now is a lot of these beauty brands, and especially the premium beauty brands, are realizing you have to find a way to capitalize and capture the customer on Amazon.”

“Obviously, you don’t normally associate Amazon with a luxury brand. But so far, so good,” said Forte.

Amazon’s “Premium Beauty” program, offering assistance on taking down unauthorized sellers, has been around since 2013. But it especially saw an influx of brands during the pandemic. Currently, 450 brands are part of the program, according to e-commerce-focused software company Ideoclick.

Consumer behavior as a result of the pandemic has shifted shopping habits to Amazon. According to 2021 survey data from Power Reviews, which was published in the 2 AM newsletter, 47% of respondents said they shopped for beauty on Amazon, up from 22% in 2019.

“The pandemic turned the premium beauty industry upside down. When their coveted traditional distribution outlets of luxury department stores were closed, shoppers went from browsing in-store and later buying (often online) to online being the primary destination,” said Anne Zybowski, managing director of omnichannel strategy for Ideoclick.

Amazon has been under scrutiny lately for its labor practices, with reported stories of employee deaths and drivers urinating in bottles to meet delivery times drawing criticism. But that criticism does not tend to extend to brands that sell on Amazon, including those with ethically minded customers.

“The reality is that most people shop on Amazon,” said Forte. Her brand is a certified B Corp, and she said Amazon’s carbon net-zero pledge aligns with her brand’s sustainability focus.

Many premium brands’ approach to Amazon is “often very defensive,” with a focus on combating third-party sellers rather than making it their biggest sales channel, said Steve Strong, COO of SuperOrdinary. “They’re not super aggressive” when it comes to marketing.

“These premium brands are trying to figure out the best way to dip their toe in without going too crazy and investing a lot of capital into the platform,” said Hinshaw. “They’re just really trying to figure out the best way to protect their brand in the space because they know the customer is there,” said Hinshaw.

But for some brands, massive user numbers have made Amazon a platform for product discovery. This is especially true for brands using its advertising options, as well as livestream and influencer affiliate marketing.

For Kora Organics, Amazon is “definitely reaching more new customers than existing,” said Kerr. “We’re seeing a lot of new customers on Amazon purchase the smaller travel-size products because of the lower price points, and then they come back to purchase the full size.”

Selling on Amazon can be a “careful dance” for indie brands selling through other retailers, said Strong. Brands sold through retailers like Sephora “rightfully want to make sure that, if they’re going on Amazon, they’re doing it in a way that is not disruptive to those relationships,” he said. “They’re very careful, as they should be. But the more successful ones that have exited, such as Drunk Elephant, have been able to establish a presence on Amazon.”