This week, I take a look at Ulta Beauty’s new DE&I announcements and indie brands’ strategies for going bigger.

More than a year after the nation’s racial reckoning, spurred by the murders of Ahmaud Arbery, Breonna Taylor and George Floyd, the ongoing support for Black Lives Matter has been questioned. But for Ulta Beauty’s part, its diversity, equity and inclusion efforts have only grown more ambitious.

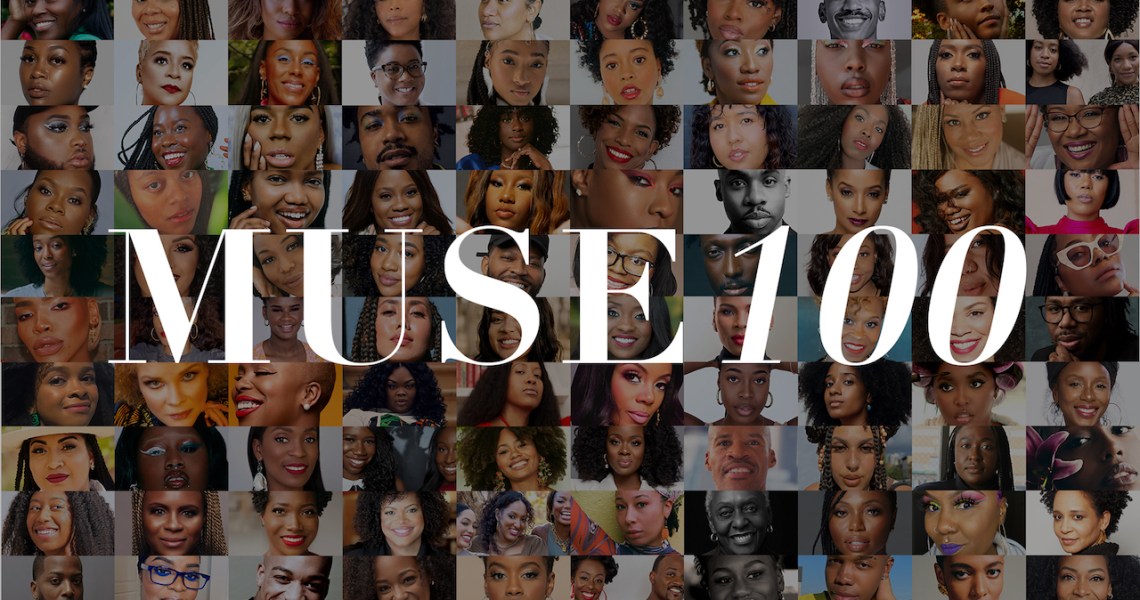

On Wednesday, Ulta Beauty announced its Muse 100, a group of 100 honorees driving positive change across DE&I initiatives in their personal work. Comprised of a wide-reaching swath of women, men and non-binary individuals, these changemakers’ reach goes beyond beauty. The full list is made up of 10 categories: “Makeup Magicians,” “Hair Raisers,” “Style Setters,” “Well Makers,” “Story Shifters,” “Culture Creators,” “Luminous Leaders,” “Executive Excellency,” “Fearless Founders” and “Next Gen Muses.” It includes model and advocate Bethann Hardison, writer and activist Michaela Angela Davis, and Marley Dias, the 16-year-old founder of #1000BlackGirlBooks. Across the beauty founder space, many of the honorees on the list are from brands that are not yet sold at Ulta Beauty, such as Diarrha N’Diaye-Mbaye, Ami Cole founder and CEO, and Jamika Martin, founder of Rosen Skincare. Each honoree will receive a $10,000 grant to accelerate their work and influence, making Ulta Beauty’s total contribution over $1 million. They Muse 100 will also be featured across Ulta’s marketing touchpoints.

“Ulta Beauty is a values-based, purpose-driven company. Diversity, equity and inclusion are very much in our DNA, and it’s baked into our mission. We fully understand our responsibility to lead in this important space, and this is a milestone in our journey,” said Dave Kimbell, CEO of Ulta Beauty.

In Kimbell’s mind, the Muse 100 is a continuation of the beauty retailer’s $25 million commitment to diversity, equity and inclusion, unveiled in February. At the time, Ulta Beauty planned to double the number of Black-owned brands in its merchandising assortment, amplify Black voices in media through its Muse platform, create better in-store experiences and offer more career advancement opportunities for associates. The first iteration of the Muse platform was via its media advertisements featuring beauty executives like Lisa Price, founder of Carol’s Daughter. The ads ran across Ulta.com, on social media, and during select television spots such as during “The Today Show” and “Good Morning America.”

The Muse 100 list was selected by Ulta Beauty executives and its DE&I counsel, with input from Tracee Ellis Ross, who is the founder and CEO of Pattern Beauty and the a diversity, equity and inclusion advisor for Ulta Beauty. Other input came from celebrity stylist Mecca James Williams, among others.

“We have set very clear and tangible goals for our organization and work so that we’re pushing to do even more to elevate diverse voices,” said Kimbell.

An internal example of that was Ulta Beauty’s first-ever Diversity Week. Held in April, the five days of programming included group training “chat-ins,” live sessions (that were all recorded for distribution later) and resources for all of its 8,800-plus corporate, store and distribution center employees. It plans to do similar programs on an ongoing basis. Ulta Beauty has been quite public on its progress, as well; it posted its stance on hate and highlighted Trans Day of Visibility on Instagram. It also pulled ad dollars from Condé Nast-owned Teen Vogue over new editor Alexi McCammond’s past tweets, in March. (McCammond has since resigned.) Naturally, it has also increased its Black-owned brand assortment.

“As the largest beauty retailer, the connection we have with our roughly 35 million guests and members in our loyalty program is significant. We have to tell those stories, and to highlight not only great brands and great influencers at Ulta Beauty, but also people that are having a great impact,” said Kimbell. — Priya Rao

How indie brands are going bigger

Last week, Drunk Elephant, a one-time Sephora exclusive, announced it was making its way over to Ulta Beauty. The brand’s full collection of skincare, haircare and bodycare will be available on Ulta.com and in all of the retailer’s 1,300 locations on September 26. Drunk Elephant, which was acquired by Shiseido in October 2019, will now have wide- domestic distribution at beauty’s biggest retailers like other Shiseido-owned brands such as Nars and Shiseido.

“It was important for us to be exclusive for the first several years,” said Tiffany Masterson, Drunk Elephant founder and chief creative officer. “I launched into Sephora in 2015. I was able to get my feet on the ground and grow the brand in one place and give them all my energy. It was great for both parties; I’ll forever be appreciative of that. At some point, though, as the brand starts to mature in a market, the consumer starts to demand it. You have to move out. I’ve been getting requests for years to go into Ulta, but it needed to be the right timing for everyone.”

Many former Sephora-exclusive brands are making their way over to Ulta, including Briogeo and Josie Maran, which both debuted in January. LVMH’s KVD Vegan Beauty launched at Ulta in August 2020. Briogeo’s move came relatively soon after private equity firm VMG’s minority investment in the brand in July 2019 and aligned the brand’s trajectory with that of First Aid Beauty. The latter had established distribution with Ulta Beauty and Sephora prior to its 2018 acquisition by Proctor & Gamble. The same was true of Deciem, which established distribution with both retailers before Estée Lauder Companies upped its 29% stake in the company to 76% in February. In three years, ELC plans to buy the rest of Deciem at a to-be-determined valuation. Industry sources previously told Glossy that Briogeo is primed for a sale in 2021, based on the interest of multiple hair-focused conglomerates including Henkel and Wella. For Sephora’s part, it has been busy incubating the next guard of indie beauty brands, such as Alpyn Beauty and The Inkey List.

“When we sold to Shiseido, it was time. They could offer us innovation and more access to bigger teams, so we can really launch globally and do it the right way,” said Masterson. “Sephora caters to a lot of people, and Ulta caters to a lot of people — and a lot of it is overlap, but some of it’s not. You want to find new ways to bring fresh eyes to the brand, and you want to make it convenient for people. And we’re now at the stage in our growth that we can do that; we can make it more convenient for people. We’ve got two great destinations, and we’re excited about it. This is a very positive step for spreading awareness.” –Priya Rao, with reporting from Emma Sandler

Reading List

Inside our coverage:

NFT event Crypto Fashion Week finds big beauty brand sponsors.

More than 100 beauty companies advocate for climate change policies with CodeRed4Climate social campaign.

Twitter Communities and Super Follows see early beauty adopters.

Scott Disick shares why he is getting in the beauty business.

What’s we’re reading:

Smashbox is saving two of Becca Cosmetics’ best-sellers.

KylieBaby is here.

Toni Braxon is the latest celeb with a beauty brand.